05Apr11:27 amEST

Folks: The Real Enemy is Shrinkage

Stocks endured an abrupt and sharp downswing off the open this morning as news hit the tape that noted prior dove and Federal Reserve Governor Lael Brainard said that The Fed could start reducing its balance sheet as soon as May and would be doing so at “a rapid pace.”

Even more than rate hikes, the pace of them and how substantial each one may be in the coming FOMC events, the market seems particularly anxious about the idea of The Fed shrinking its vaunted, multi-trillion dollar balance sheet which has been home (or a graveyard) for a variety of toxic debts over the years.

Indeed, the exact ripple effects of such balance sheet goodies being freed are, in effect, known unknowns. But it is hard to see how it will be a good thing for markets and perhaps the economy at-large.

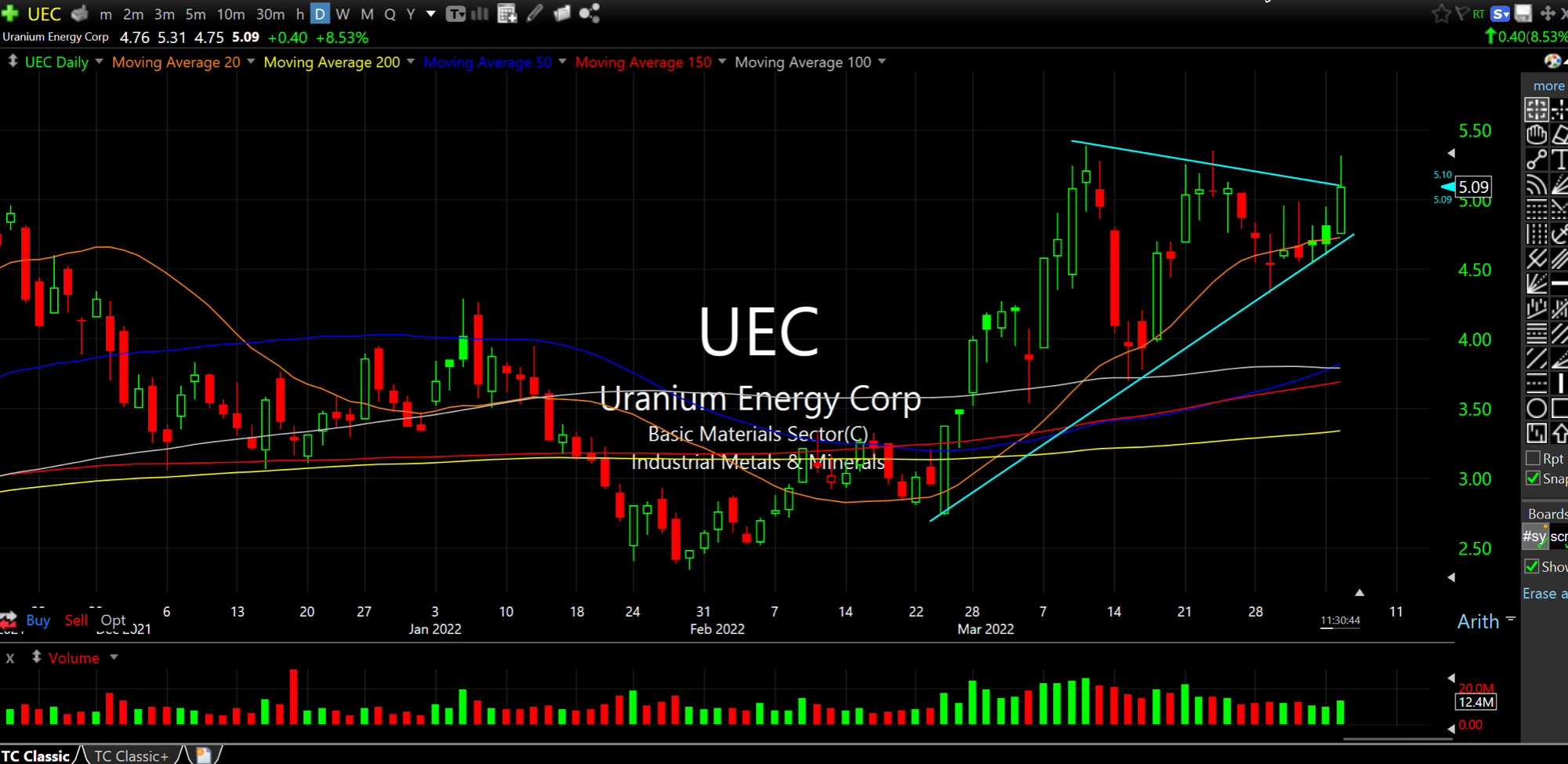

As for the market today, uranium stocks look like they endured the selling jolt well, as seen by UEC on the daily chart, updated below. Bullish news (for the sector overall) out of Europe does not hurt the cause, of course. With natural gas surging again, and some of the ags like wheat and corn strong, I am looking to see which commodity stocks distinguish themselves amid broad sector consolidation of late.

Two Charts Which Make Sense ... Weekend Overview and Analysi...