28Jul10:21 amEST

It's Easier Being Green Now

Although solar stocks jumped Thursday after Senate Majority Leader Chuck Schumer and Senator Joe Manchin said they’ve reached a deal (which earmarks a record $369 billion for climate and clean energy) on climate spending, we ought not overlook other alternatives like wind.

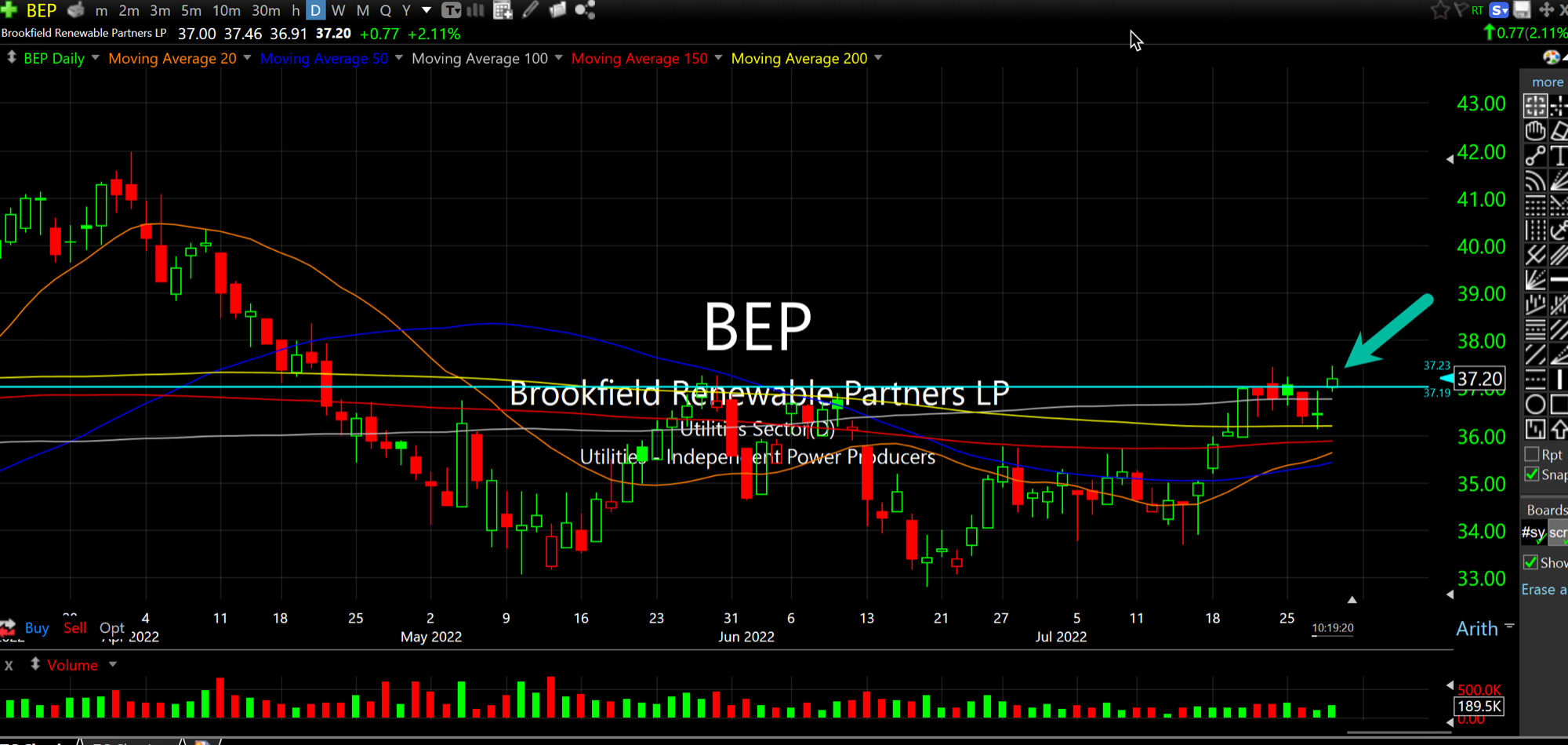

BEP is one such idea, with earnings on August 5th, below on the daily chart trying to clear a base.

In addition, names like CLNE WPRT, even GPRE ought to be monitored to see if these moves have legs.

Personally, I usually abstain from chasing up news-related pops as it is not my style. However, with crude oil not collapsing below the mid-$90s despite a ton of reasons to do so I want to have anything energy-related on my radar long. And that goes double to industries where politicians are spending tons of money on them to stimulate.

As for the market at-large, some backing and filling after the big rally yesterday in front of AAPL and AMZN earnings tonight seems standard. Ultimately, I still reject the idea that The Fed can pivot back to QE or cutting rates anytime soon unless we get a market crash, due to inflation not abating and the market not displaying much fear at all that Powell's policies will actually make a serious dent on the demand side beyond the natural business cycle.

However, as we head into autumn it will have been about six months since the first interest rate hike by The Fed last March. Recall during the Bernanke years, when he cut rates aggressively and started QE, that there was a lag for the new regime to filter into markets. This time around, on the reverse side, there may very well be that lag, too, which would be a rude awakening for bulls after Labor Day.

Stock Market Recap 07/27/22 ... What Would Mr. Miyagi Would ...