11Jan10:23 amEST

Dude, Where's My Bitcoin Rally?

After an exhilarating rally throughout much of the crypto space (including proxy stocks like MARA RIOT) over the last few months, the plethora of headlines today about "Bitcoin is crashing" should be taken with a grain of salt, at least (the title of this blog post notwithstanding). Indeed, this sort of volatility is the rule, not the exception, for the cryptos. And quoting the percentage drop, for dramatic purposes, in Bitcoin from recent highs seems disingenuous considering the prior advance.

But the real issue seems to be whether we are on the cusp of a change in character for the U.S. Dollar currency. The reverberations of a regime change would almost assuredly have broader reaching implications across most asset classes than whether Bitcoin experiences standard volatility.

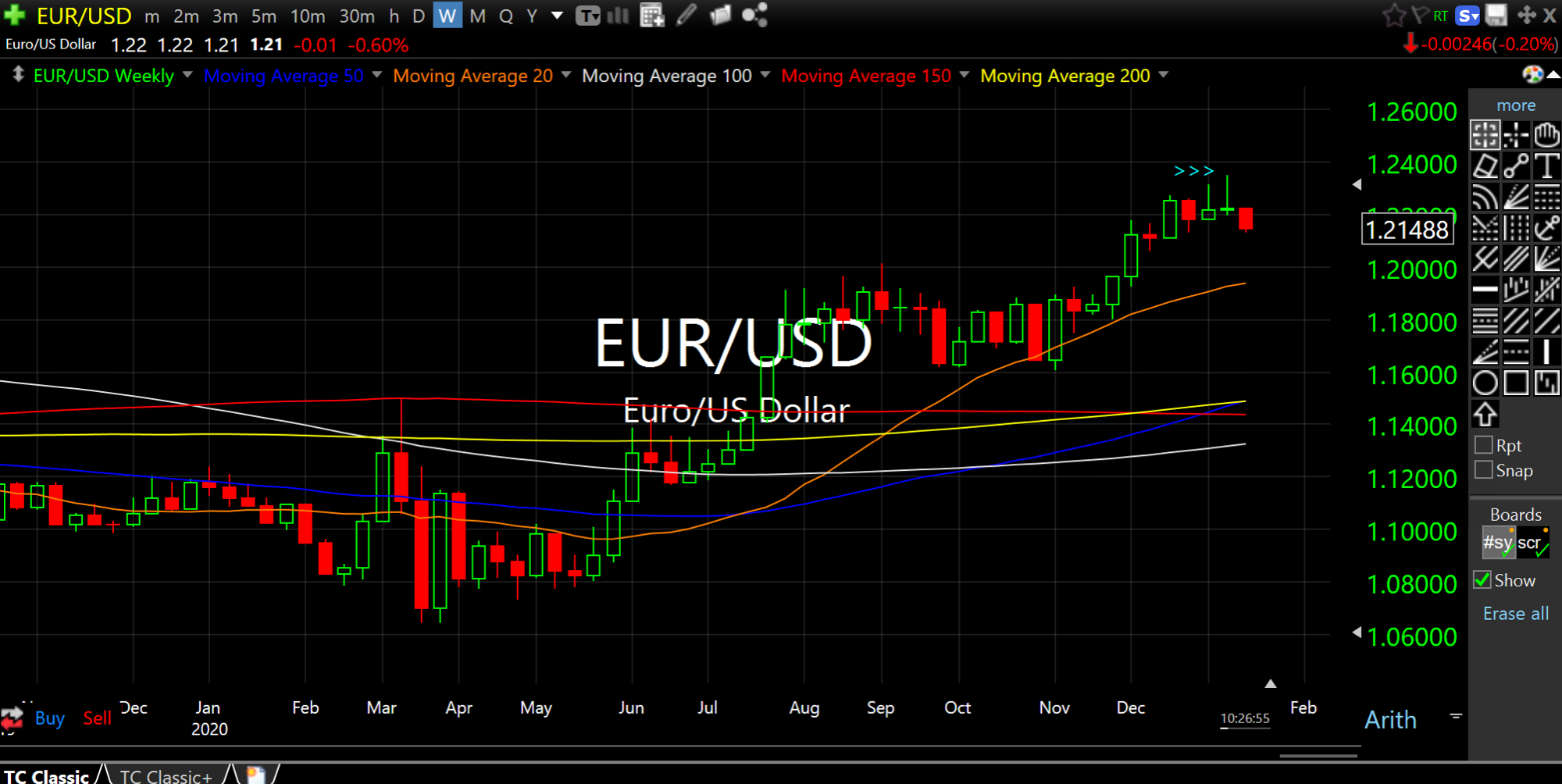

One observation worth noting, as we see below on the Euro/U.S. Dollar weekly currency cross, is how the hot Nasdaq stocks, small caps, and even crypto all seemed to correlated nicely with the Euro strengthening (the numerator) versus the Dollar (the denominator).

In other words, all is fine and great as long as the Dollar did not signal global dislocations and a need for Dollars, thereby strengthening the greenback.

But if and when this currency cross buckles, we would need to quickly adjust.

Note, for example, the potential reversal candle last week on the Euro/Dollar (arrows) after the prior steep rally. Should today's weakness hold true, I expect the correlation across the board to work to the downside just as they did the upside, perhaps with even more velocity.

After all, with the optics and fallout of the political events last week, spilling over into this week, what better time for a surprise short squeeze in the Dollar than now?

Weekend Overview and Analysi... Stock Market Recap 01/11/21 ...