05Apr3:34 pmEST

No Mania for You? I Have Your Play Right Here...

I always find it amusing when some people try to pigeonhole this website and our general strategy as this, that, or the other thing. In reality, we have demonstrated over a period of years that we are willing and able to adjust to the market's ever-changing landscape while still staying focused on sound risk management principles. Yes, we typically focus on technical breakout strategies.

But inside the long-term, VIP arm of Market Chess Subscription Services we also bought TWTR with a $16 handle and are still long the name as an investment in the face of disbelief from many that TWTR had fallen so far, so fast from its 2013 post-IPO highs. We also, in real-time, ran through the relevant sentiment (apathy) last Halloween in the energy sector in detailing why we turned bullish on oil stocks like CVX.

As the equity markets move through bullish seasonality in early-April we are rolling with the punches and staying opportunistic. But we are not solely focused on breakout plays here, though quality chart setups like DNN and HYRE are two named we charted on social media earlier today with impressive patterns.

But if that is not your jam, there is nothing wrong with staying focused on the quality value names which have been steadily finding bids for months now to little fanfare since the high-flying growth names hit many a hotshot trader in recent weeks.

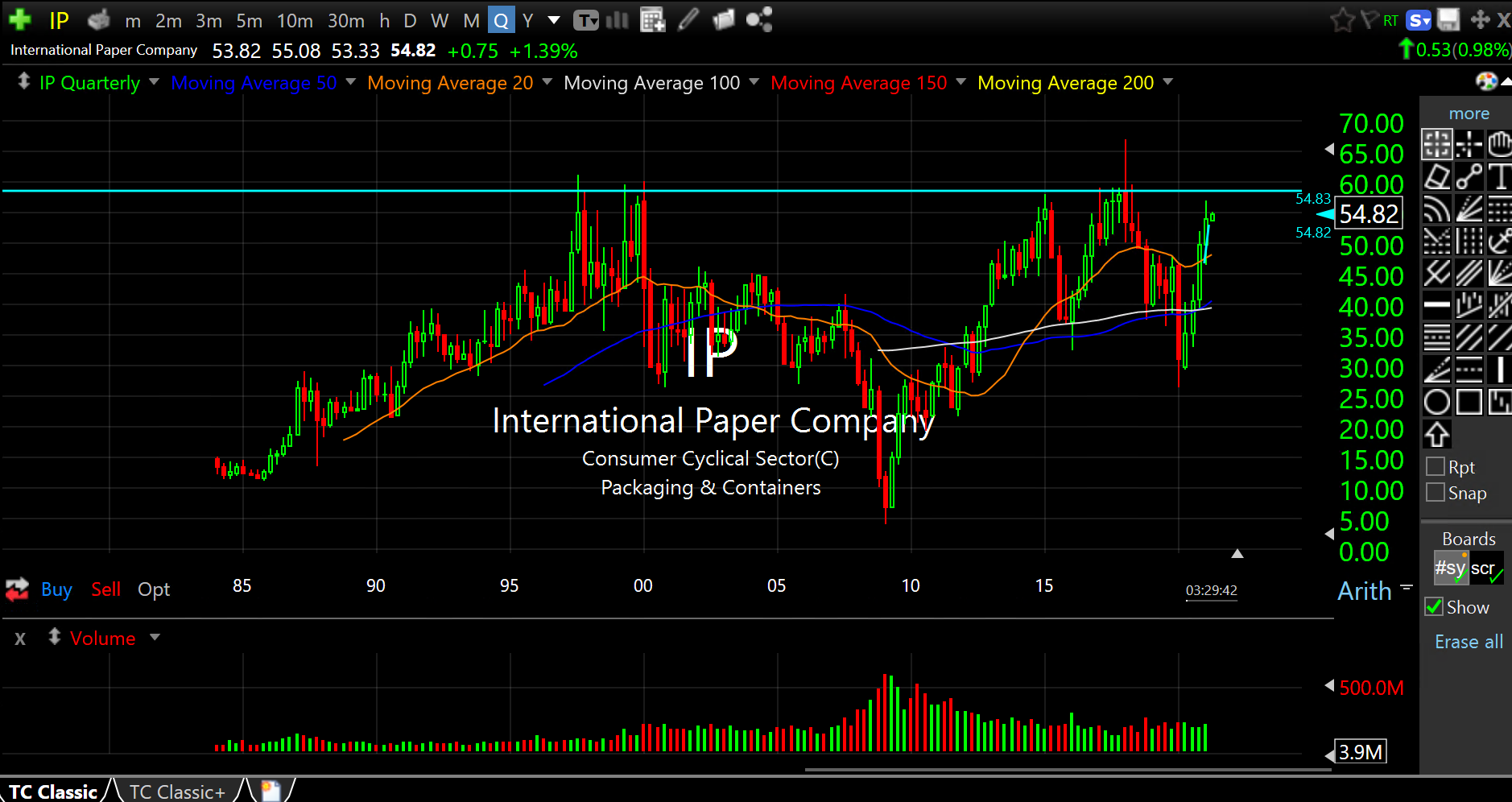

One fascinating value play is the packaging name, International Paper, with about a 3.78% dividend. The stocks has gone, overall, nowhere for the last twenty-five (!) years, as seen on the first quarterly chart, below. The Memphis, Tennessee firm has about 56,000 employees and is instrumental in making the boxes that monsters like AMZN use.

On the second daily chart, below, IP is as coiled as can be and, frankly, looks as strong as any swing long setup out there right now.

It may not be as sexy as any pot stock, streaming play, or even a "FANG" or Cathie Wood play. But IP is precisely the type of name which could have more upside than any of those hot tamale growth sectors over the coming quarters, especially once we get beyond this early-spring bullish seasonality.