17Mar11:05 amEST

Enemies at the Gate

The triple-threat of a pandemic and subsequent supply chain disruptions, a war overseas in a commodity-centric part of Europe with the distinct possibility to escalate into a broader global conflict, combined with a Federal Reserve consciously way behind the inflation curve and essentially betting on its own "hope," as a strategy mind you, that inflation will magically recede later this year all amount to a potentially perfect storm for commodities to rally further.

And if you think the rally we have already seen in recent months is overdone, you ain't seen nothing yet.

In the 1966-1982 bear market in equities when inflation roared, gold was easily one of the stars of the show. Everyone these days, including me, references 'Tall Paul' Volcker for his gumption to aggressively raise interest rates to finally crush inflation in the early-1980s.

But before that moment we have a few Fed Chairs who were way behind the inflation curve.

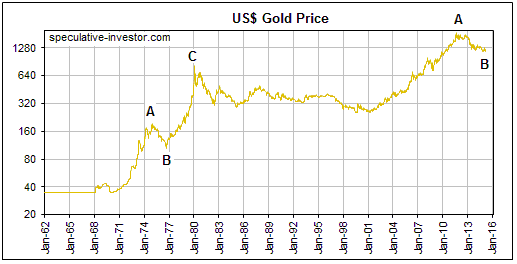

As you can see on the historical graph of gold prices, below, the rally in the early-1970s in gold likely responded to the Fed Chairs' given mistakes at the time. But even after Volcker took over in August 1979, there was still another and final thrust higher in gold for good measure.

In other words, this is gold's time to shine, especially as Powell tries to fight off inflation with mere words rather than the necessary aggressive action.

Most often think of bond market vigilantes as being the ultimate defenders of pure markets and the entity which can most put a check on The Fed and central planners, in general. However, we must remind ourselves that The Fed has been a dominant player in fixed income for so long that the asset class may be reeling and somewhat broken, even though I still think rates go higher.

Commodities, however, despite the undertones of meddling in the nickel and silver markets, for example, represent a relatively pure form of auction where an erroneous Fed may be punished more severely like the 1970s.

Stock Market Recap 03/16/22 ... Stock Market Recap 03/17/22 ...