05Dec11:08 amEST

Backing, Filling, Shaking, and Baking

This sort of market action continues to be a grind for most traders, as the day-to-day flopping around of most markets can take a toll on the psyche.

In these moments we often focus on mental toughness inside Market Chess Subscription Services by 1) Not over-trading and letting the market settle down, and 2) Working through the grind and continue to research/scan various stocks, sectors, asset classes for relative strength.

As just one example, even though the natural gas commodity is getting pummeled again this morning, a natty-related stock like LNG continues to exude phenomenal relative and absolute strength. If and when natty (UNG) turns back higher it may very well see LNG explode for a new leg up.

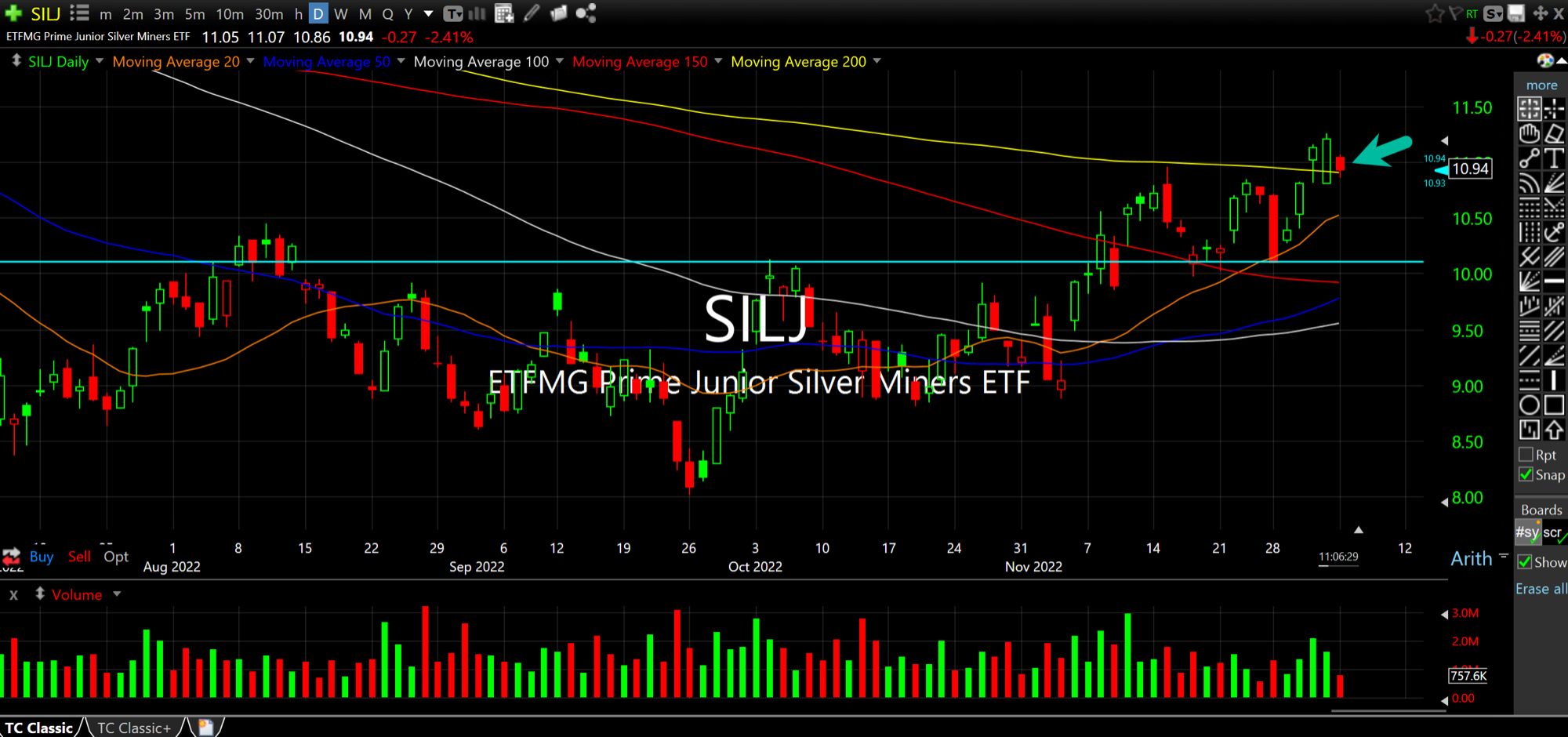

Regarding the precious metals and miners, here again we have some weakness to kick off the week. But on the SILJ ETF for junior silver miners, below, as high beta as this group of stocks can be if they can hold above the 200-day moving average (yellow line) into this dip then it is a victory for silver bugs.