21Jul11:14 amEST

The Inflation Battle is Far from Over

Although Monday's broad market selloff in equities, which was accompanied by Treasuries rallying as rates plunged, saw a bevy of "I-Told-You-So's" from market players and pundits who remain unconvinced that inflation is anything other than a minor blip coming off a pandemic re-opening, it is interesting to note that some prominent commodities did not miss a beat.

Furthermore, Treasuries themselves reversed down hard yesterday and are following-through lower yet today and rates move back higher. Indeed, if TLT loses its 200-day moving average, just below spot, a colorable argument can be made that the Monday's rush back into bonds was a clear overreaction by a market which sees Treasuries less and less as an actual safe haven due to The Fed's maniacal policies.

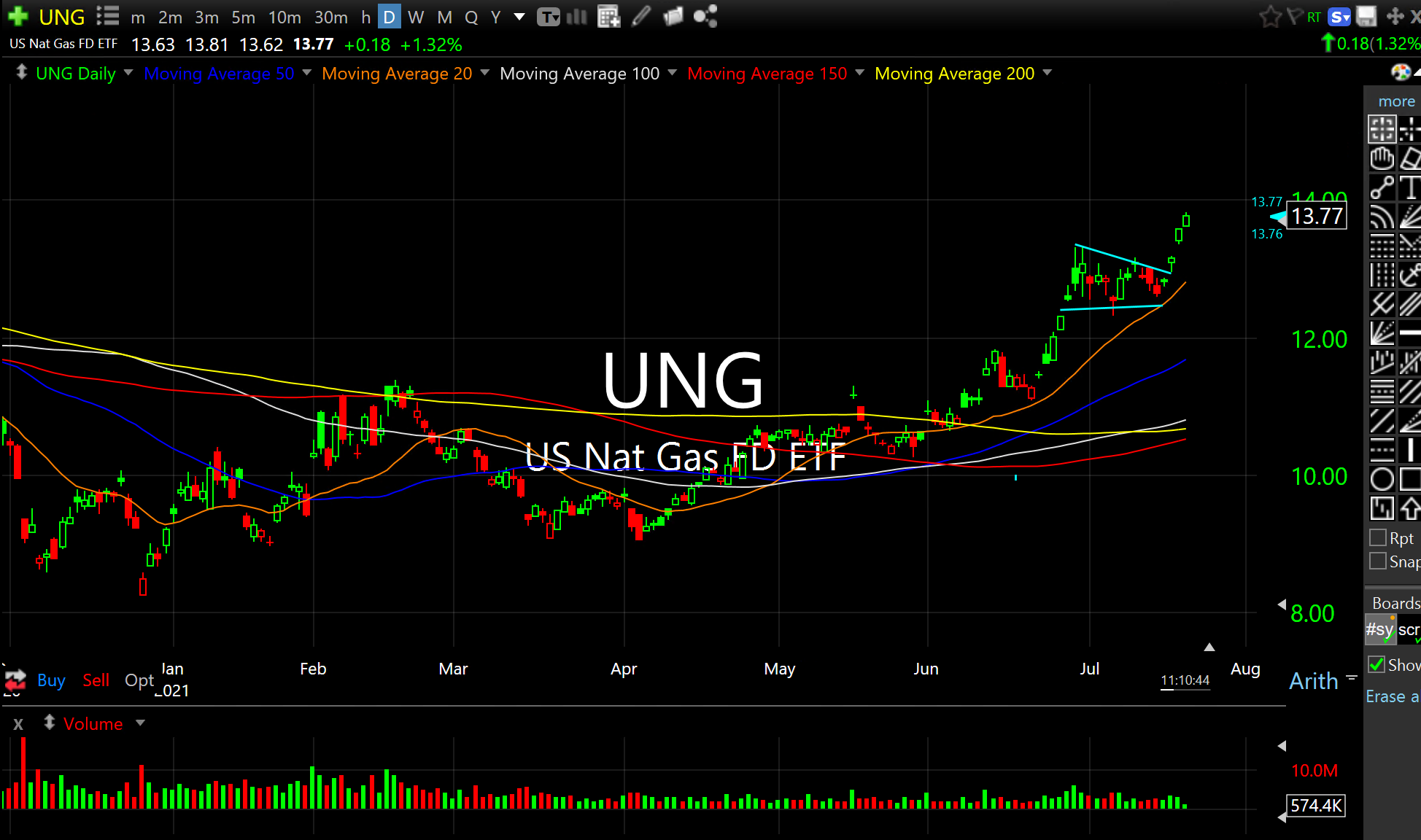

As for the resilient commodities, both coffee (JO ETN, first weekly chart, below), and Natural gas (UNG daily chart, second below) both continue to shine and ignore the deflationistas. A further rise in both commodities should place more pressure on the consumer and folks in general going forward.

Regarding this morning's tape, small caps are getting some more relief and the indices are green despite the NFLX earnings selloff. But I am on watch to see if IWM stalls out around these levels just as many seem to be thinking the worst is already behind us.

Stock Market Recap 08/25/15 ... The Storm Has Not Quite Pass...