29Oct10:44 amEST

If a Netflix Falls in the Forest

As we discussed in the full recap for Members last evening, as well as the brief video here, the total lack of dip-buying interest in Netflix since its earnings gap down last week seems to continue to go virtually unnoticed by the market.

To be fair, there are plenty of other headlines, stock, issues, and concerns to fret over. But NFLX has been one of the undisputed leaders of the market for a good while now. And even with the "Cuties" controversy it is all the more surprising to see that apathy is reigning supreme rather than a love/hate dynamic. Recall that in life the opposite of "love" is not hate, but rather it is apathy. Applied to the behavior finance discipline of analyzing market psychology, the apathy we are seeing in NFLX may very well be symptomatic of the stock simply running out of organic buyers over time, as well as too many shorts who have been burned throughout the years.

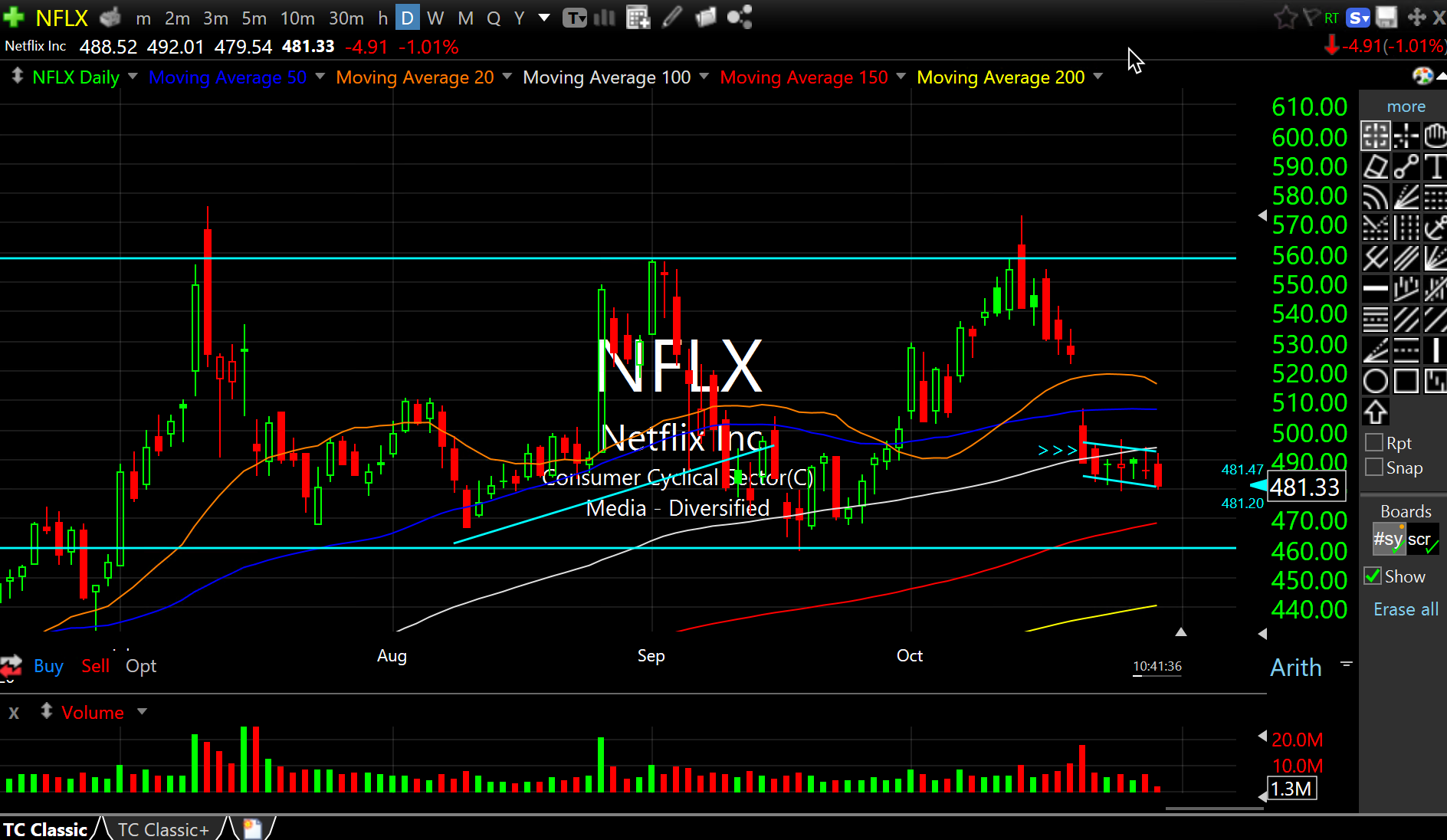

And thus we are left with this--A leader bear-flagging post-earnings on its updated daily chart, highlighted below.

In front of the blockbuster lineup of its peers in "FANG" reporting tonight, be with AMZN FB GOOGL, also AAPL, Netflix suddenly seems like a lost little puppy among the big dog leaders. Another angle is that NFLX is a harbinger of things to come for the rest of the leaders--Simply a case of running out of incremental buyers after years of bullish overall action, on top of gun-shy shorts who have been punished with their hands in the cookie jar too many times before.

Either way, we have NFLX as a short idea if it can hold below $480, going forward. And the fact that it may be falling in the forest with no one watching it is irrelevant to me. If anything, it may offer up a better short setup than many realize.

Stock Market Recap 10/28/20 ... Stock Market Recap 10/29/20 ...