31Oct11:27 amEST

Bear Trap Alerts

As the phrase implies, a "bear trap" in trading is a situation where markets seemingly tempt bears to put on aggressive short positions at precisely the wrong time. A down move which looks like a clear-cut breakdown suddenly reverses on a dime and, effectively, traps in shorts who had been pressing for a fresh move lower.

And just this morning, wheat and natural gas are two of the most explosive commodities trading higher after Russia pulled out from the Black Sea deal.

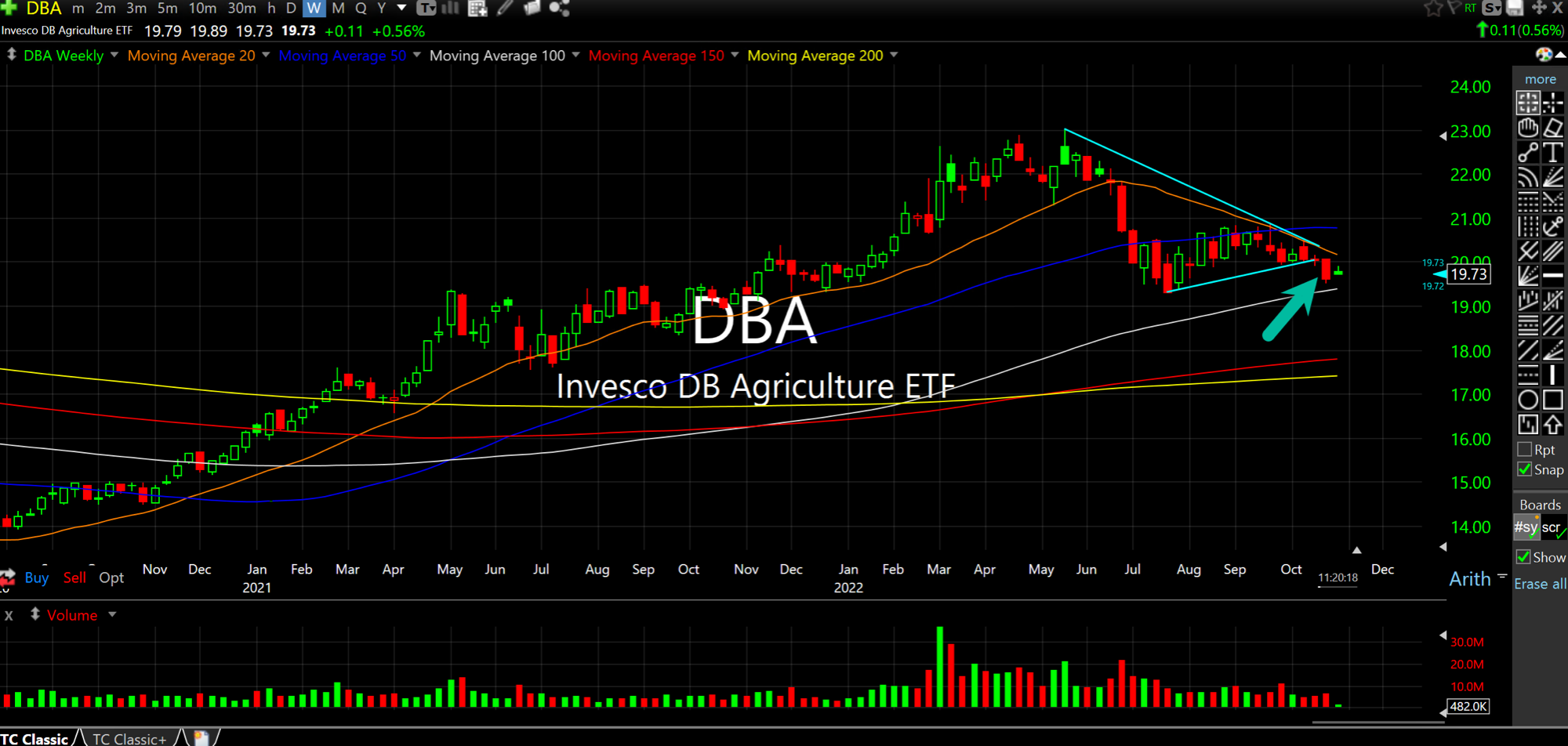

Beyond that, when we put both soft commodities as a group (DBA ETF, first chart below on the weekly timeframe) and the natural gas ETF, UNG, second below also on the weekly, we can see the potential for bear traps in both markets.

Granted, both DBA and UNG need to reclaim prior broken support levels above to further the bear trap thesis, which is $20 on DBA and $23 on UNG.

But this morning's news flow and reactions at least put us on watch for bear traps to confirm higher.

Also note both DBA and UNG were in strong uptrends for the first half of 2022. So, I would not rule out a year-end performance chase higher in these markets, either.