05Jan3:18 pmEST

It's Tough to Look and Not Touch

One of the most counter-intuitive aspects about speculation is the notion of laying off the action for various intervals. After all, who really travels to the casino to not gamble? Well, I suppose some folks do. But not the warriors in the arena most of us are--Mixing it up regularly in global markets and putting ourselves to the test.

In the current, grueling tape, mostly laying off the action is largely correct for the overwhelming majority of players, however. Until we see a bit more resolution and/or better action below the surface in either direction we are mostly keeping tabs on various developments across all markets for Members.

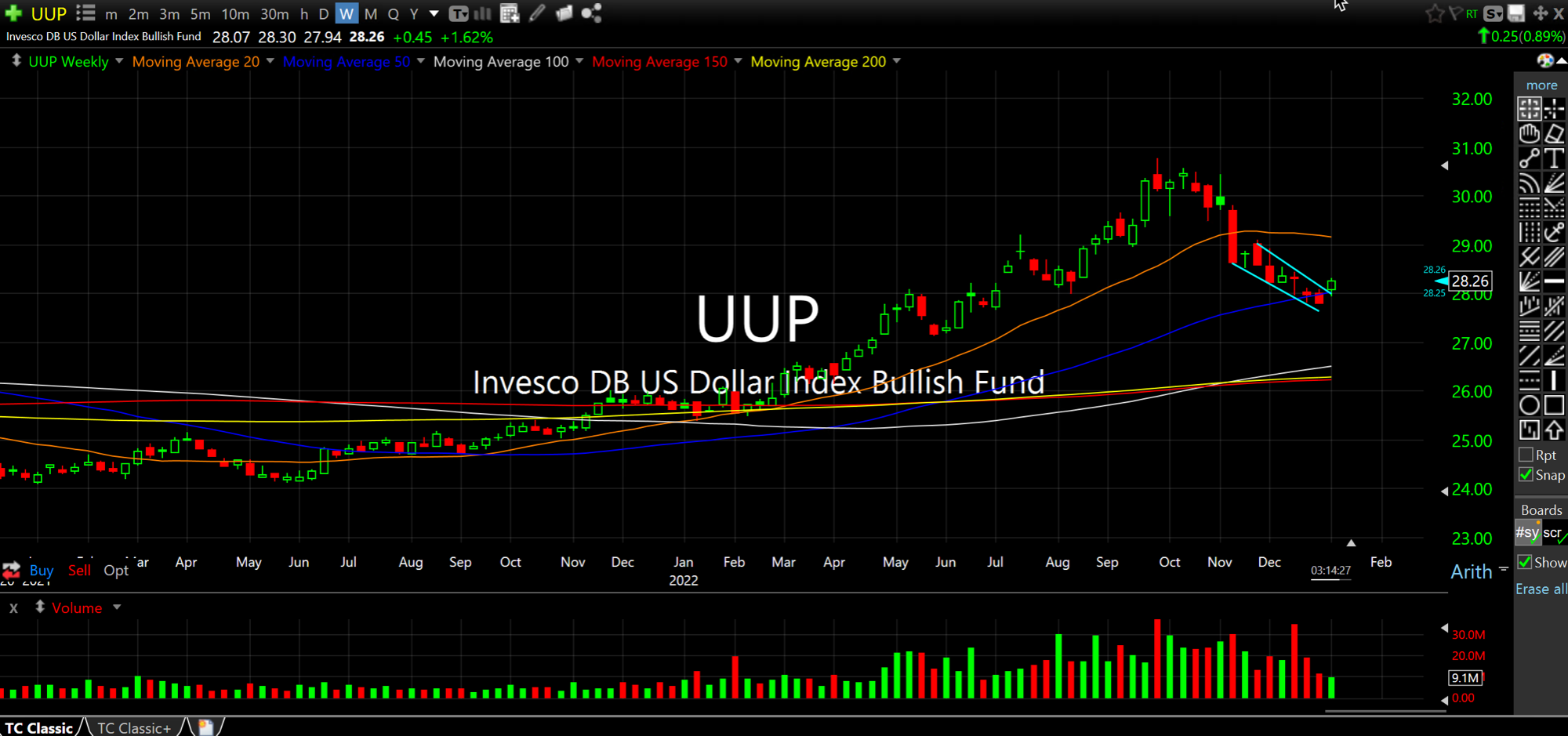

As an example, the U.S. Dollar (weekly chart for the ETF below various developed economy currencies, below) could easily have bottomed in its bull market correction since last November. I am looking for more upside in the Dollar in 2023, which likely has a negative effect on risk assets.

On the daily, the UUP gapped up this morning and may very well not fill that gap below, which would be incredibly bullish. As we saw in 2022, a strong Dollar can be problematic for our markets as well as the Pound, Euro, and Yen, in particular.

Hence, headed into the jobs report tomorrow, followed by the CPI one week from today, I will be watching this chart closely to see if the overall bull trend declares itself again as taking the greenback higher regardless of the data points.

Running Those Buy Programs I... This is Not a Return to Deca...