20Sep10:14 amEST

A New Regime Means ARKK is a Dead Duck

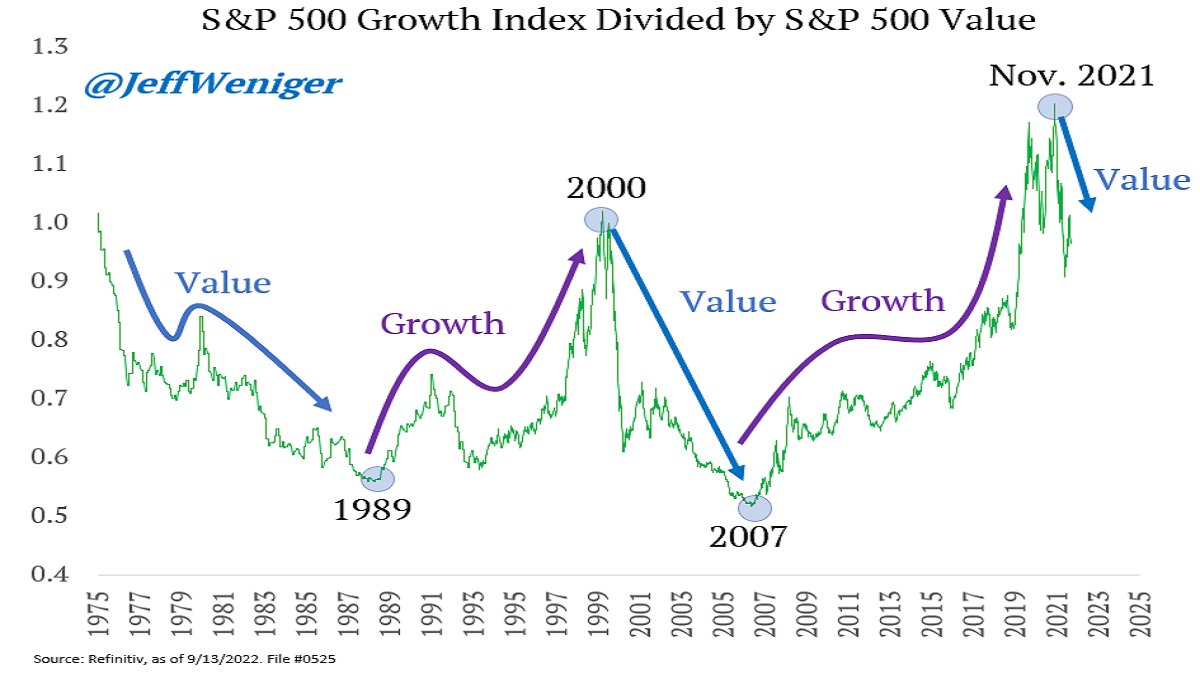

The above chart, courtesy of Jeff Weniger, illustrates the regime change already well underway with value stocks outperforming growth after the prior extended bull run for growth. In hindsight, with rates so low for so long growth essentially had open season to run higher and higher.

But as always in markets, it comes time to pay the piper. And pay we will.

With rates on the move higher again this morning in front of tomorrow's FOMC, plenty of folks are already buzzing about the potential for a post-FOMC squeeze higher, or "face ripper."

While it would be pure arrogance on my part to dismiss such a scenario, I would like to gently remind you that the overall trend for the major indices and indeed most stocks and sectors in 2022 is clearly lower. We have also yet to see classic fear, panic, nor capitulation, which means that is very much the risk before this bear market concludes.

Further, it seems to be a popular mantra that all of the Fed rate hikes are already "priced in." But that ignores history--When the CPI has gone above 5% year over year, as we clearly have done and maintained, the Federal Funds Rate historically needs to exceed the CPI in order to successfully crush inflation. Ask yourself--Is THAT priced in? Because an honest appraisal, unless you think this time is totally different and The Fed will get lucky, is categorically no.

As a result, I am following the technical trend in stocks, as well as the historical trend with inflation and rates. I remain short TLT via a long TBT position, riding it for a possible bond market crash (super spike in rates).

And I recently put on an ARKK short with Members.

ARKK is the ultimate growth stock proxy, with Cathie Wood's flagship ETF featuring a hodge·podge of richly-valued firms all pretty much relying on low interest rates.

But with inflation sticky high and a Fed which will stick to the hawkish case for the time being, coupled with a value over growth regime change underway I expect the zoomed-out weekly chart to resolve lower and head down into the $20s later this year.

While it appears as though ARKK is basing at prior multi-year support, I see no credible technical bottom forming as rates rise--To my eye, it looks more like retail players are trying to "will" a bottom in ARKK rather than strong-handed institutions flying in to scoop up values.

All of this is a disastrous recipe for Ms. Wood's holdings, as a negative feedback loop amongst her growth holdings could easily see shark-infested waters soon, meaning shorts begin to attack each of her holdings, one by one and then all at once.

Put another way, ARKK and her holdings are the exact sorts of names you do NOT want to be long in a rising rate environment with a Fed desperate to be taken more seriously about fighting sticky high inflation.