30Dec10:49 amEST

One Bounce; Everyone Knows the Rules

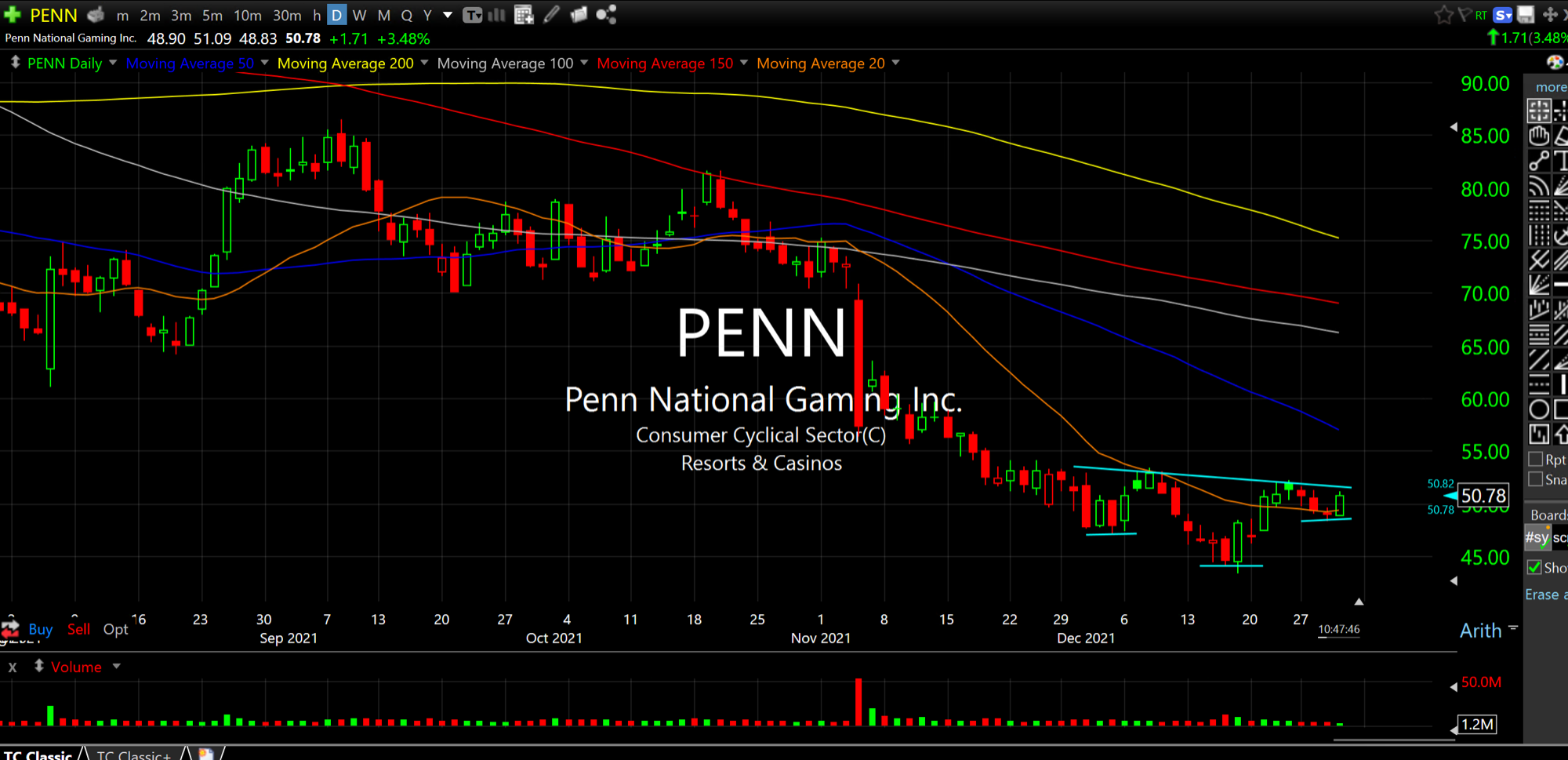

With tax loss season pretty much having run its course at this point, coupled with the general underperformance of growth stocks, one would think that the likes of DKNG PENN, especially, would finally enjoy a respite.

Mind you, I am not looking for a major bottom at all. In fact, my thesis for 2022 and beyond remains intact--Growth stocks are in the early innings of moving down from the penthouse of equities down to the basement in favor of value stocks and commodity plays moving on up.

However, when viewed through the prism of near-term trading, shorts should probably ease up a bit until we hit the seasonal rough patch around mid-January after MLK Day.

Beyond that, as noted, DKNG and PENN are sports betting plays. And with both the major college bowls approaching in the coming days, on top of the NFL playoffs, you can be sure these names will be scooping tons of gambling revenue.

Specifically, I would look for DKNG and PENN to tag their respective 50-day moving averages (dark blue lines on daily charts, below) before contemplating puts or to re-short them.

Overall, small caps, ARKK, and biotechs are finally getting some relief today. A rotation back down to those groups in the near term while the senior indices and mega caps dip should set up the bearish seasonality after MLK Day to ramp up aggression on the short side as The Fed presumptively faces down sticky inflation.

The Single Most Important Ch... The Fed is About to Leave Al...