18Oct10:52 amEST

It's Been a Long Cold War

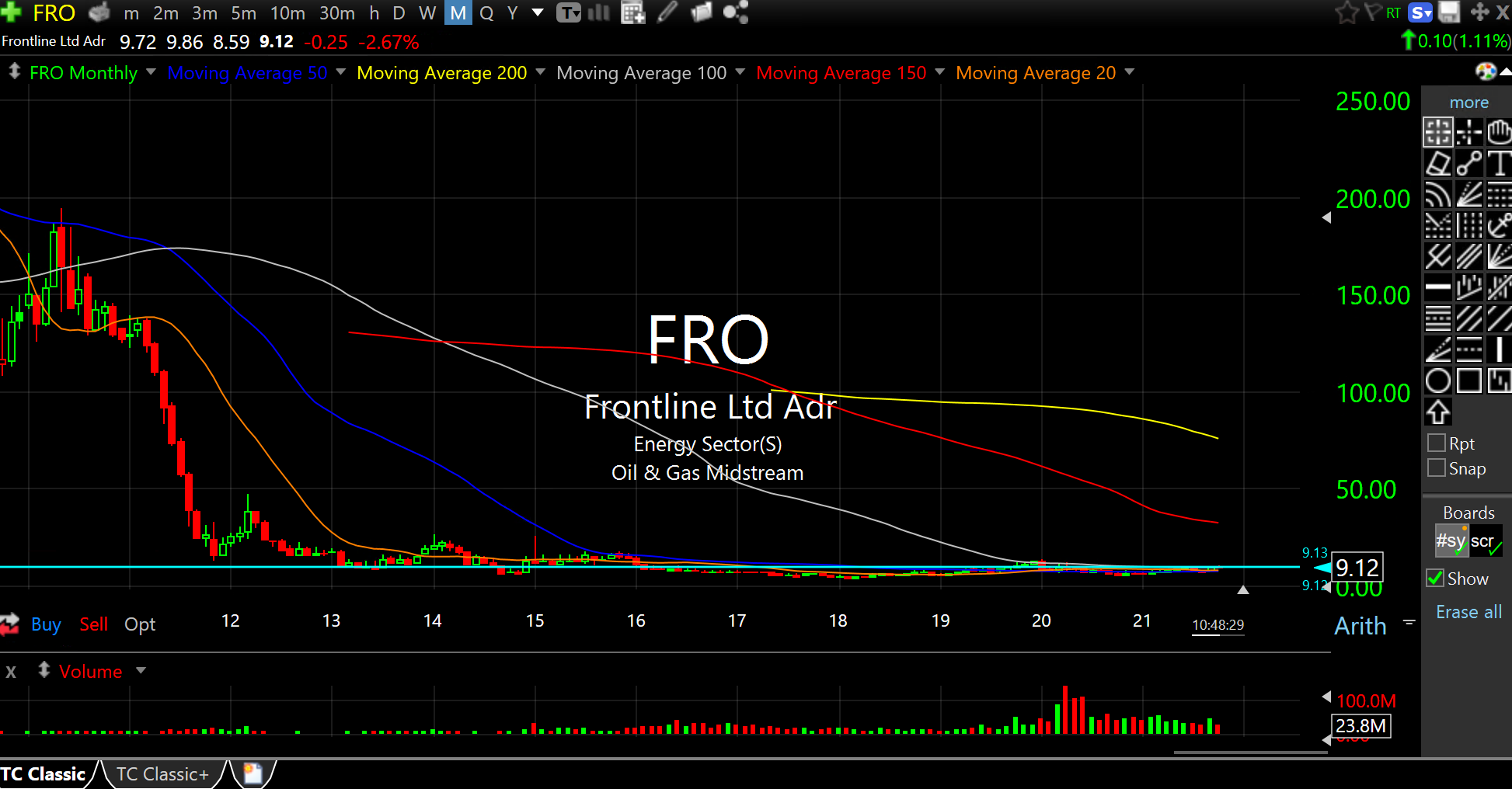

The first chart, below, is the monthly timeframe of Frontline Ltd., the world's fourth largest oil tanker shipping company. As you can see, the stock has, overall, been dead money for nearly ten full years at this point. Much of that coincides with oil itself alternating between cyclical rallies within the context of a secular or long-term bear market.

However, if you are of the view that oil is now in the midst of a new secular bull run, then a name like FRO becomes all the more attractive on the long side, on top of other tankers like NAT TK, etc.. Looking back at the oil run-up into 2007-2008, FRO shined with its stock price more than doubling into the June 2008 peak for commodities.

Currently, FRO is attempting to hold onto the key $9 level, as seen on the shorter-term daily chart, second below. Note the buy volume surge in September, perhaps hinting that the big money is positioning themselves for another commodity run-up into the winter months.

Weekend Overview and Analysi... Stock Market Recap 10/18/21 ...