24Nov9:55 amEST

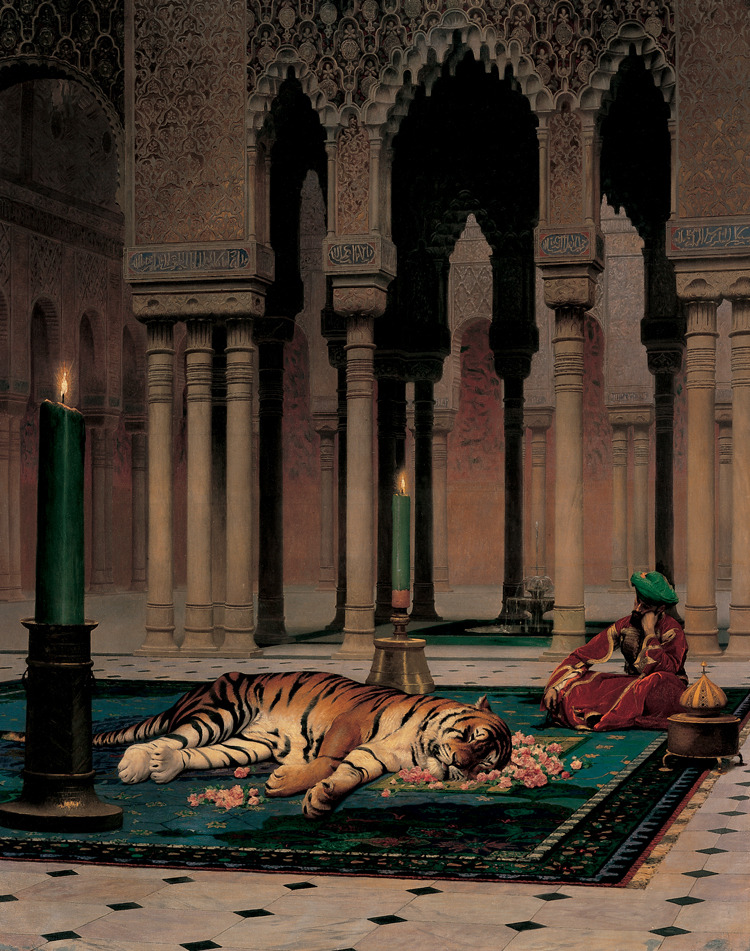

The Paper Tiger is Real; He's Just Asleep

No one is talking about gold and the miners, and that suits me just fine.

The apathy we are seeing the precious complex is reminiscent of our discussions about energy and materials around Halloween--It was no longer a case of the being "hated," or even mocked, but rather just roundly shunned altogether as a total waste of time.

And who can blame them? Bitcoin is the new girlfriend, hot and fun. Gold is the old, miserable, boring negatively nelly. Or so it seems.

But with the junior gold miners, below on their GDXJ ETF's daily chart, undercutting the 200-day moving average the way their larger cap counterparts in the GDX ETF did yesterday, we are likely getting close to a tradable low in the complex, especially if the apathetic sentiment is any indication from folks who were vocal cheerleaders over the summer at recent highs.

Overall, the gold bull thesis is intact long-term, with monetary and fiscal policies aligning to help the yellow metal. Unlike Bitcoin, gold has intrinsic value and has been recognized for its value over thousands of years, transcending various civilizations. As we know, the same cannot be said at all for Bitcoin. That is not to say crypto is doomed to fail, but the notion that gold is obsolete remains laughable.

Technically, at this point with the 200-day moving averages now undercut in the miners, we are simply looking for signs of buyers stabilizing price as the gold metal itself in GLD closes in on its own 200-day, which would create a nice alignment of signs to probe a long during this holiday week, just as everyone is focused on crypto, Thanksgiving, EV stocks, etc...

Stock Market Recap 11/23/20 ... The State of Gold 11/25/20 {...