07Sep10:37 amEST

Someone Will Be Exiled

Rates are moving higher this morning, which at the moment seems to be mildly concerning for the market but nothing creating any real fear, since AAPL FB GOOGL and TSLA are all higher as I write this.

That said, if rates trend higher throughout this post-Labor Day period in September, it should eventually show some wear and tear and high multiple, growth stocks. And there is no better collection of them than Cathie Wood's ARKK ETF, which she clearly worked to perfection at various times during the bull run.

However, the fact remains that ARKK has not yet exceeded it highs from February, and would need to stage a powerful rally to retest them. Many bulls are expecting just that. But we know Michael Burry is not one of them, as he is presumed to still be bearish ARKK TSLA, and betting on higher rates, to boot.--The Burry vs. Wood battle became a rather public one over the summer, with Ms. Wood taking some thinly-veiled shots at him over Twitter and on CNBC.

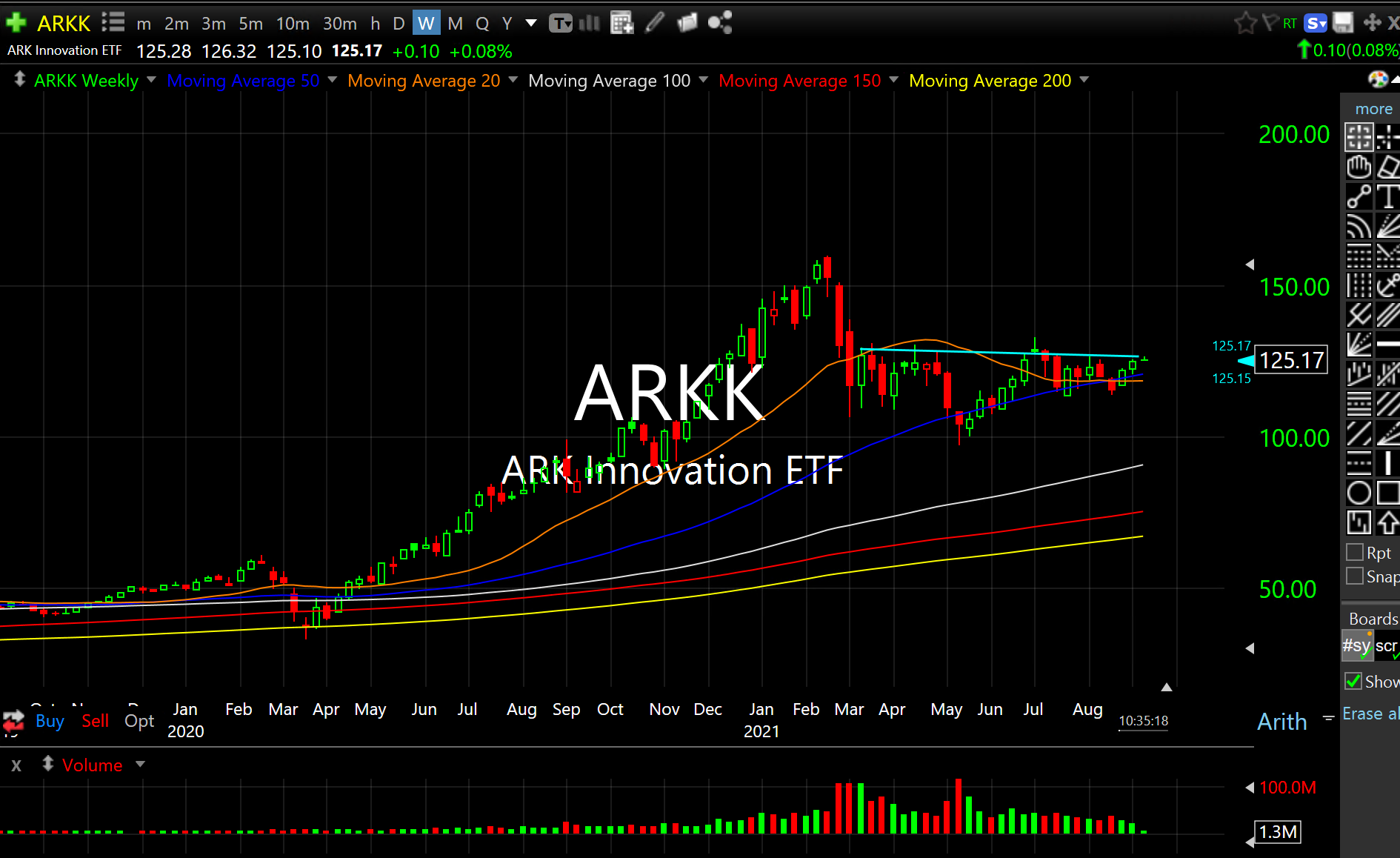

With summer trading now behind us, I expect this battle royale to begin to take center stage, with ARKK already back up to prior weekly chart resistance, seen below. Bears are looking for another leg down like we saw in ZM or PTON, clearly high multiple names in their own right, while bulls are counting on the overall market melt-up, plus the inverse head and shoulders weekly chart bottom they decipher, below.

But after such a prior steep uptrend, the inverse head and shoulders bottom typically carries less viability--It works better after prior steep downtrend.

As for me, my tell continues to be rates. If TLT keeps breaking down, I expect virtually all growth and "TINA" types of multi-year winners to crack, not unlike we have already seen to a degree in shares of Visa.

Elsewhere, as we noted last week here and with Members, keep an eye on the tankers and shipping stocks for strength.

Labor Day Overview and Analy... Someone Needs to Set Up a Sp...