29Nov10:46 amEST

Remus Doesn't Like Opening Gaps in Corrections

Instead of referring to myself in the third person, let us use George Remus as an allegory of sorts of Wall Street yesteryear. In Wall Street yesteryear, it was often said that roughly nine out of every ten opening gaps higher in the context of a corrective market are to be sold into, rather than bought.

Of course, the counterargument is that we are in a new paradigm, where "stonks only go higher," backed by a maniacal Fed hellbent on seeing higher asset prices indefinitely. While there are some elements of that in play, the recent inflationary pressures are a wildcard, indeed. And despite all of the newfound virology and epidemiology experts out and about regarding the Omicron variant, I firmly believe that even if we do lock down again (an extreme scenario, to be sure), that the supply chain inflationary pressures will actually worsen instead of abating. Hence, inflation remains a major issue threatening wanton central banking behavior of nonstop money printing.

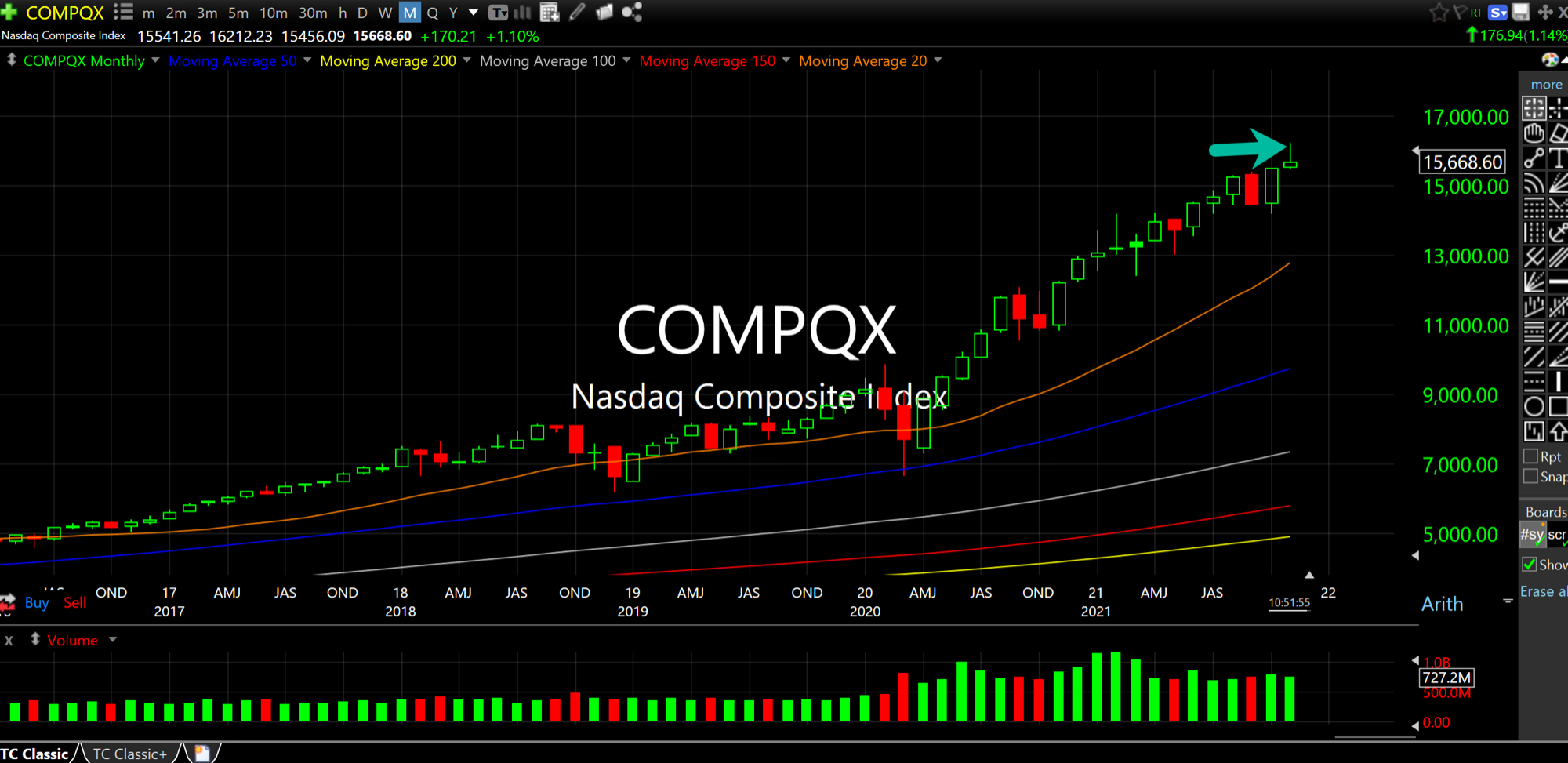

As for the tape this morning, ARKK is back down 1% as I write this as small caps and the Dow fade. Tech is still up nicely, though with less than two sessions left before a potentially nasty Nasdaq monthly chart candlestick is completed (below).

TWTR is also well off its opening highs on the initial pop after news of CEO Jack Dorsey stepping down. I sold out of my long-term TWTR position with VIP Members last this summer, as I still expect growth stocks to underperform going forward, including Twitter.

Weekend Overview and Analysi... Lockdowns or Not, Blue Apron...