15Sep11:30 amEST

An Ironic Comeback Only a Hipster Could Love

We have some more pronounced rotation today away from some large cap tech names, such as AAPL AMZN FB, and over to energy and some materials plays.

However, the sense of urgency in the rotation is not yet at the type of pace I want to see to think the move is going to be rocket fuel higher, just yet, although with the European energy crunch I would not rule out energy plays (of which I am long a few with Members) sprinting higher. Still, bears need to do better than this to get QQQ down, namely with an acceleration lower below $374 this afternoon.

I am eyeing some steels and other materials plays housed in the XME ETF for long ideas. Here, again, I want to see the rotation take on more of a life of its own, with market players scrambling to get long names like CLF.

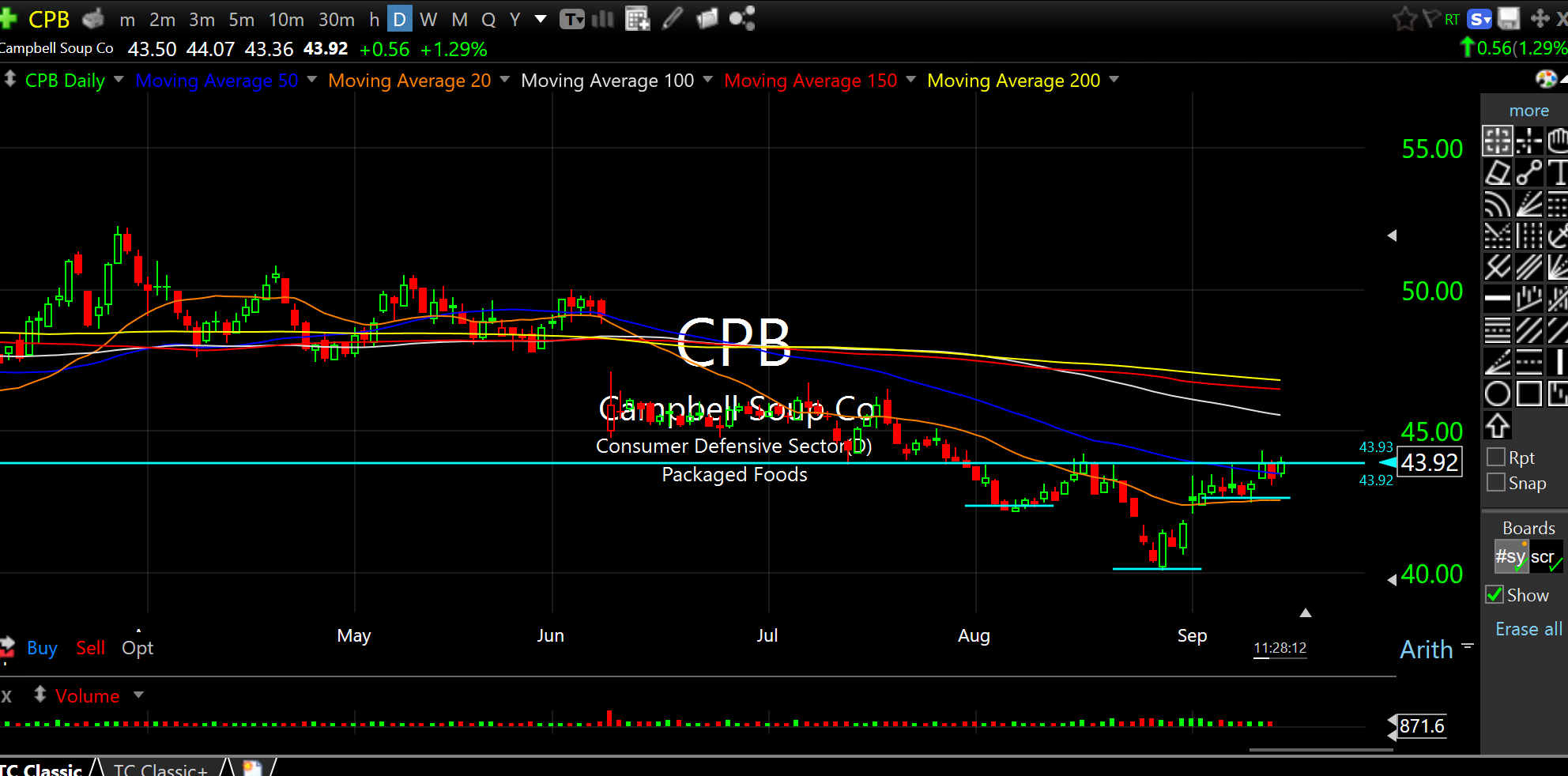

And let us not forget the value, dividend paying defensives, too. One of our Members, Stu, flagged the iconic Campbell Soup. With a nice dividend and an inverse head and shoulders potential bottom playing out after a recent downdraft seen on the daily chart, below, CPB fits the play for safe dividend name.

The market always seems to have a dark sense of humor at the most serious of times. Case in point, during the October 2008 crash, CPB was the only single stock green during one of those brutal down days in the S&P 500.

I am not saying that soup kitchens are making a comeback, but with food prices soaring to sixty-year highs, on an inflation-adjusted basis, I have to think consumers will throw in a few extra cans of soup in lieu of other items skyrocketing in price.

Stock Market Recap 09/14/21 ... Stock Market Recap 09/15/21 ...