01Jul12:28 pmEST

To Short or Not to Short?

By now it may not be a reach to declare the bullish seasonality argument for July to be well-known, if not an outright literal rallying cry for a market which continues to flounder. As the S&P 500 Index struggles to reclaim 3800, one has to wonder if the July bull setup may be a nasty trap which spawns a new leg down in the bear market.

What seems actionable, on the other side, is that if we do get that rally then the biotechnology stocks, which have been outperforming for weeks now, should lead higher.

But first things first, and bulls must demonstrate they can sustain rallies better than what we have seen, or the biotech strength may be simply something to file away until a later date, and nothing more.

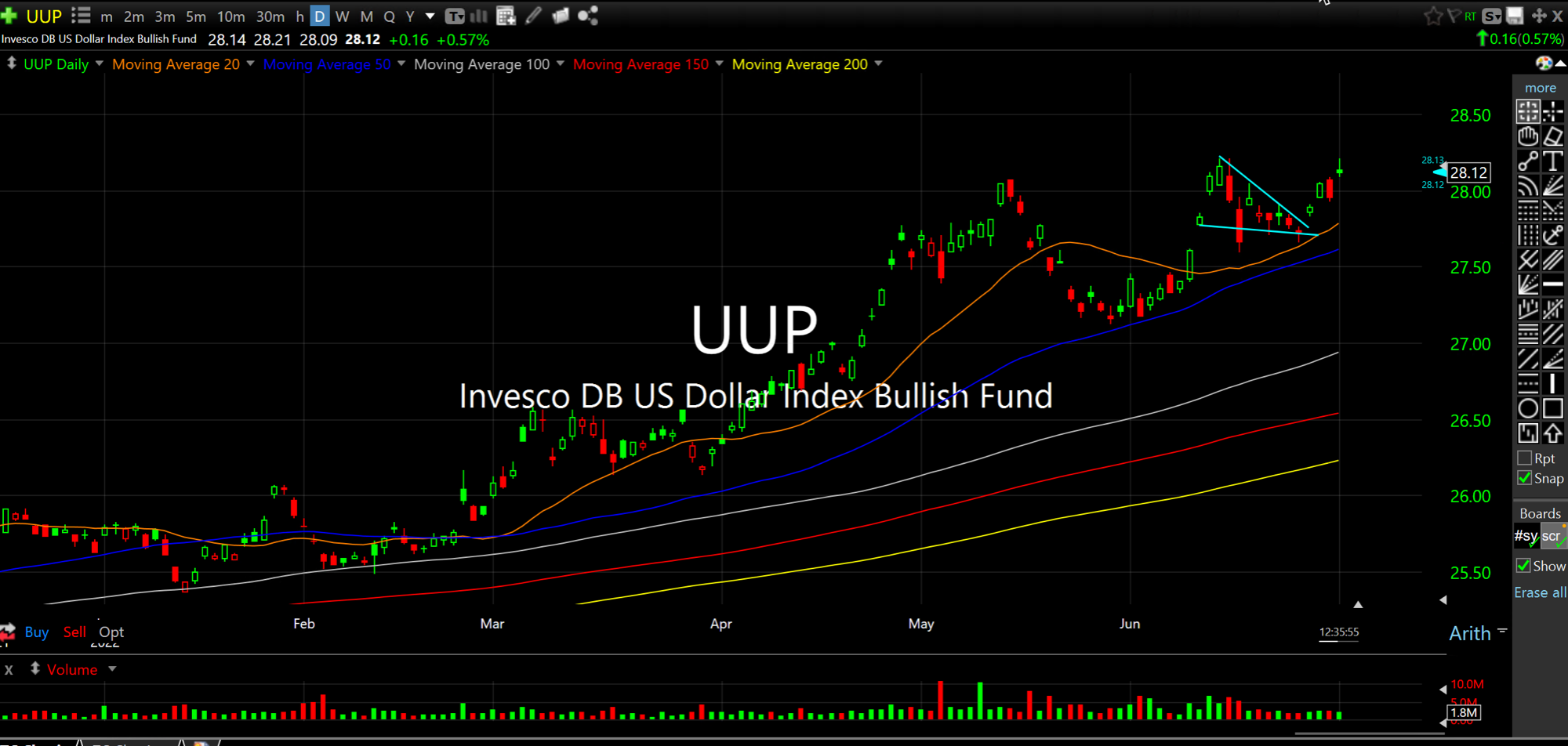

Above all else, perhaps stocks need the Dollar chart, below, to break. We have been tracking this one more closely with Members of late, and Independence Day seasonality notwithstanding, a runaway Dollar move higher is typically bearish for global stocks. As you can see, the bullish cup and handle setup is threatening to uncoil higher.