08Mar10:45 amEST

Tepper Monday Front Runs Turnaround Tuesday

With his well-earned gravitas in play, hedge fund manager David Tepper threw his market-weighted opinion around this morning again, reminiscent of the post-Labor Day 2010 rally after his famous "balls to the wall long" exhortation on CNBC.

Given that equities had managers to find some footing, albeit in a violent way, on Friday, I had decided to close the few bearish bets I had on and wait for a failed bounce to re-short. While I respect Tepper immensely, and this rally could easily last a few weeks, I expect the vast array of broken chart and, now, possibly broken model recalibrating to a rising rate environment, to eventually come home to roost either later this month or in April for a classic "Sell in May" scenario.

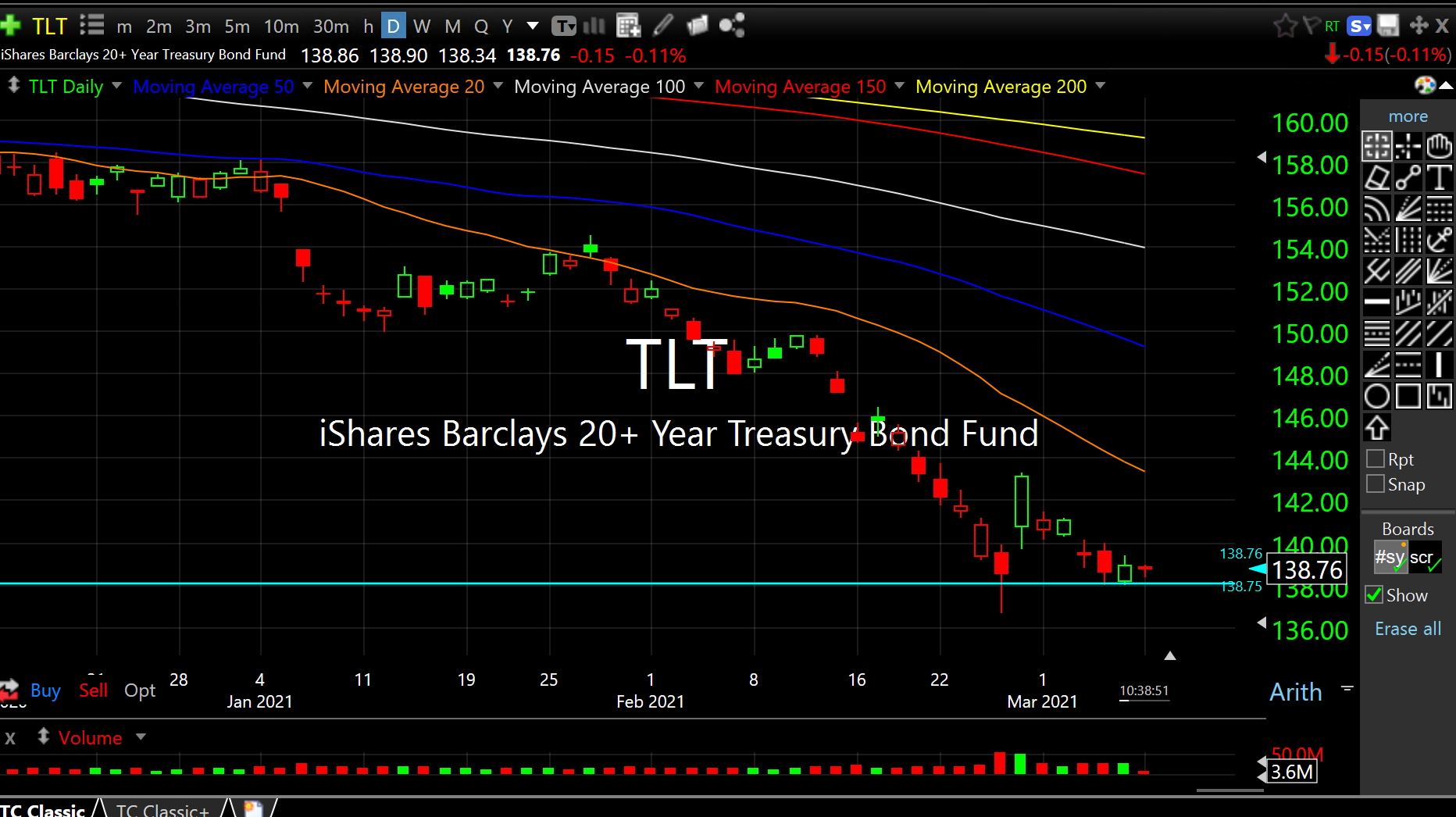

Thus, playing some quick bounces makes sense if bulls avoid a fumble here. And when we gauge just that, it seems imperative for TLT to hold $138 as support, seen on the second daily chart, below. Should that happen, it means rates have likely stabilized near-term, giving stocks room to firm up a bit.

Of course, the gold miners have been dropping with Treasuries, which is likely a mistake long-term. But GDX, first daily chart, below, still needs to hold $31 to sustain a relief rally coinciding with rates backing off.

Two Stimmy Setups 03/06/21 {... Stock Market Recap 03/08/21 ...