22Feb11:04 amEST

Futility in Trading the News

“Never mistake activity for achievement.” –John Wooden

In this era of 24/7 news where even using social media to tweet out a headline seems obsolete just a few seconds later, it is worth remembering the analogy that the market is equivalent to being the world's largest open book exam.

Back in my law school days, virtually all of the final examinations (which counted for 100% of the final grade) were "open book," meaning you could use whichever materials you wanted during the actual exam. The reason why was twofold. First, as an actual attorney you pretty much had access to all the materials you wanted as well. But, beyond that, the real reason was because the skills being tested had much more to do with your abilities to parse through the vast sea of information to determine what was actually important and what was not.

Similar comments apply to the current market. And as tempting as it may be to cast oneself as a faux journalist pretending to be an expert on all things political and global, I think it is safe to say that the markets and macroeconomic backdrop is challenging enough as is.

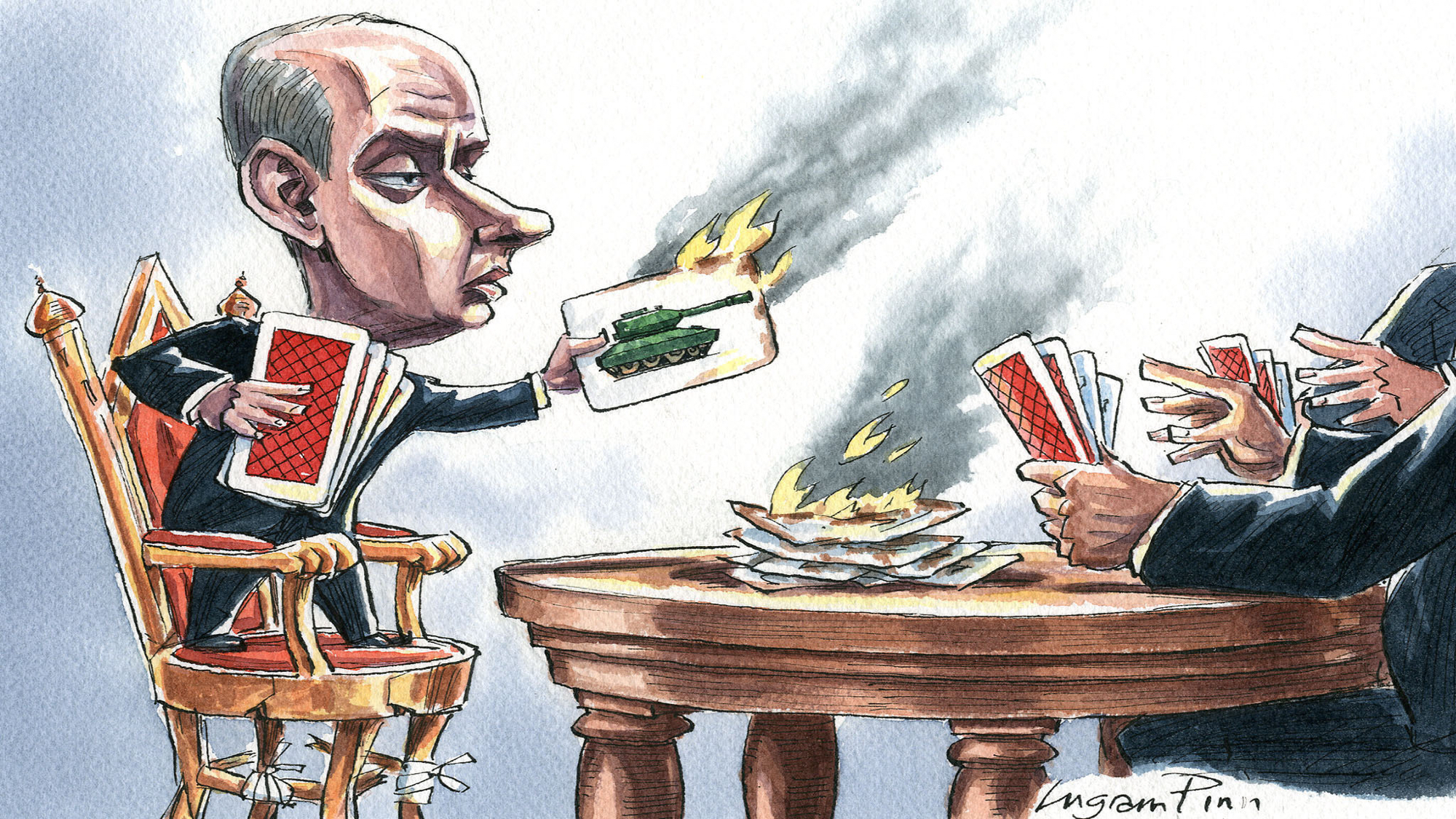

Hence, not making assumptions about Putin, Ukraine, NATO, Biden, and the like is probably the correct strategy from a market perspective. In other words, getting riled up about every headline which crosses is likely a colossal waste of time, energy, and eventually precious capital-- You cannot afford to devote time to it, at least not the way I see many on social finance doing, without suffering adverse effects.

Simply put, we continue to have a violently indecision market with all major indices still below their respective 200-day moving averages and very few quality long swing trading setups which are triggering and holding fresh breakouts.

Our "tells" here continue to be the holdouts like AAPL, which is soft as I write this, as well as TSLA ( I went short on Friday with Members, below on its daily chart) and the semis flipping green to red.

After a plethora of sputtering bounces attempts overnight into today (including those last week), it is tough to expect the prior late-January lows to hold on TSLA and the indices.