04Aug10:42 amEST

Money Where Mouth Is: I Went Short Apple

Leading up to the epic, historical 2008 crash and all of its accompanying volatility which occurred after Labor Day of that year, it is easy to forget that none other than Warren Buffett had spent much of the year, and that summer before everything hit the fan, building a sizable position in the rail Burlington Northern Santa Fe Corp (he would eventually buy the entire thing out).

At the time, there were countless seasoned market professional who seemed cocksure that the bottom for both equities and the economy had to be in, since how else could Buffett possibly buy an economically-sensitive railroad at a time like this? Well, if you did subscribe to that view then you needed the onions to hold through the epic crash and subsequents series of lows until March 2009.

My point is that just because Buffett is now a heavy AAPL hold, and has been for years now, does not render it a sacred cow in an ongoing bear market. And if you agree that we are still in fact in a bear market then AAPL should become the very thing many seasoned market pros are saying it can never be--Vulnerable.

As you might imagine my view is substantially different from those folks. I believe AAPL to be uniquely vulnerable into the next bear market leg lower, as are the "FANG" stocks, not to mention NVDA and TSLA. Thus, I went short with Members and love the risk/reward ratio to the play going forward with earnings behind us.

But, why?

For starters, they are all monstrous market cap names, widely-owned (still), widely-loved (mostly, still), and not particularly cheap. In some cases they remain uniquely expensive.

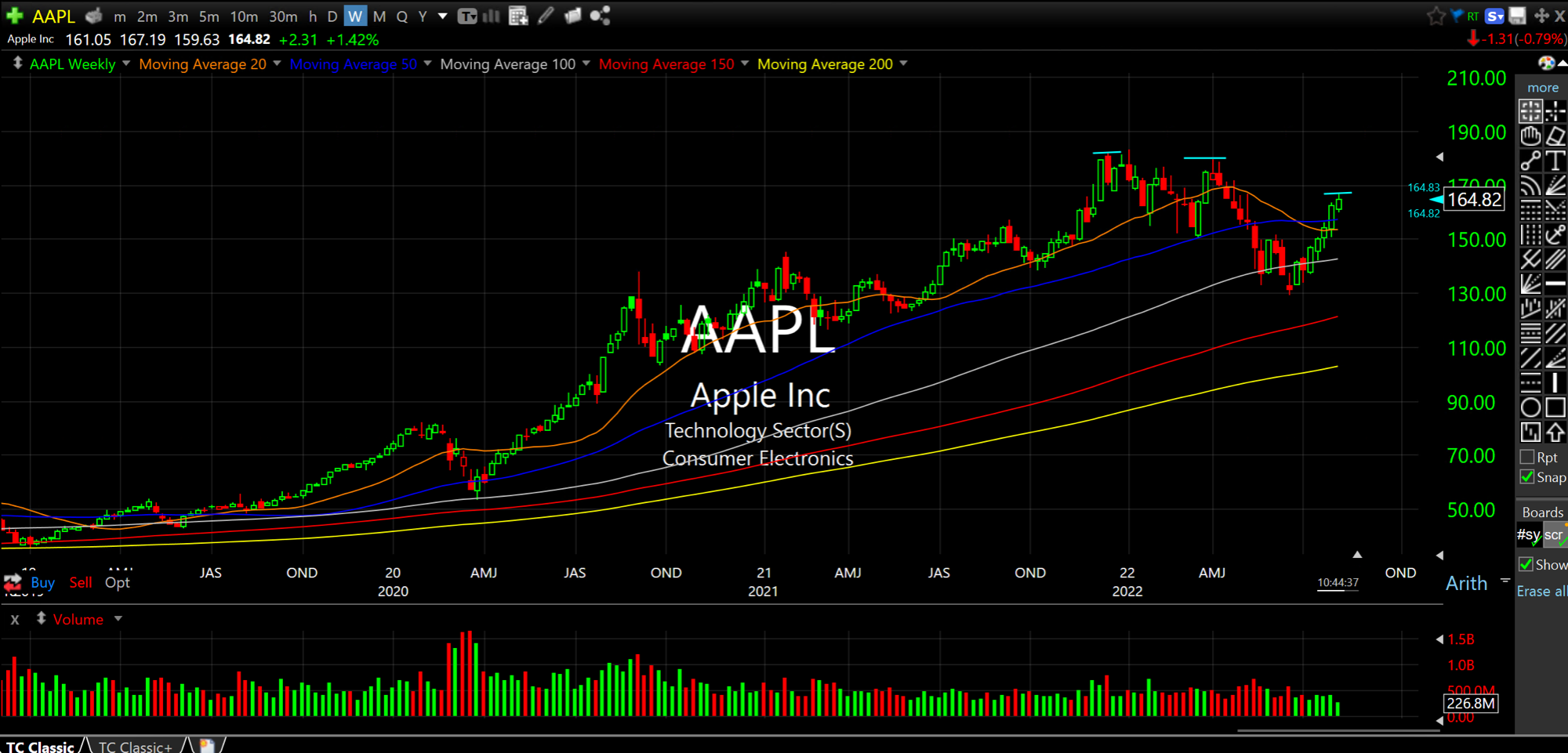

Technically, the likes of GOOGL MSFT and others are sporting the same type of weekly chart for Apple, first, below--A massive head and shoulders top which I expect to confirm into autumn for AAPL (GOOGL and MSFT have already confirmed despite the recent rallies).

