08Sep9:17 amEST

J-Pow Money Printer Go...Ahhh?

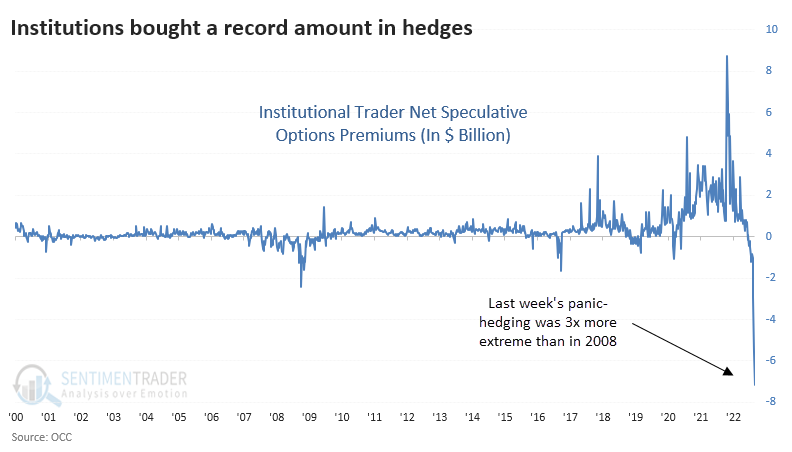

A chart making the rounds of late (chart posted below, via @sentimenttrader) has been how over-hedged institutions appear to be leaning right now, as many on social media infer therefore that we are on the cusp of an imminent short squeeze higher of epic proportions.

If you have been following my work then clearly you know I am not of the mindset to look for a strong rally anytime soon and I disagree with the above view.

However, with Powell speaking this morning the larger point, beyond what I think, is that liquidity is indeed being drained from the system via quantitative tightening and rising interest rates--Those are facts, not opinions. And this is also the inverse of the QE/ZIRP era, by definition.

Now, part of the allure of the short squeeze and the "hated rally" and the reason why those phenomena became so popular over the last decade was most likely due to the liquidity being injected from QE/ZIRP. Those numerous V-shaped bottoms to new highs rewarded brazenly buying any and all dips with leverage, culminating with the meme stock squeezes last year and even spilling over into BBBY this summer (you can already see the tragic consequences of that).

Case in point: When I traded from 2000-2007 the very idea of looking for a short squeeze was far less ubiquitous amongst retail traders. In fact, I knew quite a few relatively serious traders who, frankly, could not properly explain what a short squeeze even was.

Now, in this case I recognize we are talking about options positioning and hedges but the larger point remains that the liquidity environment we are in, and heading into, is the polar opposite of the last decade or so. Thus, using the old QE/ZIRP playbook to squeeze institutions is likely a trap in and of itself.

En parlance, JPOW money printer is no longer going "brrrrr," but is instead saying "Ahh!"

A Quick Apple Short Before W... Stock Market Recap 12/09/15 ...