18Oct11:02 amEST

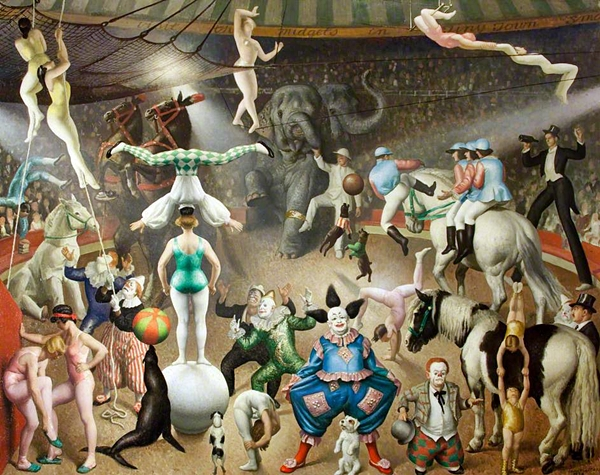

The Oil Circus Rolls On

"Don't blame a clown for acting like a clown. Ask yourself why you keep going to the circus."

One of the most difficult realities of life to accept--and some never do--is that changing people is a fool's game. You simply must accept full responsibility for choosing to surround yourself with certain people, rather than blaming them for their given tendencies depending on their personalities.

In markets, the oil space right now is smacking of a toxic, circus vibe. We know that the Strategic Petroleum Reserve continues to be drained in the wake of the OPEC cuts (and, let's be honest, on the eve of the midterm elections, to boot). Mind you, I am not necessarily taking a shot at Biden at the Democrats there, since politics is essentially war without the blood. To be fair (and balanced!), Trump publicly bullied Jay Powell back in 2018 to gift America "the gift" of negative rates, as he termed it, as the Europeans had that gift back then, too. In other words, politicians are politicians and nothing is new under the sun.

But with crude oil itself getting smacked again today, we have a stiff and rather telling test for the oil stocks themselves.

It is often said that when the commodity stocks outperform the commodity itself it can be seen as a good sign of risk-on for the sector. Hence, when I see, for example, the OIH (ETF for oil services stocks) trying to make a major higher low after a prior multi-year bear market (seen on monthly chart, below) it reinforces just how important this spot is for energy stocks.

As for the broad market the opening big pop is partially gap-filling below on the indices. I am looking to see after the initial squeeze since yesterday if organic buyers are willing to step back in.

Sending Energy Bears Up the ... A Setup in Oil Which Would M...