26Aug3:25 pmEST

Old School Readers Will Know

First and foremost, that Clark Gable photo only comes out once per year, usually on my birthday. But since that is in the rear view mirror, I think me charting a rare "megaphone" pattern on the updated QQQ daily chart, first below, is worthy of a special photo for a special post.

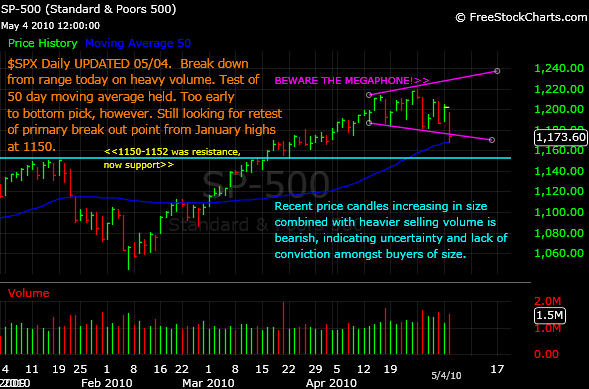

For those who have been following my work for over a decade, you may remember the very first website I started (the blog post I just linked to was from May 4th, 2010) ironically called "Double Dip Trader," which was a play on the many forecasts coming out of the Great Recession and Global Financial Crisis for a "double dip" in markets and the economy, which never happened.

What did happen, however, on May 6th, 2010 was a flash crash which led to a deeper, volatile summer correction until Labor Day when David Tepper famously went on CNBC and declared he was "balls to the wall" long with The Fed at his back, helping to rocket markets higher pretty much for quarters on end.

On the second chart, I included a way-back-in-time look at the market leading up to the flash crash, where we observed the rare megaphone forming.

So, what is a megaphone?

After an extended prior uptrend, if we see higher highs but also lower lows, it can indicates buyers are losing their grip on the market even though a new high is printed. Like many other technical patterns like double tops, double bottoms, etc., the pattern is so often thrown around in a cavalier way and over-identified as a lock to happen, which is why I am reticent to discuss it much.

However, in this particular setup, with expectations of the market having priced in The Fed's likely Taper talk coming this autumn, I sense some complacency in tech after the latest QQQ melt-up on low buy volume to form the potential peak of this megaphone.

I am short QQQ via a long SQQQ position into Powell's speech tomorrow looking for a bit more shake and bake than others may be, megaphone or not.