15Jul12:53 pmEST

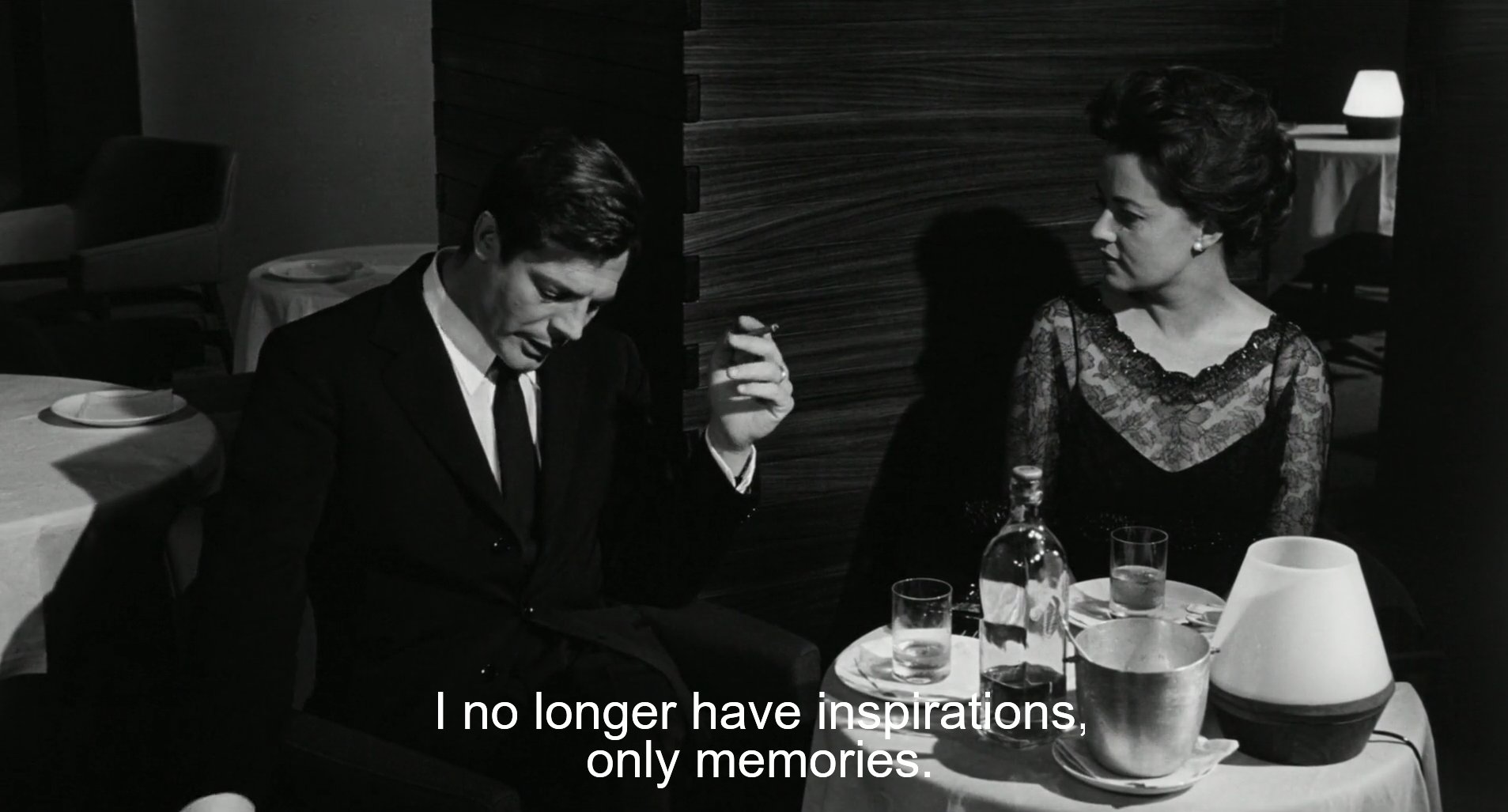

Price No Longer Has Inspirations; Only Memories

With small and mid-cap stocks (the latter, on the MDY ETF daily chart, below) sloshing around in summer ranges and weak again today there is an even bigger premium for bulls being placed on how well the Dow, titans like AAPL and the QQQ can hold up. Although QQQ is one of the weaker parts of the market so far today, bears are likely going to need more of an effort than this to get some heavier selling to capitalize on the likes of ARKK knifing below its 200-day moving average.

In the meantime, the IWM and MDY ranges are responding to prior price memory going back several months, as it known to happen in extended ranges. But the threat of breakdowns as overall upside momentum and breadth sputter is a legitimate one, and should be watched closely in the coming days. It is often said, for example, that plenty of "smart money" likes to make big options plays in the MDY so as to fly a bit more under the radar, which makes that MDY chart below all the more concerning when you see how vulnerable to a $470 breakdown it is here.

Overall, with semiconductors in the SMH gapping down, combined with ARKK TSLA and "FANG" stocks plus AAPL all red here, bears have their best shot in a while to pound this tape just when it seems as though bulls will own it forever with a Fed Chair remaining defiantly dovish.

Stock Market Recap 07/14/21 ... This Market Just Wants to Sl...