17Feb10:32 amEST

The Many Phases of Winter and Markets

We are at that point in a fairly harsh winter season where it is hard to remember what warm, sunny weather feels like, yet it is still too early to truly see spring around the corner. Similar comments apply to equities, where it is hard to remember what a legitimate, albeit garden-variety, 8-12% correction on the major averages looks and feel like, even if the last two trading sessions are the prelude to just that.

What some of the newcomers to the market since last March may not realize yet is that a true correction can actually be wildly bullish, helping to reset extended charts, shake out excessive froth, and even introduce a new batch of exciting leaders going forward. But the longer the drunken stupor of an endless melt-up lasts, such as the one we have seen, the rising risk of the rubber band snapping off in such a way which creates a far messier situation to the downside.

With TSLA, the semiconductors, as well as the small and micro-cap stocks all coming in this morning, the issue is whether the buy-and-slight-blip crowd steps in and is rewarded once again. To be clear, the action so far barely qualifies as a "dip, given the sheer size and scope of the one-way move higher heretofore.

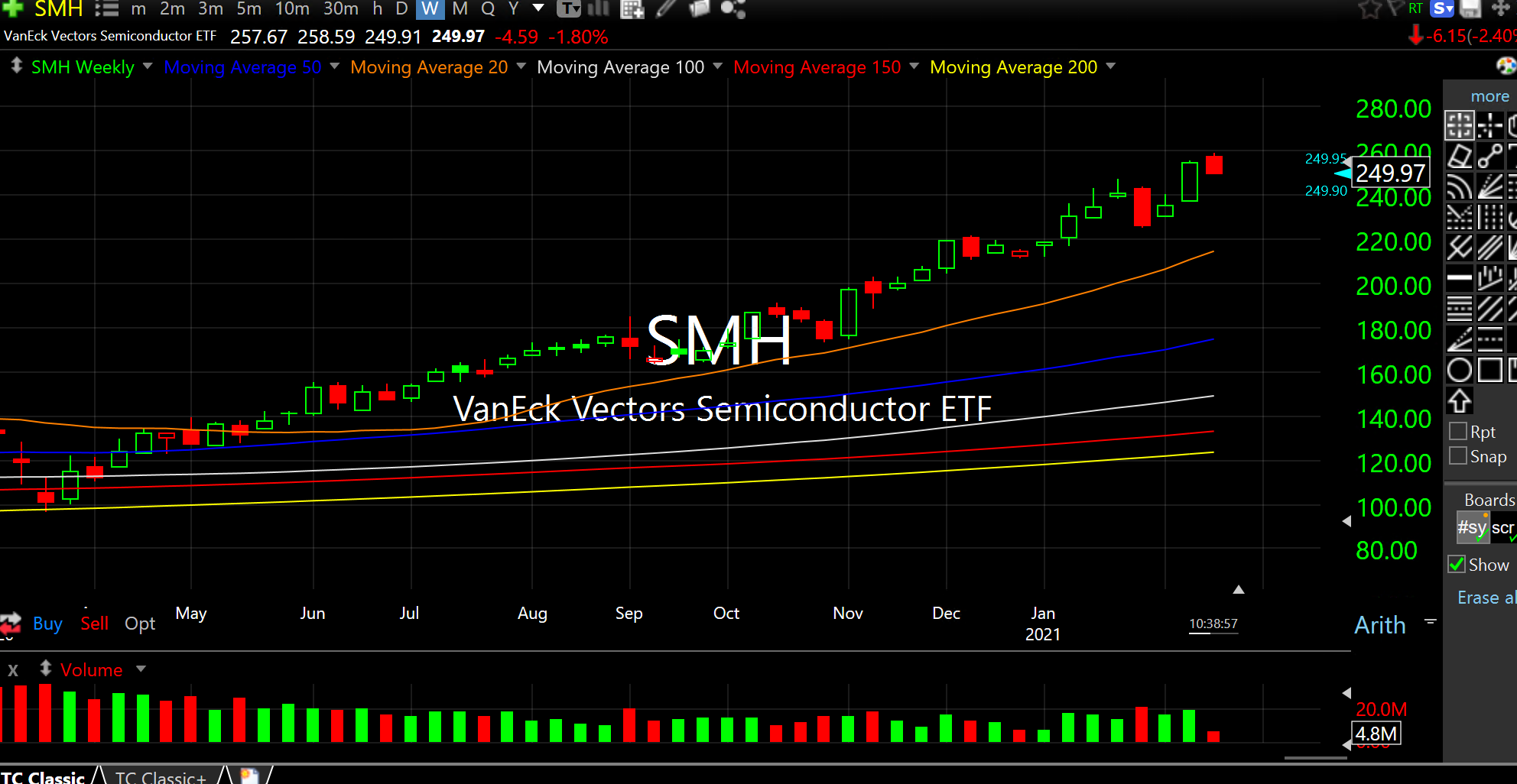

On the SMH ETF for the semis, below on the weekly timeframe, you will note the sector is not even down to the mid-point of their price range for all of last week (note the prior candle, denoting last week on a weekly chart, the prominent green one). Also note the 20-period weekly moving average (orange line) has not been tested since May 2020. Even if there is no outright test this time around, the relationship between price and that reference point narrowing seems likely now.

We are int he list of a seasonally rough patch, not just for wether but for markets, too, especially in the first year of a Democrat President and a President ousting an incumbent. Biden's coming SOTU address could present some risks the market has been asleep at the switch on, such as China, Big Tech, healthcare, and now energy.

While the melt-up could continue as soon as the New York lunch hour today, given this market's recent history, I see an opening for a higher volatility environment through March and have positioned as such.

Stock Market Recap 02/16/21 ... Stock Market Recap 02/17/21 ...