24Sep10:19 amEST

Gold Miners: Welcome to the Fall Battleground

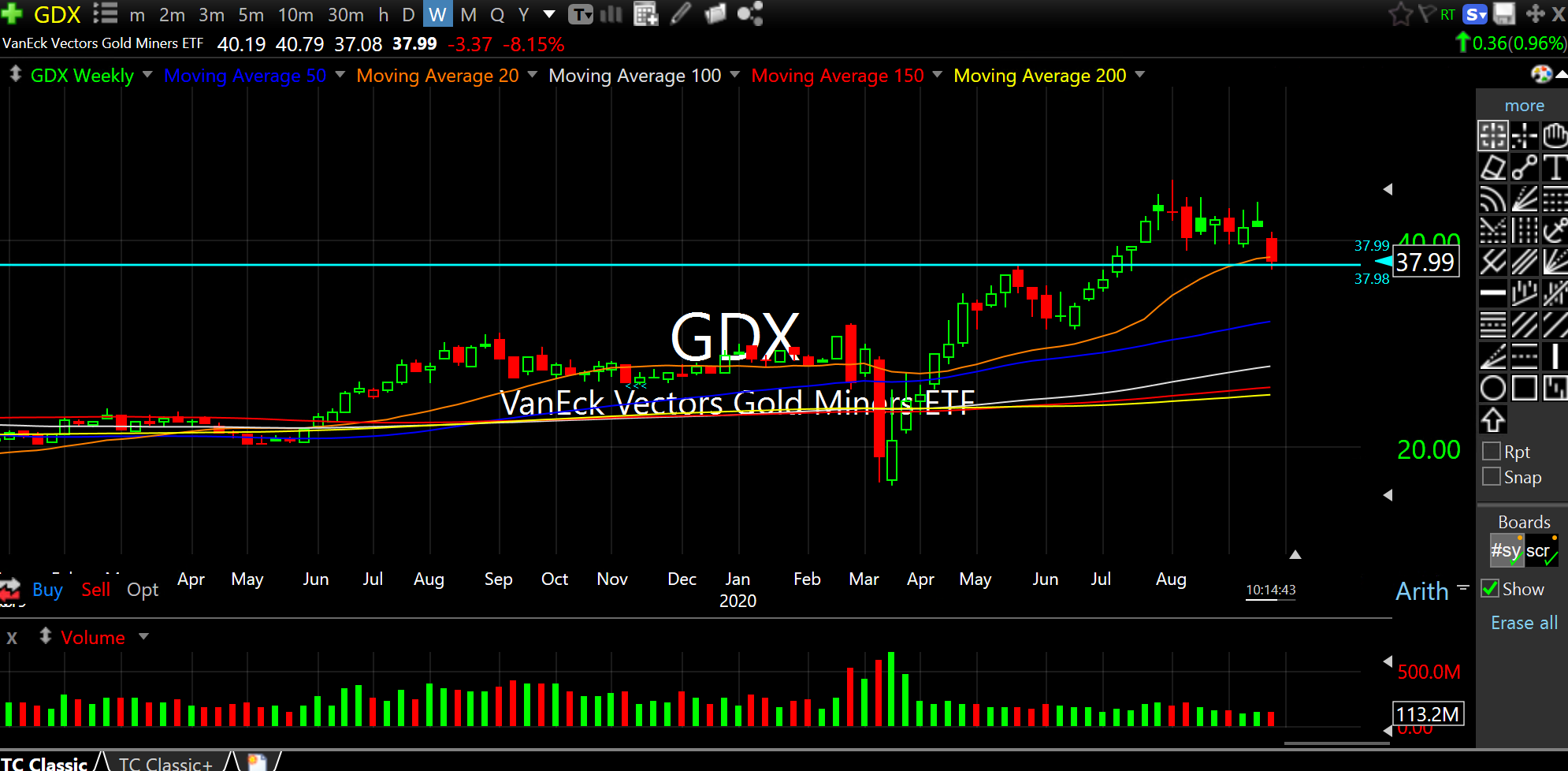

Back in late-July, just when the precious metals and mining complex enjoyed a new batch of converts to the yellow metal religious fervor, we expected the exuberance to at least level off for a few weeks, if not months. Inside Market Chess Subscription Services and on this website, we noted the GDX (ETF for larger cap precious miners) weekly chart as a good litmus test for the coming likely pause or dip.

In essence, the $37.50 level was one we harped on, not just because it marked the prior May highs (light blue line on weekly chart, updated below), but also because it is a level which actually dates back to 2007 as being a significant one. While not a guarantee, it did seem more likely than not that the near-term buying panic we saw over the summer would correct itself.

Fast-forward to the current market, and it is fair to say that the summer gold euphoria has properly corrected itself, with the nonstop money-printing-bad arguments taking a breather. Note how this stands in stark contrast to what we have seen in tech since the March lows--The gold correction has been healthy and much-needed, and likely sets up a fresh bull leg higher, whereas the drunken Nasdaq soirée may only just now be unraveling.

Either way, with respect to the precious complex, we continue to key off $37.50 as that level finally gets tested this morning. I am focusing more how the miners deal with it on a weekly closing basis rather than sweating it tick-for-tick intraday. Mind you, losing $37.50 would not be cataclysmic for gold bugs. But it would probably mean more time is needed to set back up long.

Another issue is the U.S. Dollar, as the greenback finally has seen some short covering. If and when the Dollar bounce starts to run out of steam, I will be even more inclined to add to precious miners for both short-term trades as well as more for long-term investments.

NC-17 Trade Ideas 09/23/20 {... Stock Market Recap 09/24/20 ...