03Feb10:18 amEST

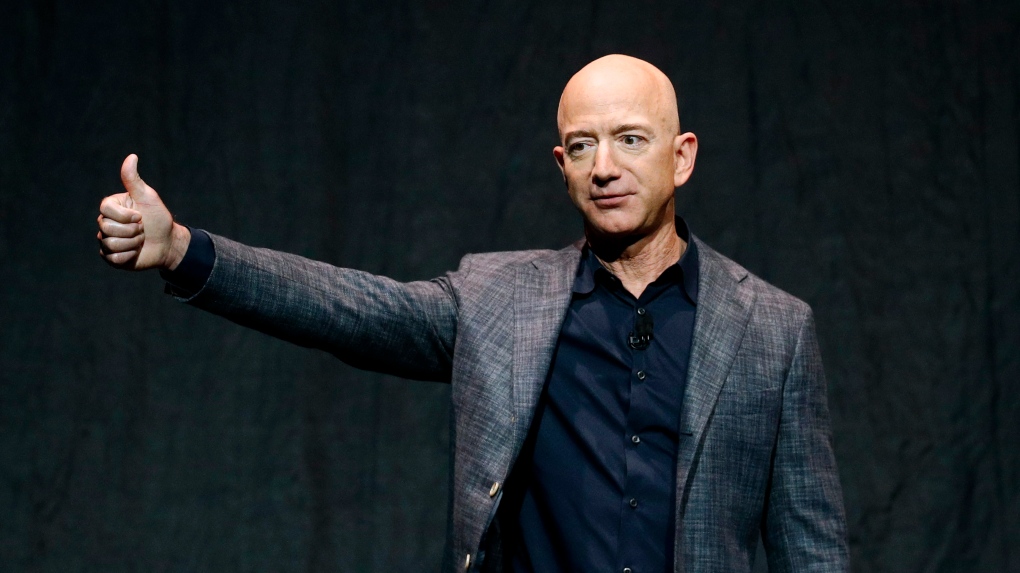

Jeff Bezos to Us: "Good Luck, Pendejos"

It may as well have been a decade ago, but it was actually around this time just last year that the market was melting higher...and then we suddenly got hit with a barrage of headlines regarding prominent CEOs and major players on the Board of major firms stepping down mostly "for personal reasons," or something to that effect. The most memorable instance, of course, was Bill Gates at Microsoft, which, in hindsight, serves as fodder for conspiracy theorists and general skepticism about the pandemic and his involvement in it.

Naturally, we all remember what happened not too long after the stream of resignations from big-time executives--A multi-week crash which found its footing just in the nick of time to stage an explosive and historical rally into the present moment.

And then just last evening on the back of Amazon's earnings, CEO Jeff Bezos surprised many by announcing he was essentially stepping down to focus on other projects and interests of his. The incoming CEO is, by all means, accomplished and competent. So that is not likely to be an issue.

But the larger picture of Bezos choosing this moment in time is interesting, just when everything looks brightest and the pandemic seems to be abating.

As I wrote about a month ago, I thought the pandemic was actually topping out. However, that may not be as bullish going forward as many would seem to believe once the market turns its attention to reality (namely, valuations and forward growth prospects with historically high bars everywhere).

Thus, we may very well look back on this move by Bezos as being a memorable moment not just for Amazon but for rich tech at-large.

As for the here and now this morning, the indices turned in a sloppy first hour after a sharp multi-day move higher. Pot stocks are celebrating the GWPH buyout, which has been eyeing NBEV as a pot-beverage play capable of moving quickly.

One other point to make: AMC and GME have the look and feel of wanting to now chop every single trade up to pieces in them after now being obvious "big move" stocks. In other words, both longs and shorts should beware of changes in character for these two names this week--We may get a whole lot of nothing now after a few weeks of nonstop action.