30Nov11:25 amEST

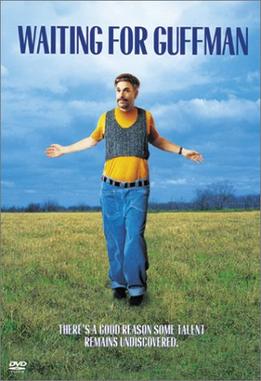

Waiting for Powell

This afternoon at 1:30 pm EST the Brookings Institution, Fed Chair Jay Powell is expected to deliver a speech which will be his final public remarks before the next FOMC in mid-December.

Given the indecisive nature of markets in recents weeks after previously rallying off the mid-October lows it sure seems like Mr. Powell's comments today may very well carry even more significance.

Thus, as I write this the indices are mixed, at best, if not drifting lower again into Powell. I expect him to continue to harp on the need for a "long fight" against inflation. However, I suspect he may give some wiggle room if the economic data points steadily weaken into 2023 for The Fed to at least slow the pace of rate hikes.

More than anything else, as usual, for speculators like us it will come to how the market perceives Powell's comments more than the actual comments themselves.

Silver and crude oil, despite some mid-morning fades, are still turning in strong opens, right where both commodities needed to technically. If they can make it through Powell intact I suspect we may finally get a bit better trading in commodities into December.

Stock Market Recap 11/29/22 ... Silver's Acting Great and No...