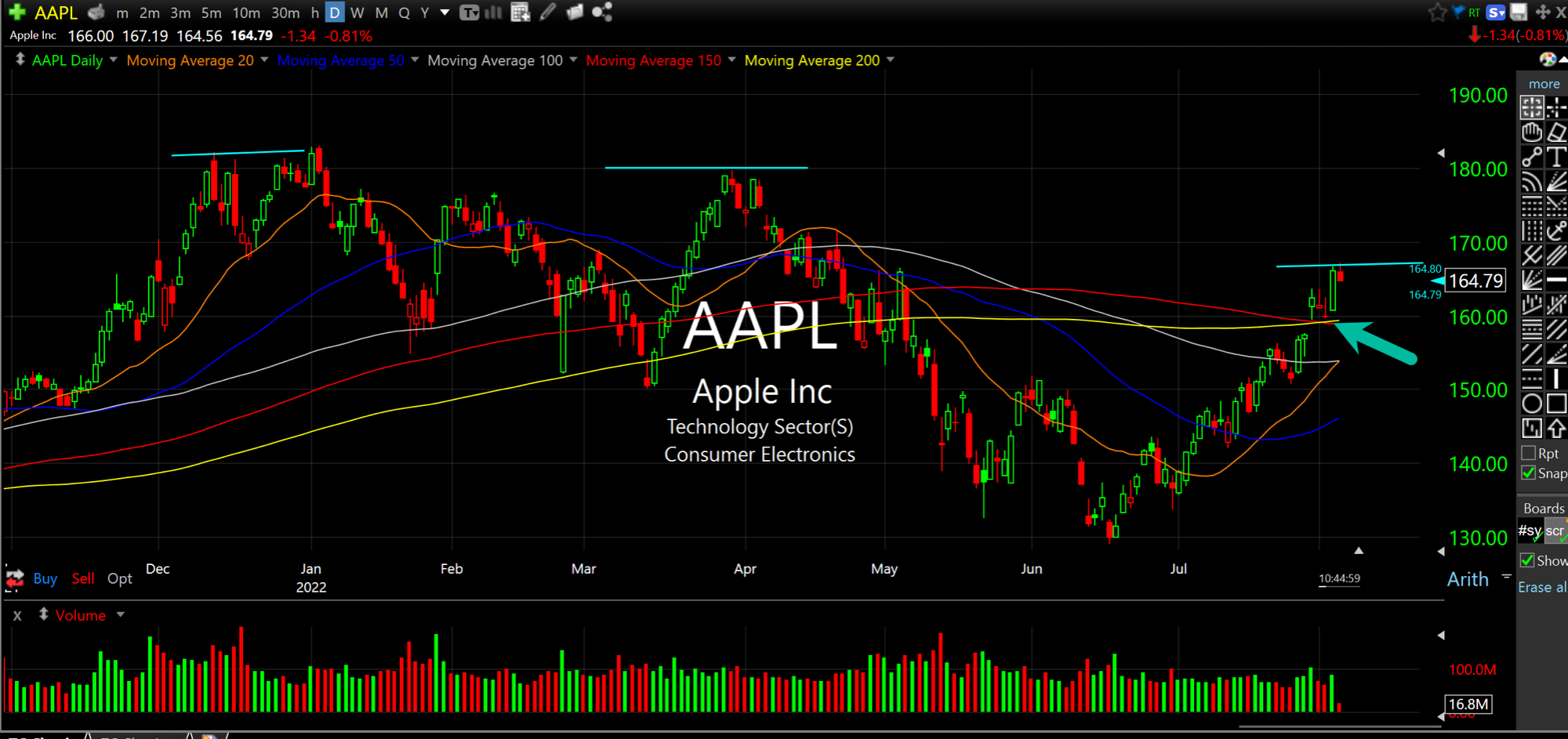

But mostly, as per the second daily chart, below, AAPL versus its 200-day moving average (arrow, yellow line) is the story for the here and now. I expect the recent bounce above it to be a trap and to fail.

With a consumer likely to finally falter after a summer of spending on pent-up demand, post-pandemic animal spirits, and generally trying to fight off high inflation, it should all come home to roost when by the time the weather turns chilly--I have seasonality on my side in addition to basic economics. In addition, human nature to store a few nuts for winter should be a factor.

But mostly the recent rally in equities and growth stocks is predicated on hope. Hope that a clueless Fed which is clearly winging it knows what it is doing and will not make a massive blunder. Hope that the consumer will keep the good times rolling even though many signs point to continued slowing. Hope that QE/ZIRP will come back right away despite sticky high inflation.

The winners from the QE/ZIRP era, namely mega cap tech, should become the big losers into the next bear market leg down as years of growth have been priced in and investors finally lurch towards easy sources of liquidity to maintain any semblance of their current lifestyles.

The Big Level Everyone is Wa... Stock Market Recap 08/04/22 ...