30Mar10:46 amEST

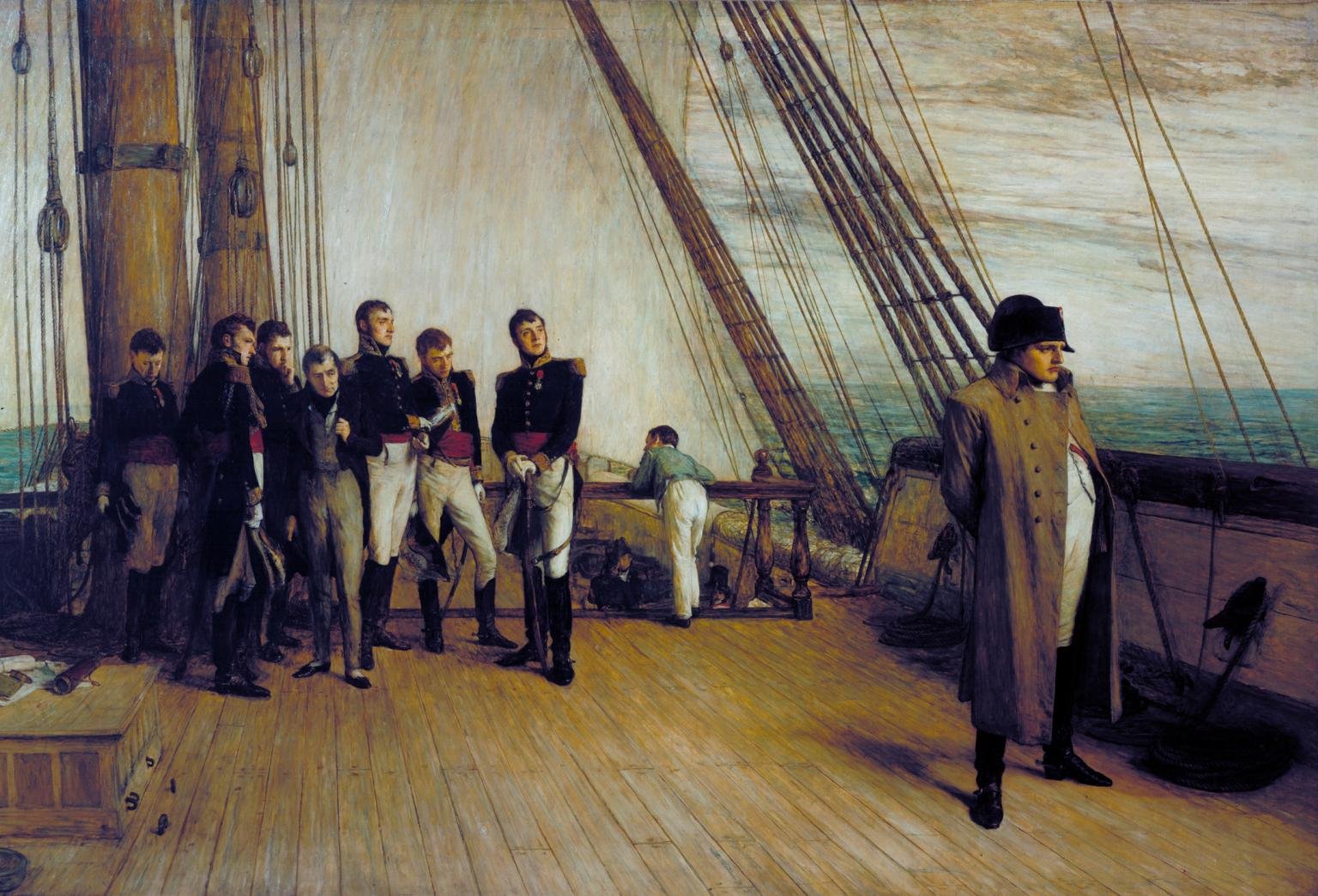

A Leader Returns from Exile

Beyond the bullish price action itself, not to mention the relative strength to choppy if not outright bleeding growth names thus week, one of the more bullish aspects about the rallies in materials plays like USCR and X has been the downright lack of enthusiasm from market participants and pundits alike concerning the group's strength. To be sure, that is to be expected given that X (U.S. Steel), for example, is trading basally where it was at the bottom of the 2009 bear market lows. Indeed, at the beginning of the Trump years many were on the X bandwagon only to get burned there, too.

And so the lack of excitement here is understandable--There are only so many times one is willing to burn one's hand on the hot stove before concluding the dish is not worth the risk of tasting.

But this time around we have rates rising, deep values across the board in materials mining (and energy and industrials), and a likely barnburner of an infrastructure plan announced soon enough amid unprecedented fiscal stimulus. Moreover, these firms also have pricing power, something which becomes a moat during supply chain disruptions and periods of rising inflation expectations. This is all happening as the extremely rich growth stocks have undergone corrections which have already humbled many of the complacent longs from the bull run off the March 2020 lows, but may very well have another leg down into the summer, too.

Another point being overlooked is that when the materials and commodity stocks finally do move, they offer uncommon alpha (see early/mid 2008 and parts of 2011, e.g.), which make all the difference in the world if growth stocks continue to disappoint with pedestrian rallies in the coming months.

Above all else, as the materials trade continues to outperform to little fanfare I am simply along for the ride and see a decent potential at some outsized moves as a nice sweetener.

Even a small cap domestic play like Ryerson, below on its daily chart, is acting like it is not just the large cap iconic materials plays with an improving position. Note the bullish pattern just below $18 resistance. Needless to say, there are not may tech/growth plays at the moment sporting as solid of a bullish long setup.

Stock Market Recap 03/29/21 ... ...But I Might Be a Whole Ma...