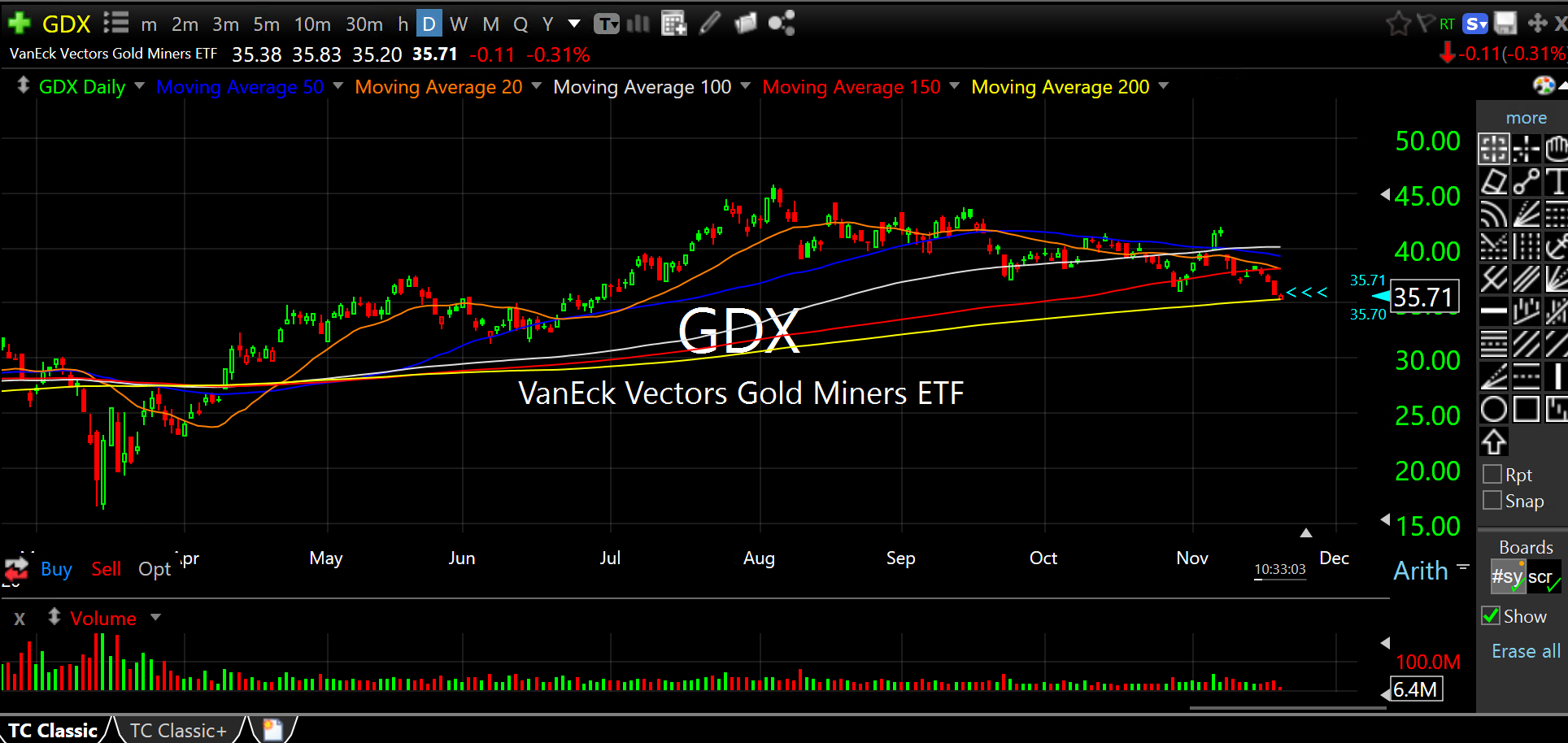

19Nov10:30 amEST

A Big Event, Minus Pomp and Circumstance

Back in the middle of summer it was hard not to find gold bugs and newly-converted precious mining bulls champing at the bit to trade the sector in the midst of a strong bull run. After all, The Fed just wants to print money and our politicians treat our deficits like they are a total joke. How could gold not be the answer, or at least one of the big answers alongside crypto?

Inside Market Chess Subscription Services, we were also pretty bullish on gold and the miners up until late-July, when we surmised in real-time with Members that a consolidation was growing likely, for a variety of reasons we discussed at the time.

Since then, the group has been in a rolling pullback, not outright bearish but also most certainly testing the patience and discipline of steadfast gold bulls.

On the GDX, ETF for senior gold miners, for example, we had the $37.50 level in mind as a precise level to see if bulls would make a concrete stand and put a floor underneath the group.

Instead, we have seen various fake-outs as the group is simply not yet ready to resume its primary uptrend.

With that in mind, I update them for you today because we have the GDX testing its 200-day simple moving average (yellow line on daily chart, below) for the first time since April. This test is happening to basically no pomp and circumstance, given how obvious of a test the 200-day is.

But that's just it: The gold/miner rolling, tedious, consolidation since late-summer has taken its toll, to the point where the gold miners just are not very exciting...at least for now.

If buyers show more willingness to defend this 200-day than the $37.50 level, I am interested in stepping back into the group for a trade--A quiet 200-day test for a group still in a primary bull run (see the 200-day sloping higher, still) is a intriguing long setup to me.