19Jul11:18 amEST

Roundtrip: But is it Really Over?

The once red-hot soft commodities and their related agribusiness stocks have been humbled throughout the spring and early summer months. As the war in Ukraine marches on, however, coupled with entrenched inflation overall one has to wonder (not unlike with the energy stocks) if the sharp moves lower have been more of the bull market correction variety rather than a sign of inflation having peaked and deflation underway.

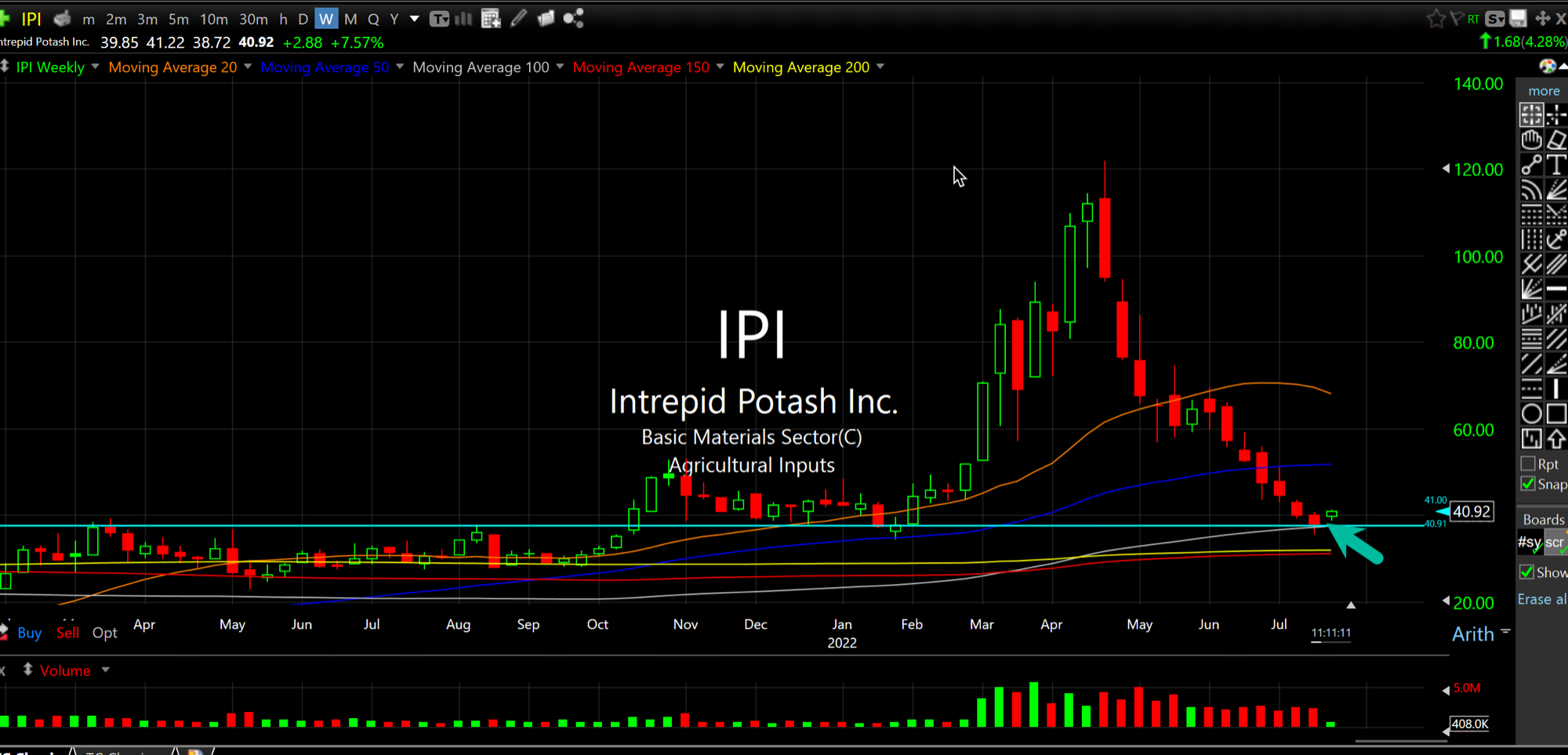

Little Intrepid Potash, below on its weekly chart, is a prime example.

The small cap, Denver-based fertilizer manufacturer was once the hottest thing going back in April before the stock took about a 65% haircut in a fairly short period of time.

As you can see now, however, IPI is back down to a prior significant price area. At issue is whether the bull run resumes after a correction, albeit a nasty one. Suffice to say, commodities are notorious for some of the nastiest correction possible, which renders the massive haircuts we have seen as still plausible for an ongoing bull market.

But, again, that would require buyers defending the current, big price levels right here and right now. Much like energy, you can find similar charts in the ag space as they all ran up sharply and then corrected just as sharply seemingly in unison.

As for the market overall, bulls are back at it and making a mockery of those who jumped all over the AAPL reversal yesterday during the summer doldrums--I continue to hold my fire on the short side.