09Sep10:34 amEST

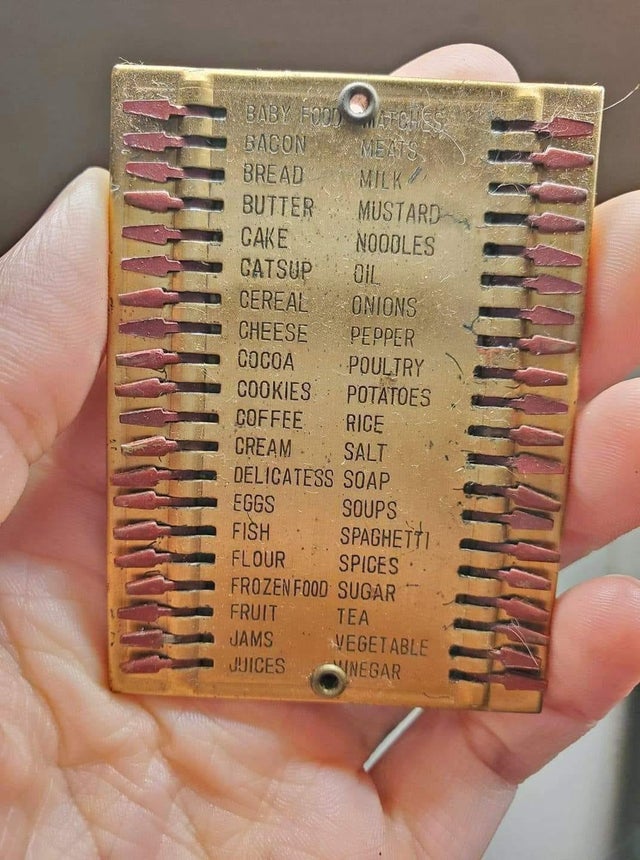

A Shopping List for the Proper Aisle

Equities are ignoring a few earnings duds this morning, namely COUP LULU WORK, to snap back after the last few sessions of a tech-led dive off recent highs.

While seeing a bounce in the face of the financial media repeating the arbitrary "10% correction" threshold for the Nasdaq is none too surprising in the near-term, from a contrarian standpoint, the trust test of mettle for bulls and indeed for the market character at-large headed into the FOMC next week, a General Election, more pandemic economic fallouts, social unrest, etc., will be whether the bounce can hold bounce a morning or so.

Although we have certainly seen plenty of V-shaped rallies off micro-dips since March, it is worth remembering, for example, that in ongoing corrective markets we often see early strength get aggressively faded as buyers simply do not have the conviction to hold beyond making quick flips. In other words, bulls have, indeed, had it quite easy and have been riding rather high on the hog, so to speak. My goalposts continue to center around the $271-$280 levels on the QQQ ETF for large cap tech.

As far as dip-buying, I have some shopping list ideas in mind but as of this morning I am a bit more intrigued in seeing if the precious miners can wake back up more than anything else.

The bounce in the miners is strong so far, and the GDX ETF, updated below on its weekly chart, has consolidated tightly since mid-summer, when we essentially took an agnostic view on the sector for about a month. The $37.50 level we have been eyeing with Members was never breached, too.

Now that the group has held steady in their respite, I am inclined to look here for some tester bets sooner than later, albeit with The Fed meeting a known risk event one week from today.

Stock Market Recap 09/08/20 ... Stock Market Recap 09/09/20 ...