16Mar3:34 pmEST

The Rapacious Twenties Cometh

Some late-day buying in bonds is helping to stave off a bit of selling momentum which gathered across the board earlier this afternoon. Once again, this sort of price action still figures to be digestion and backing and filling in front of tomorrow's FOMC, where we will see whether Fed Chair Powell can say the right things to assuage bond market fears of them being complacently behind the curve as the vigilantes begin to raise rates for them.

Of course, bulls view higher rates as part of the Roaring Twenties narrative, where the U.S. will boom and most markets, namely growth equities and crypto, will continue to surge higher. I remain skeptical of that thesis on a multi-year basis, but have not shorted in a few weeks either as I suspect we are in the process of one final push higher before a sell-in-May setup materializes.

I am, however, onboard with a "Rapacious Twenties" scenario on the re-openings this spring and summer, with pent-up animal spirits leading to some wild behavior.

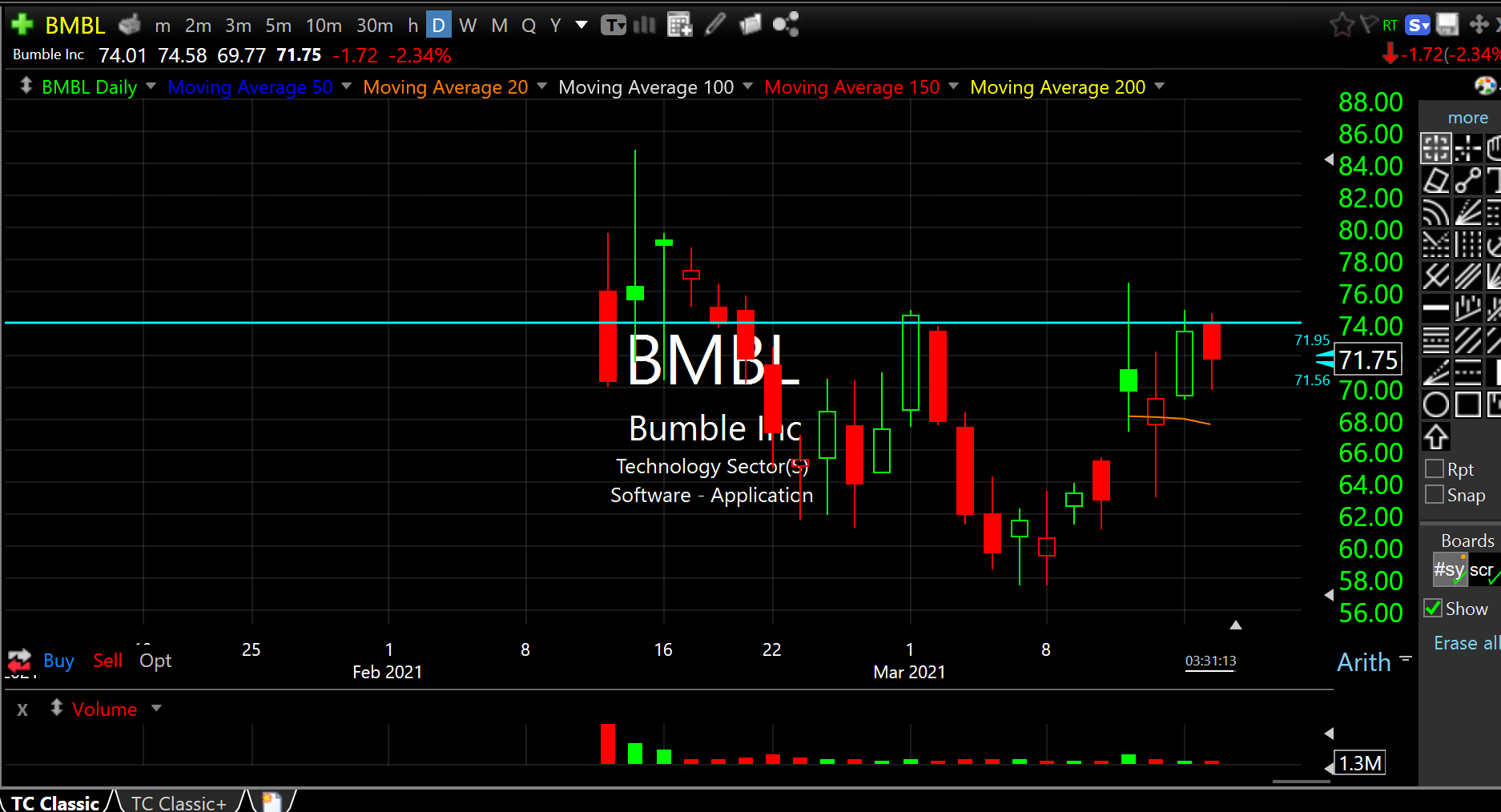

Bumble, the dating app off its recent IPO and first public earnings report, figures to be a play on this rapacious behavior, especially those freshly-minted singles coming off divorces and breakups after a long pandemic. On the BMBL daily chart, below, the stock may indeed form a "handle" from here as it recently completed a "cup" pattern, with $74 being a sound long trigger above. Should equities enjoy a few more weeks of fun and games, it would not surprise me to see BMBL make a run into the mid-$80s to test its IPO day high, at a minimum.

Also note how well MTCH, owner of Tinder, has been basing the last few days and weeks, coiled up in a strong uptrend.