26Aug11:26 amEST

Basic Glitch

An initial, "basic" glitch this morning sent the indices reversing lower abruptly as the Jackson Hole virtual symposium gets underway.

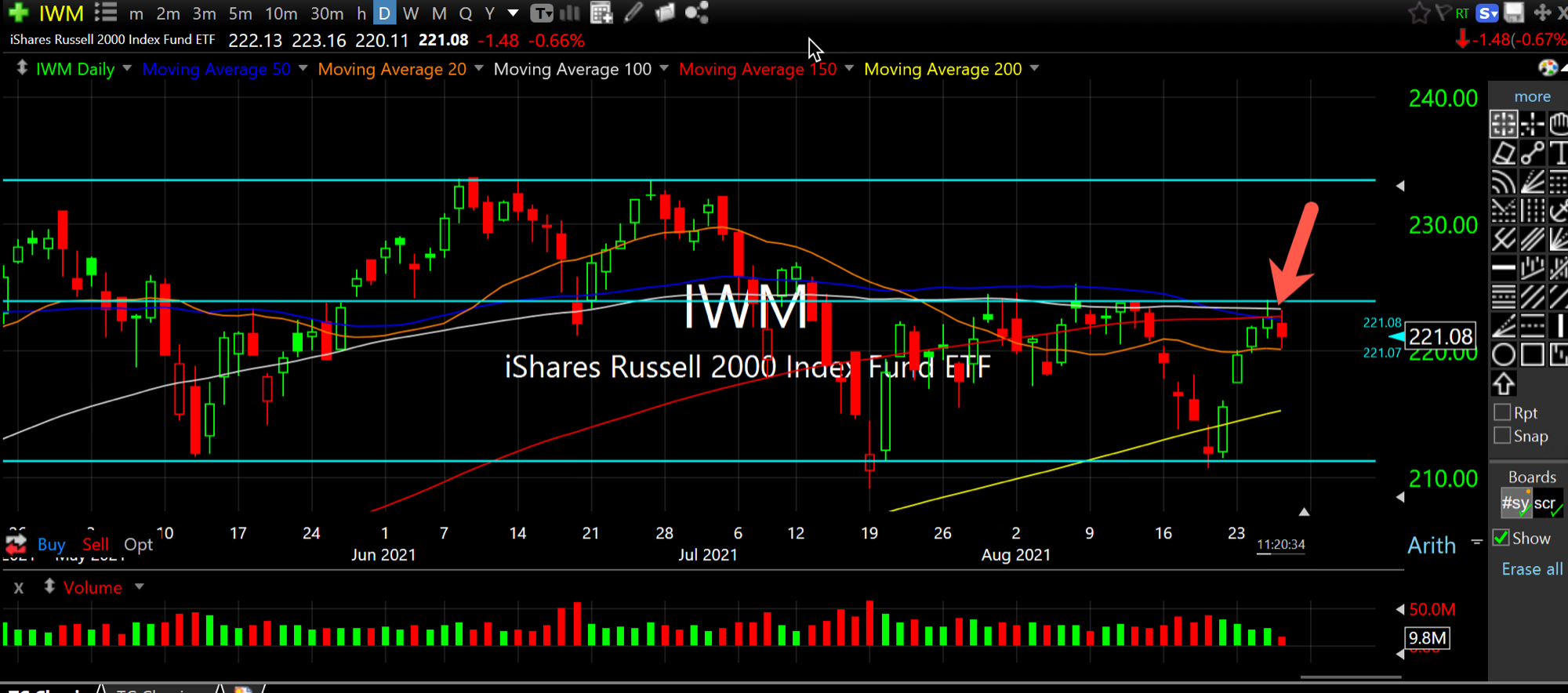

However, looking at the updated IWM (ETF for the small cap-dominated Russell 2000 Index) daily chart, below, we cannot be surprised in the least that smalls ran into some "basic" resistance in the midpoint of its massive, multi-quarter sideways range which has pretty much spanned all of 2021, heretofore. This midpoint coincides with the 50-day simple moving average, which small caps closed above yesterday and got bulls mighty fired up, although I suspect we need more than one day above it to make any sort of inference about a breakout to the upper end of the range.

For now, I am looking to see if bulls reemerge to keep a shallow floor underneath these Jackson Hole dips, since we could easily see more of them into the weekend. In particular, once Jay Powell speaks tomorrow one ought to expect more intraday volatility.

The real issue is going to be, of course, whether bears can finally make a dent in this bearish seasonal period to sustain follow-through lower after the latest growth stock relief rally, alongside extended QQQ monsters like FB and GOOGL.

Stock Market Recap 08/25/21 ... Old School Readers Will Know...