25Oct10:57 amEST

Obstacles in War

The global materials mining giants, BHP RIO VALE, have noticeably lagged the rally in commodities and commodity stocks in recent months. This is most likely due to the fallouts in China from the Evergrande issues, not to mention lingering COVID lockdowns in places like Australia.

However, as the commodity bull seemingly flexes on a daily basis, with capital rotating within the space from softs, to uranium to oil & gas, solars, coal, and even the precious metals, the odds seem to favor a relief rally in the monsters BHP RIO VALE.

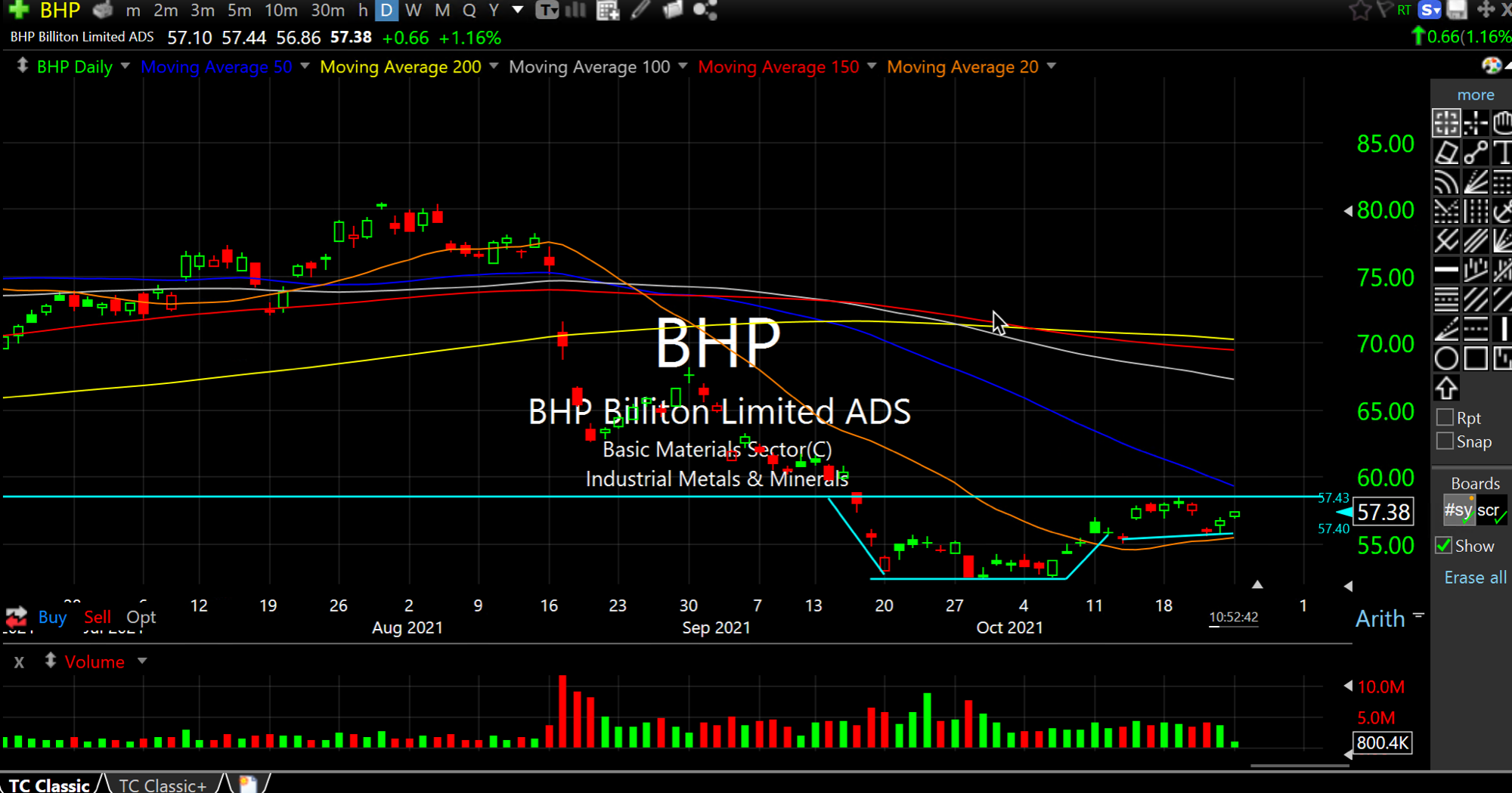

On the BHP daily chart, below (which is based in Melbourne, Australia of all places), we can see a cup and handle bottoming formation in play with a push above $58.50 likely triggering a much larger bounce.

Similar comments apply to RIO and VALE, which are both cheap from a valuation perspective and clearly out of favor.

As for the broad market today, small caps continue to make a case for a possible upside breakout. $230 and $235 are my levels on IWM for that. FB earnings tonight are a wildcard, of course. But for now it is hard to argue with the small cap strength.

Weekend Overview and Analysi... China and Russia Wouldn't Re...