04Oct3:23 pmEST

Be Careful What You Wish For

It is not so much that the market rallied hard yesterday and today after last week's drama and a weekend full of Credit Suisse fears so much as it is the promise and allure of the future being more friendly to bulls. Specifically, mounting pressure on The Fed to back off an intensely hawkish hiking regiment coupled with sharp language about fighting inflation seems to be working only as far as The Fed is actually fearful of systemic risk.

With a light earnings week coupled only with the jobs report Friday, we do indeed have a relative lull before next week's CPI data. Unless Powell leaks something intensely hawkish, beyond the scope of what he has already said and implied, the current rally in risk, alongside rates and the Dollar relaxing, may very stick or at least not totally fall apart as quickly as bears would like--Recall that seasonality is now turning bullish for a few weeks.

However, a critical issue is that commodities leading a rally higher can usher in the next crisis.

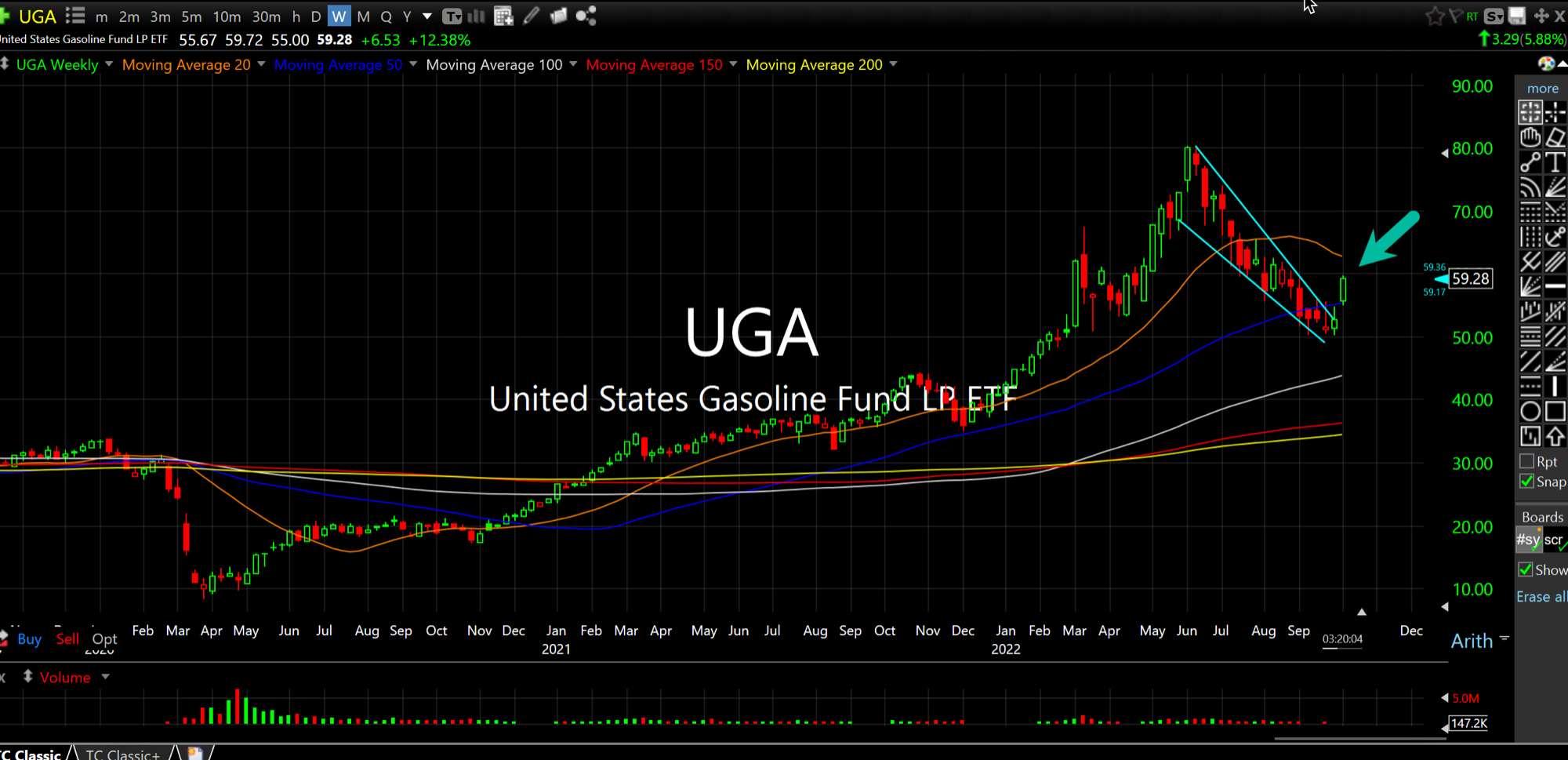

Should gasoline prices, below on the UGA ETF updated weekly chart, confirm the promising upside breakout in the coming weeks it may very well shock people how quickly we return to the early-June highs. You can only imagine the pain that will cause for consumers after several quarters now of dealing with sticky high inflation and a slowing economy Similar comments apply to other commodities which may see The Fed's worry about systemic risk as a green light to ramp back to annual highs.

Eventually, there is a breaking point. But right now bulls do not want to think about that. Right now it is all about pressuring The Fed to ease off a bit which, ironically, is the same type of can-kicking mindset which got us into this mess in the first place.

Stock Market Recap 03/05/15 ... Presenting King Dollar Like ...