27Jul10:45 amEST

Mixed Martial Markets

Is China intentionally trying to crash world markets, especially ours?

While I have no special information regarding that topic, the ongoing liquidations we are seeing in Asia, especially the FXI ETF (for China) and names like BABA are more than concerning. What makes it all the more precarious is that the U.S. markets continue to laugh off all risks despite these glaring issues. Beyond China, now we have UPS leading the transports on an ugly gap down, and small caps, biotechs, ARKK, remain weak and getting weaker.

All of this places enormous pressure on the multi-trillion monsters reporting tonight, AAPL AMD GOOGL MSFT SBUX V, among others. I have not counted up the exact market cap combined of those names, but I assure you it is a huge chunk of the total U.S. market cap. Indeed, with AAPL GOOGL MSFT SBUX V all enjoying epic uptrend for years on end, there is no question their earnings will be explosive.

But as we have been noting, the issue is whether we have arrived at a priced-for-perfection moment.

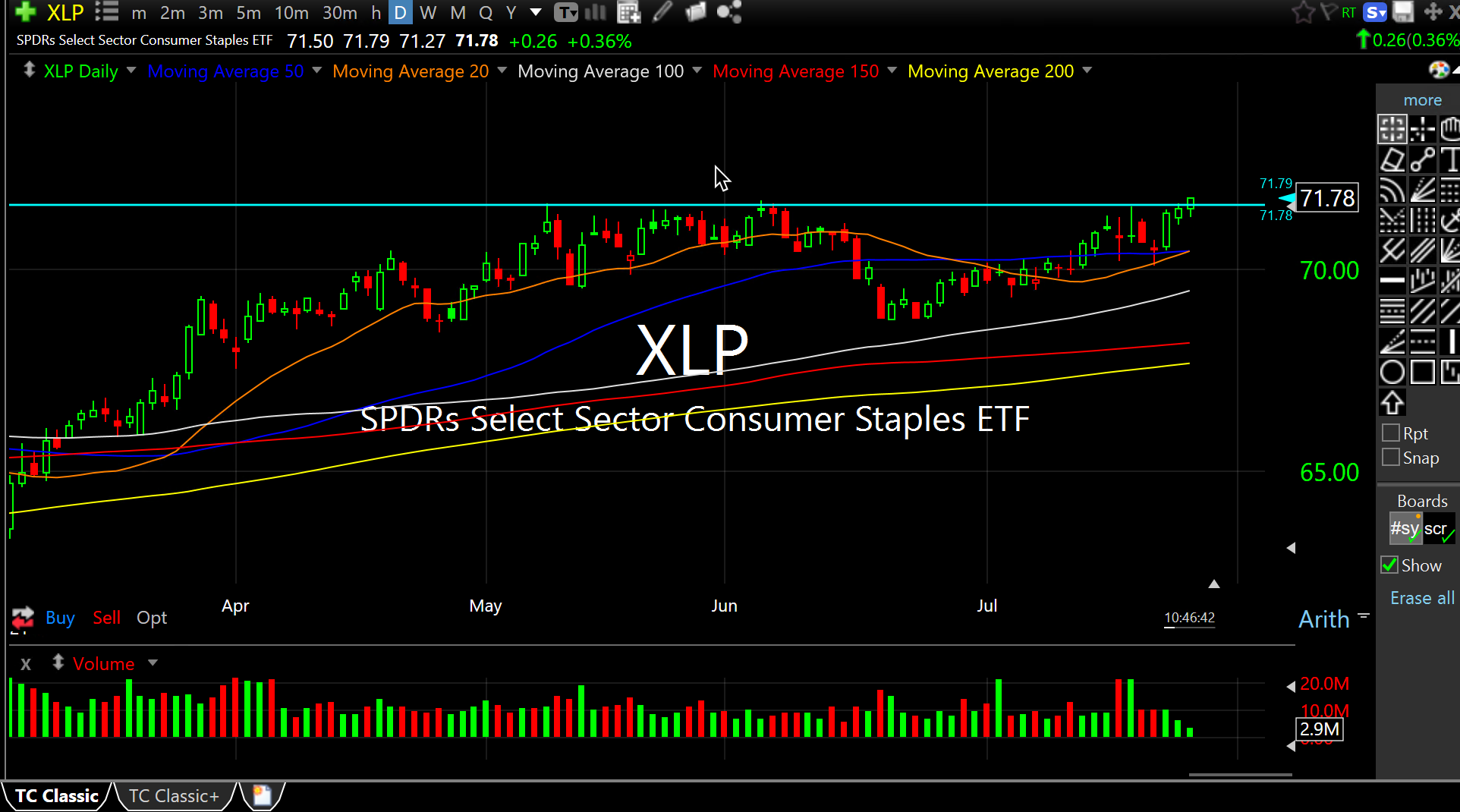

As for the here and now during the session, one of our key themes of the week for Members last weekend was the strength in consumer staples in the XLP. Note how well they are acting today as money rotates to ultra-defensive names like PM (tobacco) and perhaps braces for a new round of CDC restrictions later today which could have a ripple effect in chilling economic activity.