17Oct12:24 pmEST

Emerge or Diverge

On some level the near-term direction of risk assets may very well hinge on what happened last week.

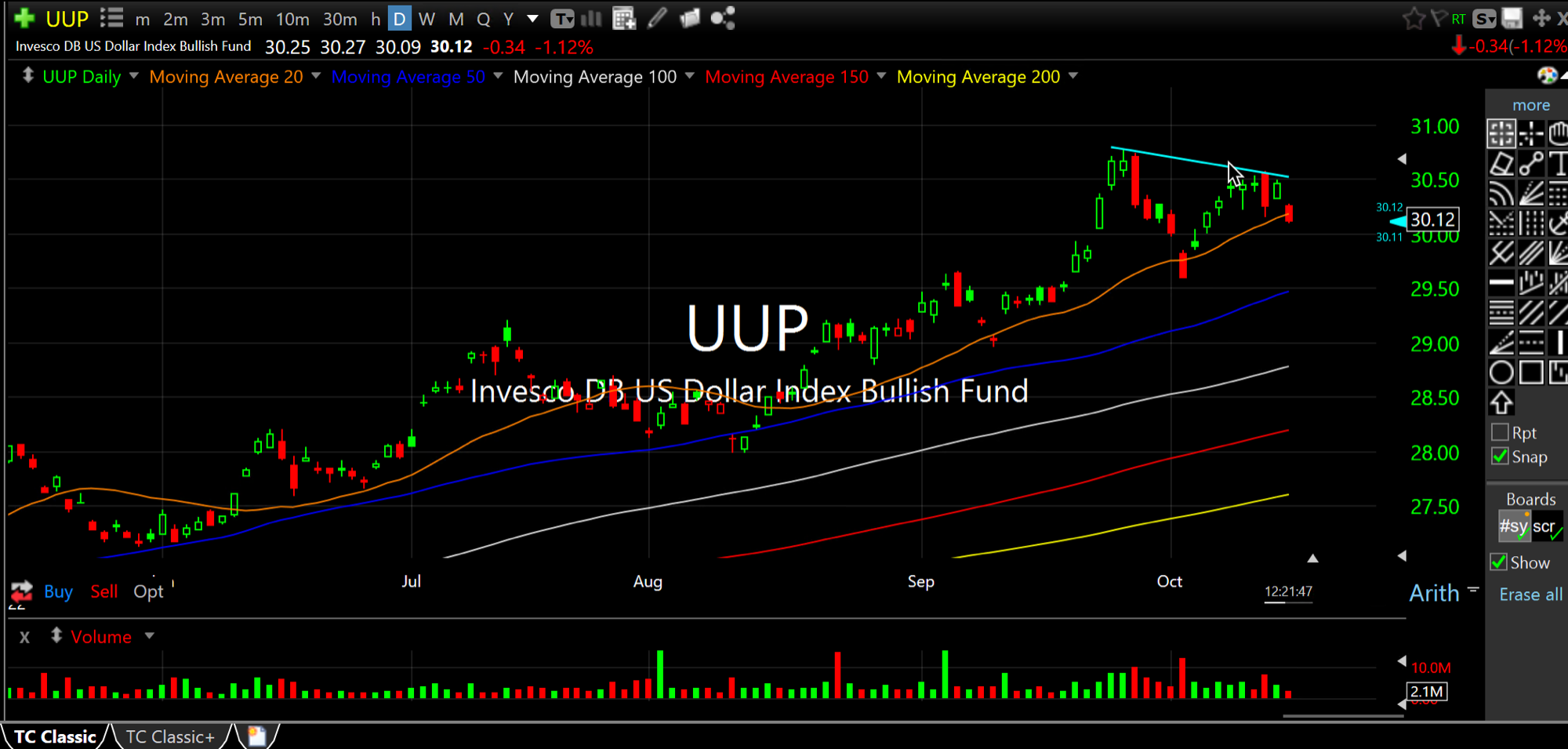

As we noted in the usual Weekend Video, typically reserved for Members but opened up to everyone over the weekend (please see prior blog post), the U.S. Dollar did not make a fresh high last week on its UUP ETF (daily chart, below, which is simply the Dollar versus a basket of developed economies' currencies) whereas we know the major stock indices made fresh bear market lows.

Given the unique strength of the Dollar throughout 2022, the divergence certainly made us ponder whether Friday's selloff was a shakeout in stocks before a bounce which began Thursday continued.

But, first and foremost, we likely needed to see the Dollar cool off, as a super strong Dollar historically has negative ramifications to risk assets and signals extreme risk aversion if not outright dislocations in markets.

And we are seeing just that so far today to kick off the week.

Going forward, whether last week's lower high by the Dollar amounts to a major bull divergence versus the indices' lower lows last week remains to be seen. I am still inclined to view it solely as a near-term trading signal rather than a major bear market bottom.

Either way, I will be keying off this chart going forward now that we have the highlighted context, below.