06Apr3:41 pmEST

I Proclaim This the Summer of George! And Wings

With just over 1,400 locations nationwide and a mere $3.75 billion market cap, Wingstop still has the look and feel of a fast-casual hybrid chain on the rise.

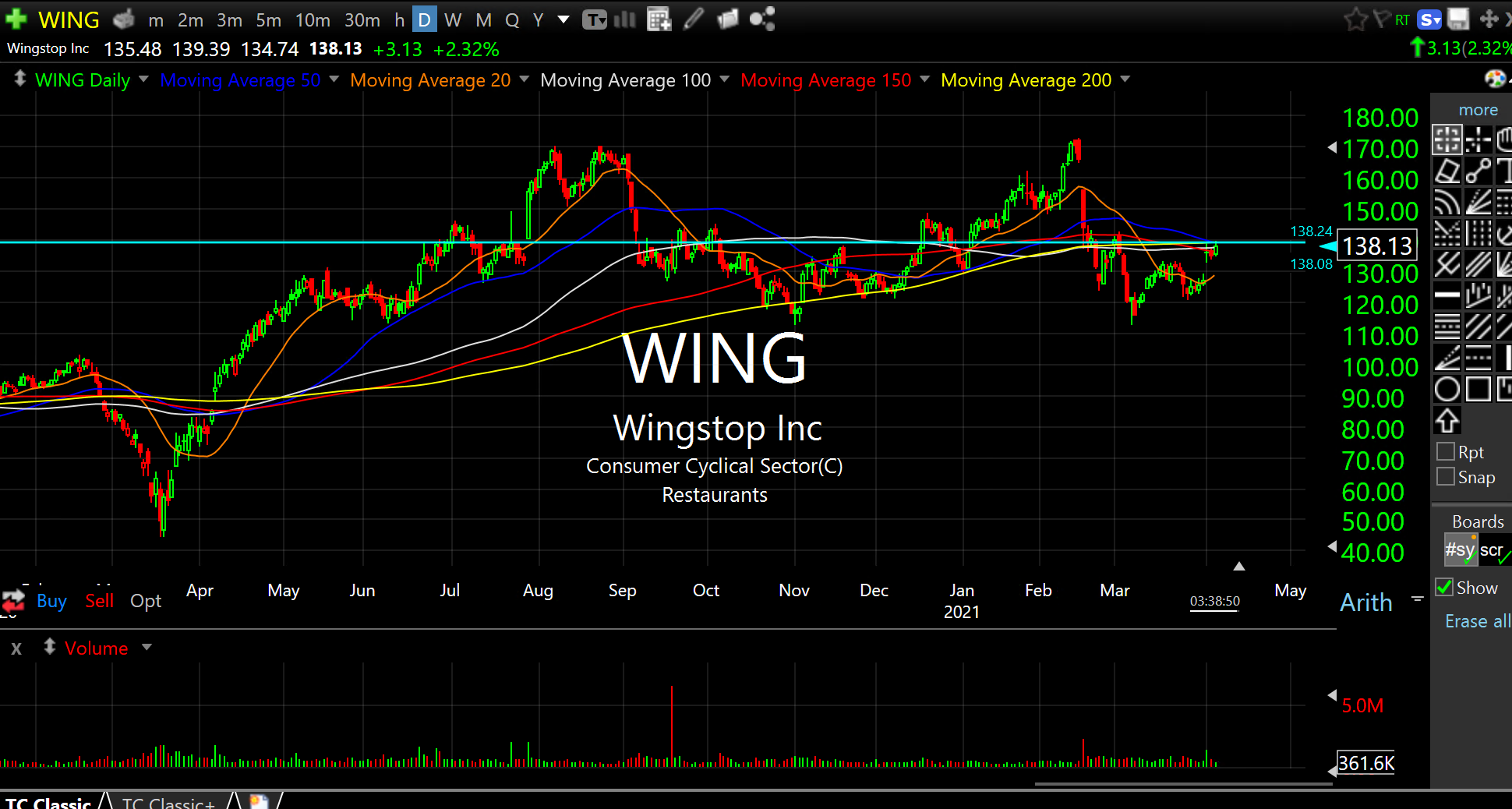

Of the March 2020 lows, Wingstop screamed higher nonstop into late-last summer before settling into a wide range ever since. On the updated WING daily chart, below, you can see as much, with the recent underperformance leading to many prior enthusiasts of the stock moving on to some of the stronger restaurant stocks like BLMN DENN DIN EAT RRGB SHAK TXRH.

However, it may be a mistake to write off WING as a has-been stock, a the reasonable price points for their products and, above all else, portable nature of their business model make sense headed into summer of a pandemic with Americans suffering from cabin fever galore and not necessarily looking to even eat indoors this summer. WING stores are primarily designed for carryout, making it a viable choice for families especially looking to string out the stimulus money.

If WING reclaims $140 soon enough I suspect it unlocks a possible gap-fill way above from February's nasty earnings selloff. That would qualify as a summer of wings scenario, indeed.

But even if WING does not make it that far, the stock is basing well at the low end of its range and worth a look for a swing long this week.

Retail Therapy to Cure Your ... Food Inflation: The Worst is...