13Apr10:28 amEST

Navigating the Bond Bear Landscape

Historically hot PPI and JPM earnings selloff be darned, this market looks to be attached at the hip to the happenings in Treasuries.

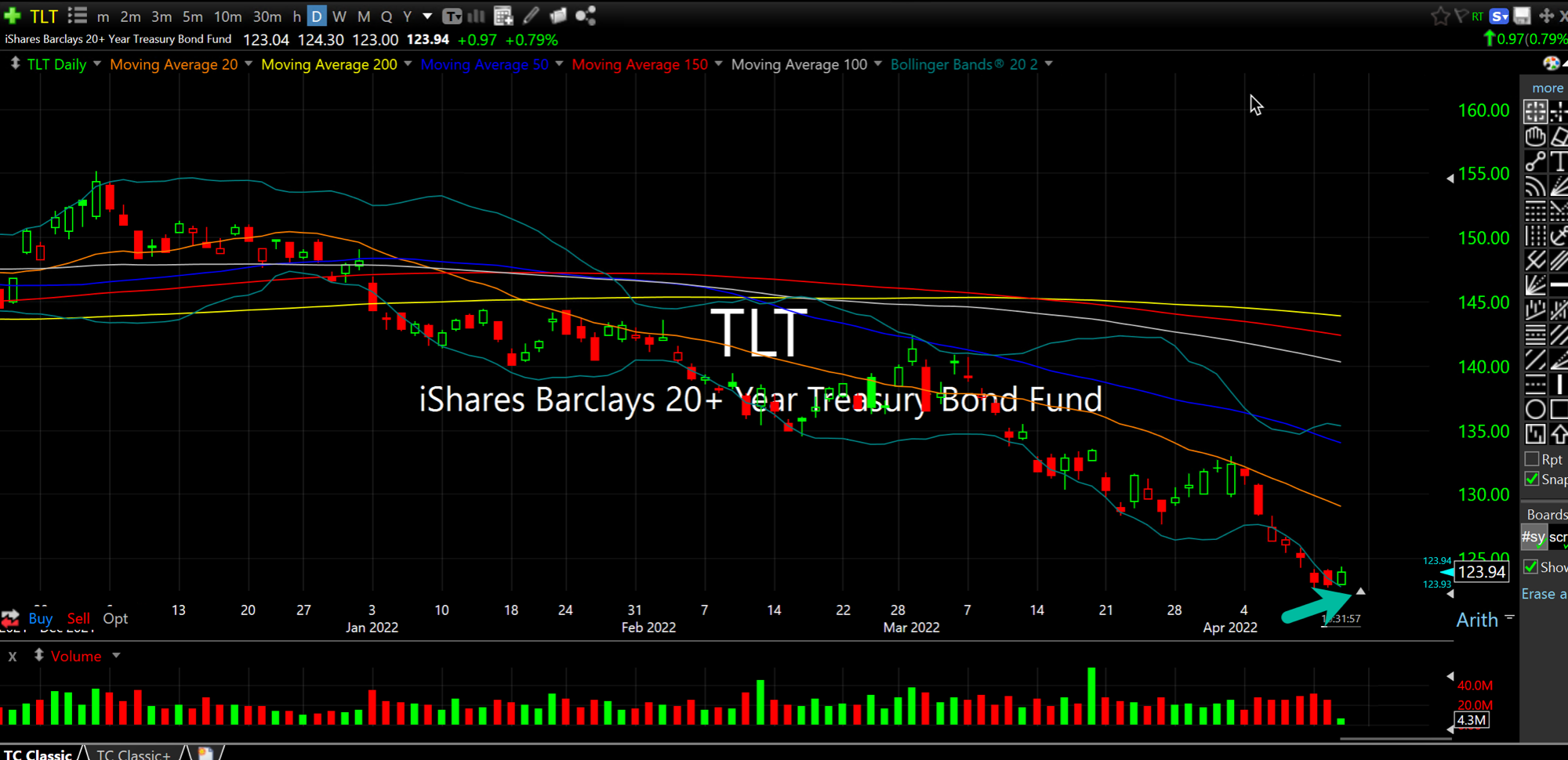

With rates on the 10-Year Note easing a bit off widely-discussed overbought conditions, TLT (ETF for Treasuries' prices, inverse to rates) illustrates as much with a bounce from oversold conditions, seen on the daily timeframe, below. You will note the Nasdaq essentially bouncing in lockstep with Treasuries, as the slight dip in rates seems to be all the buying algos need to activate.

Of course, we have seen the flip side of this equation for a good while now, as high rates in the face of inflation means richly-valued growth stocks get the short end of the stick as PE multiples must come in and be repriced. Overall, this is still the case looking out the coming months and quarters, with this looming earnings season an imminent litmus test.

But even as we flop around on days like today it is important to take a step back and objectively assess the broad landscape. And when we do there is sparse evidence of an actual bottom in both the Nasdaq and Treasuries. And seeing as inflation is clearly at the epicenter of this cycle, there is thus no reason to look for peak inflation and all the byproducts of it.

While trading around bond shorts is perfectly fine, the bias is to sell/short into TLT QQQ rallies, rather than load up for the big bottom.

How Do We Spell This Relief ... No Big Deal, Just Eleven Yea...