18Feb10:25 amEST

Are We Really Going Stag?

A surprising jump in jobless claims this morning, coupled with persistent strength in the likes of copper, lumber, inflation readings like PPI, and warnings of price hikes from companies like KHC (acting great as a stock, though) all merit at least an instructive analysis about whether we are headed towards a dreaded period of stagflation, not unlike what we saw in the economic malaise of the 1970s.

Fed heads, as well as former Fed Chair and current Treasury Secretary, Janet Yellen (who will be on CNBC at 4pm EST today) are already trying to counter these stagflation fears by declaring any uptick in inflation to be ephemeral. But with rates on the 10-Year Note not yet rolling over, the risk is that the bond market calls The Fed's bluff here and does not think the inflation readings are temporary.

What we can say for sure is this: With President Biden's State of the Union speech now apparently on the shelf until March, or at least the Stimulus is ironed out, the market is at least taking a respite to think things over after an epic melt-up.

As far as near-term risks, I still view TSLA as being a linchpin for a variety of reasons, which we previously noted here and with Members. Below yesterday's lows should increase broad market volatility and selling, in my estimation.

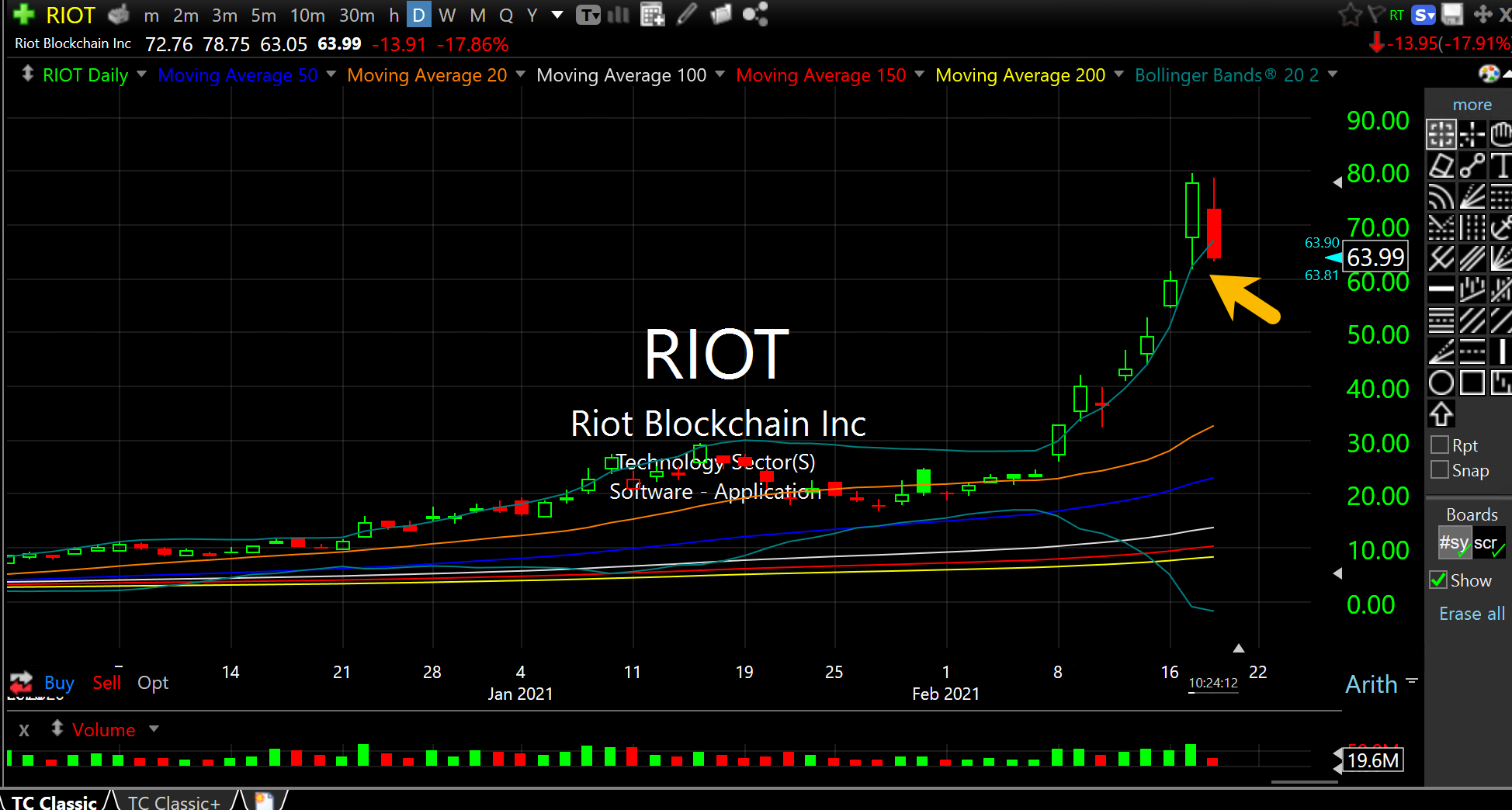

In addition, the crypto trade cooling off, as we see RIOT getting walloped today after exploding higher this month, should also impact risk appetite. RIOT just took out yesterday's lows as I was writing this, and acceleration of the selling below $60 should be taken seriously as far as a gauge of market appetite for risk as we work our way through the dog days of winter.