05Oct10:58 amEST

The Beginning of the End

Don't worry, it's a long novel.

That said, this is the beginning of the end of the great bull market in Treasuries since the early 1980s, after Paul Volcker intrepidly fought the back off a vicious, long-lasting inflation in American history.

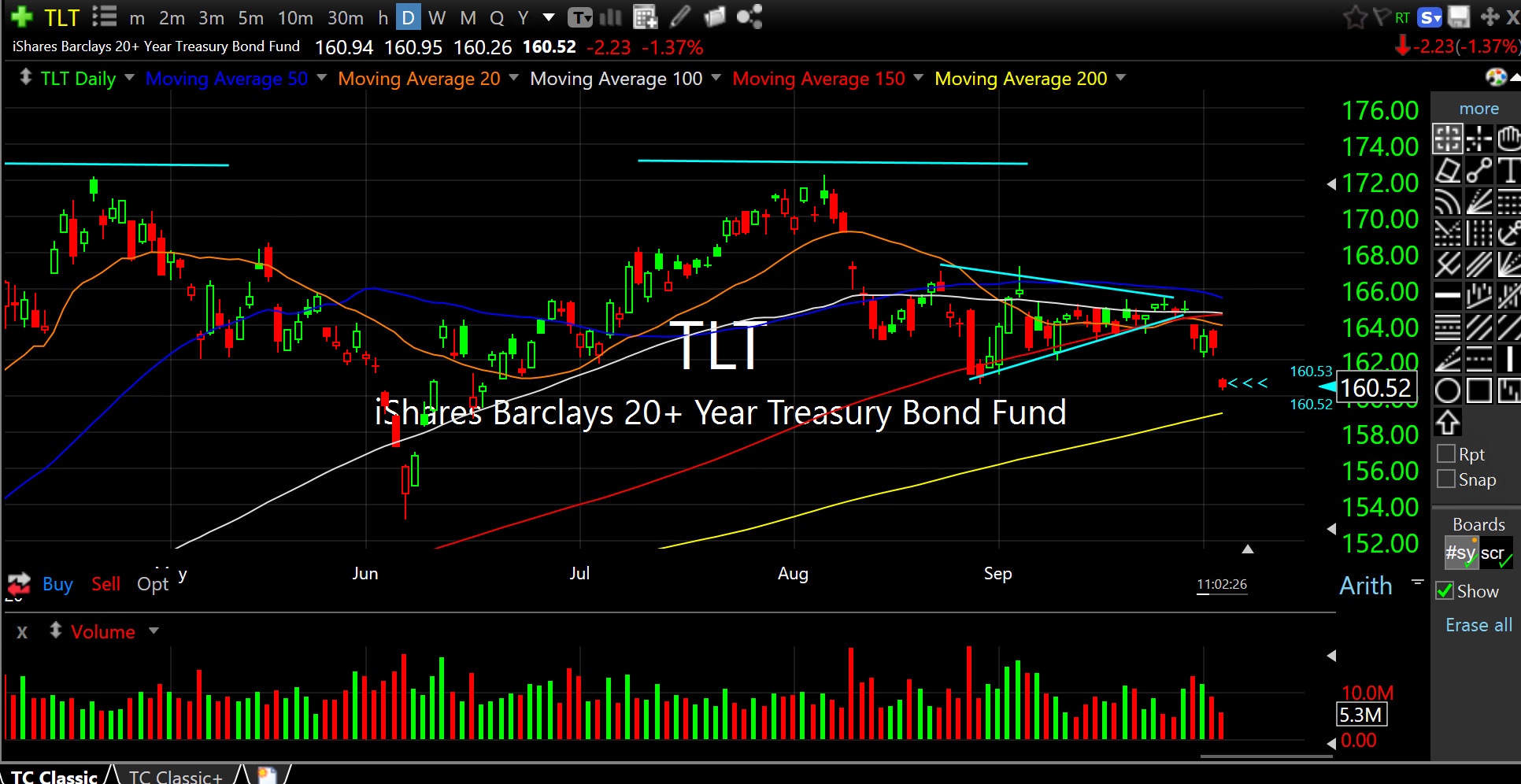

I am growing more bold by the day now that I see actual price action supporting my various views on The Fed's policies over the last two decades or so. Not only are Treasuries gapping down from the well-defined bear pennant (with a potential major double-top also highlighted) on the TLT ETF daily chart, updated below, but capital is flowing into "inflation" sectors like materials and, gasp, oil stocks, to boot.

Recall that as TLT, the chart below, goes lower, rates go higher (disclosure I am double-SHORT this chart via a TBT long bear ETF). Thus, the lower this chart goes, as we saw with a sudden crash back in March, the more dislocations can happen. True, if it happens in a more orderly way it allows for adjustment (read: Rotation!) into sectors like oil and materials.

Longer-term, though, the real reason this is happening is that The Fed is in the very early stages of losing their grip on markets--The paper tiger can only growl for so long. This will have negative consequences for America in terms of its global level of dominance for the reminder of this century. And I expect by the time the 22nd century rolls around (if only I would be so lucky to see it), America will be a shell of its former self, for other reasons, as well.

But this is no time for mourning or grieving, only time for making tactical and strategic adjustments. In lieu of focusing on the political headlines du jour, watch those rates like a, well, hawk...maybe even an inflation hawk.

Special Edition: Full-Length... Stop Neglecting the Unpopula...