21Aug10:31 amEST

Cherry Coke and Apples in Season This Summer

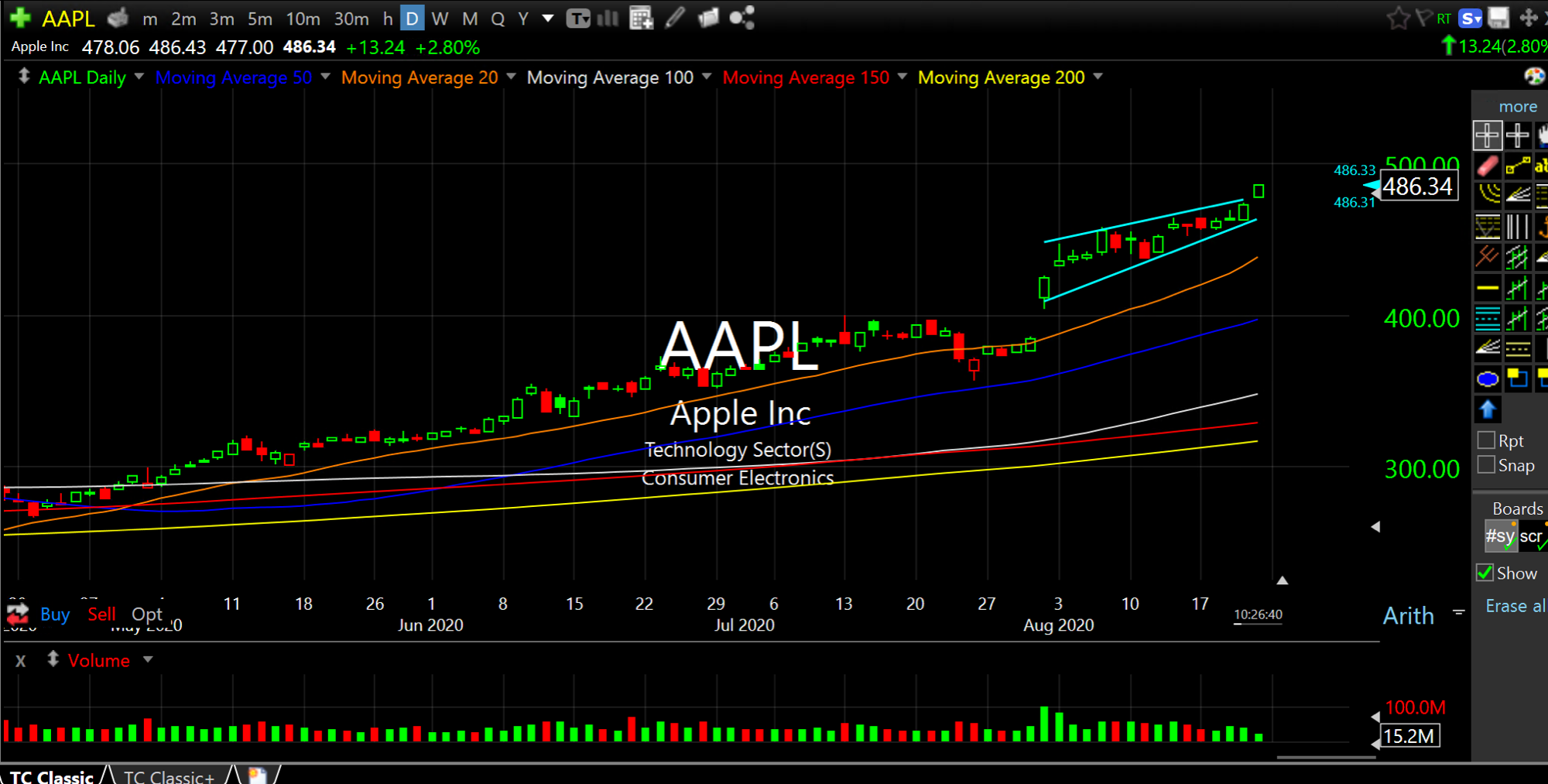

The melt-up in shares of Apple, seen below on its daily chart, alongside the likes of TSLA ZM, figure to have been instrumental for Nasdaq bulls by the time the closing bell rings today to finish out this late-summer week with another decisive victory.

While AAPL, currently over $2 trillion in market cap and Warren Buffett's second largest holding behind his nearly $150 billion in cash, seems most like the poster child for the current market melt-up, the risk for bears into next week, perhaps, is that rotation keeps the musical chairs going within the Nasdaq, possibly into the likes of NFLX SPCE TWTR, etc.. Should that occur, the current rally may very well prove to rival the dot-com bubble from the turn of the century.

Indeed, while the squeeze in TSLA is not a total surprise (after all, it has been a hated and shorted name for nearly at least seven years), the move in AAPL, at its market cap and lack of heavy short-sellers in the float, seems to rhyme if not repeat what happened in the dot-com bubble as far as beloved mega cap tech names seemingly on a daily mission to rally into the stock market heavens.

If that is the case, my suspicion for a few years now is that it may all culminate with a massive deal by a mega cap tech or media firm to buy TWTR out. Granted, I have been a long-term holder since the stock was in the mid-teens. So, of course, I am talking my book.

But TWTR, despite all of their management hiccups over the years, still seems ripe for the big, AOL/Time Warner type of buyout more than any other tech firm I see right now.

Jackson Hole 2020: Hold the ... Stock Market Recap 08/27/20 ...