16May10:55 amEST

You Don't Have to Be a Private Eye to Figure it Out

Energy and agricultural products continue to rise this morning despite a mostly red opening for stocks as a group, as The Fed talking heads keep resting their hopes that inflation will magically recede to make their lives easier.

In reality, as The Fed willingly stays miles behind the curve headed into summer, where oil and gasoline demand naturally ticks higher, the pain trade seems higher in both ags and oil/gas. If Powell makes it clear that 75 or even 100 basis point rate hikes are on the table for the June or July FOMCs, that can change, perhaps.

But this Fed seems more concerned about not rattling markets too much in lieu of actually fighting off what has become sticky high inflation. And then there are the supply chain issues like in diesel fuel, which could completely upend markets over the summer.

Hence, the outperformance of oil and ags so far today.

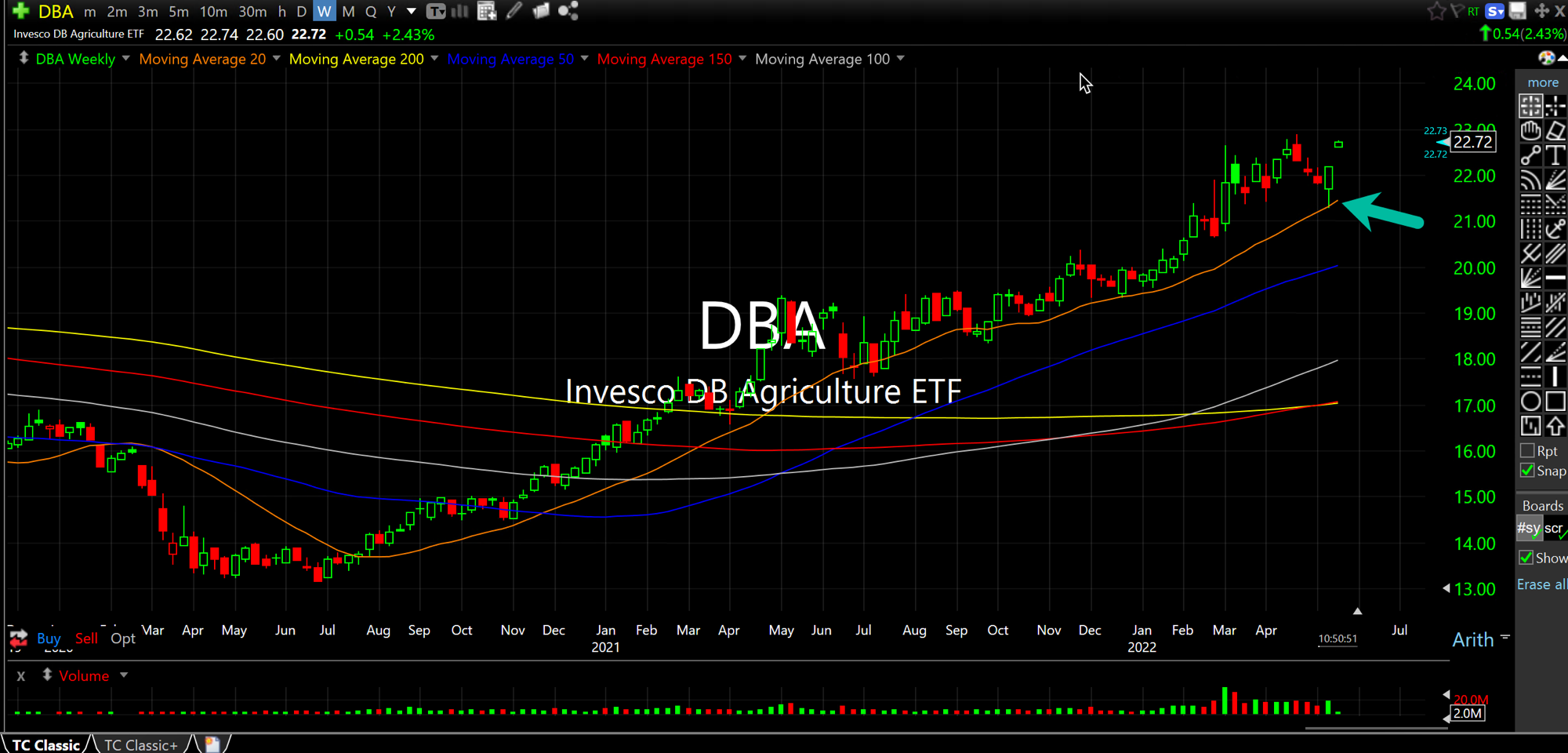

I picked up DBA last week with Members on the successful test of its 20-period weekly moving average, seen below on the weekly chart. DBA is the ETF for a basket of soft commodities in the ag complex, including wheat.

As more countries like India limit or put a halt on key exports so as to protect its own citizens during times of distress, it is likely that many commodities continue to thrive.

It will only be when we hit a true tipping point of demand destruction that the tide will turn. For Americans, even with very high gasoline prices and diesel sky high, the pain at the pump may need to get much, much worse before it gets better.

Simply put, The Fed is touting a "soft landing" for the economy from this inflationary cycle, but I doubt that will be the case. History indicates that the only real way out of inflation is to totally wreck demand, which is something Powell and his band of merry printers continue to seem highly reluctant to do.