24Mar10:15 amEST

Big Nickel

With a straight face, answer me this: Did you really think the sort of monetary policies (and fiscal) we have seen since 2008/2009, let alone since March 2020, would not have wild unintended consequences?

Nickel futures experienced another price "limit up" on the London Metal Exchange after soaring over 250% over two trading sessions in early March during the short squeeze centered on China’s Tsingshan Holding Group Co., before the nickel market was suspended on the LME.

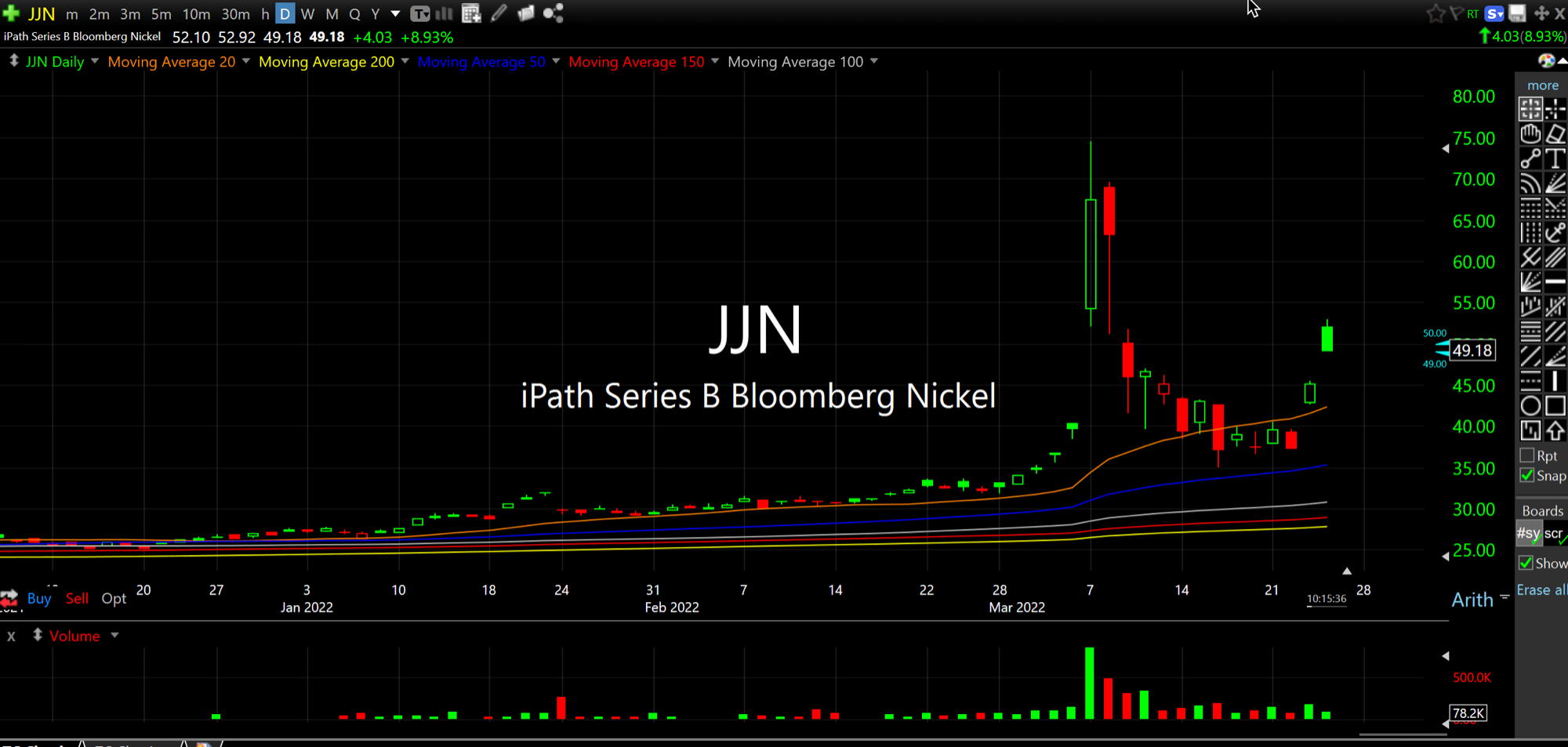

JJN is the nickel commodity ETN, seen below on its daily chart illustrating the swings in March.

However, the larger issue for us remains whether this nickel move is merely a sneak preview of what is to come in other markets. I view it as such, and think as the year rolls on we will see another commodities experience similar dislocations and volatility. Eventually, bonds and equities will experience the same.

That is the big picture from the nickel moves which seem to be lost on many--They look for excuses as to why it is an isolated event without consideration for the larger inflationary cycle we are in, coming out of excessively accommodative policies for years on end.

By the end of 2022, the sort of desperation we saw from the LME in the face of recent nickel moves will be replicated by various other exchanges around the world.

In other words, Neel Kashkari, president of the Federal Reserve Bank of Minneapolis and a longtime outspoken dove, has suddenly turned hawkish for good reason--Even if he knows inflation is out of control and not going to recede on its own.

Only he did it out of desperation and, ultimately, way too late to avoid further market disruptions across asset classes.

Stock Market Recap 03/23/22 ... Market Chess Presents: The C...