05Nov11:56 amEST

The Era of Bad Feelings...and Bad Hedges

About two-hundred years ago in this country, after the War of 1812, America enjoyed "The Era of Good Feelings," with a strong sense of unity among our citizens and even politicians for a brief period of time.

Currently, we are seeing anything but that, with trust running low and tensions running higher. Applied to markets, there is a similar theme. Indeed, as we await another FOMC later today (and Presser by Powell), I cannot help but wonder if The Fed's uniquely easy policies the last few years and even decades have been far more impactful on society than any of us are willing to comprehend. If you turn on CNBC, for example, there are dedicated macro commentators who are dedicated to defending The Fed at each and every turn.

However, as long as markets are willing to accept The Fed apparent omnipotence at face value we will not see a true crisis. It could take months, years, or in the scope of a declining empire, decades or centuries, which places even more of a premium in simply adhering to the price action and underlying setups/rotations.

Gold and her miners are enjoying an exceptionally fine day, thus far. They continue to operate in multi-month consolidation patterns in the context of new long-term uptrends. After turning cautious n them back in mid-summer, I am prepared to flip bullish on them again if they thrive after the FOMC this afternoon into tomorrow and next week.

But the real story this week from a market standpoint has been the freight train short squeeze higher amid collapsing volatility. I am not too impressed with the market rally but I have not put on any shorts this week, either, just yet.

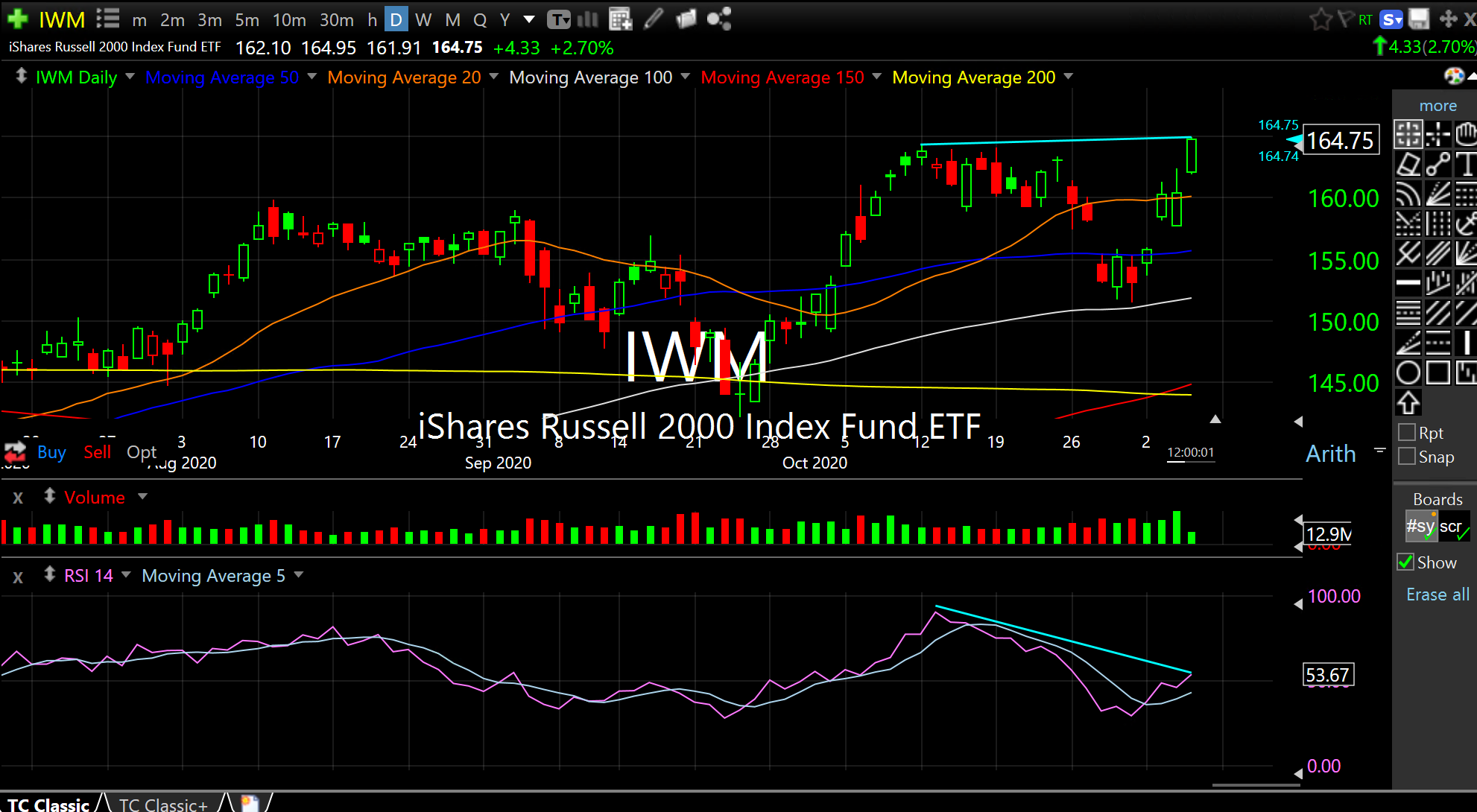

I am tempted too, though, especially if the small caps fade off their new post-pandemic highs today. On the IWM ETF daily chart, below, you can plainly see a bearish RSI (Relative Strength Index, measuring underlying momentum in a given market) to price (bottom pane of chart) on this new high since February today, relative to the October highs.

In my view, the rally this week essentially served to burn down all of the election shorts and hedges, more than anything else. Surviving and holding these gains post-FOMC into next week may very well change my tune and see me increasing long exposure.

For now, though, bad feelings in society and bad hedges in markets make for emotionally-charged, at times violent societies, and emotionally-charged, at times violent markets.

Election Rotations 11/04/20 ... Stock Market Recap 11/05/20 ...