19Jan11:09 amEST

Louis, I Think This is the Beginning of a Beautiful Reversal

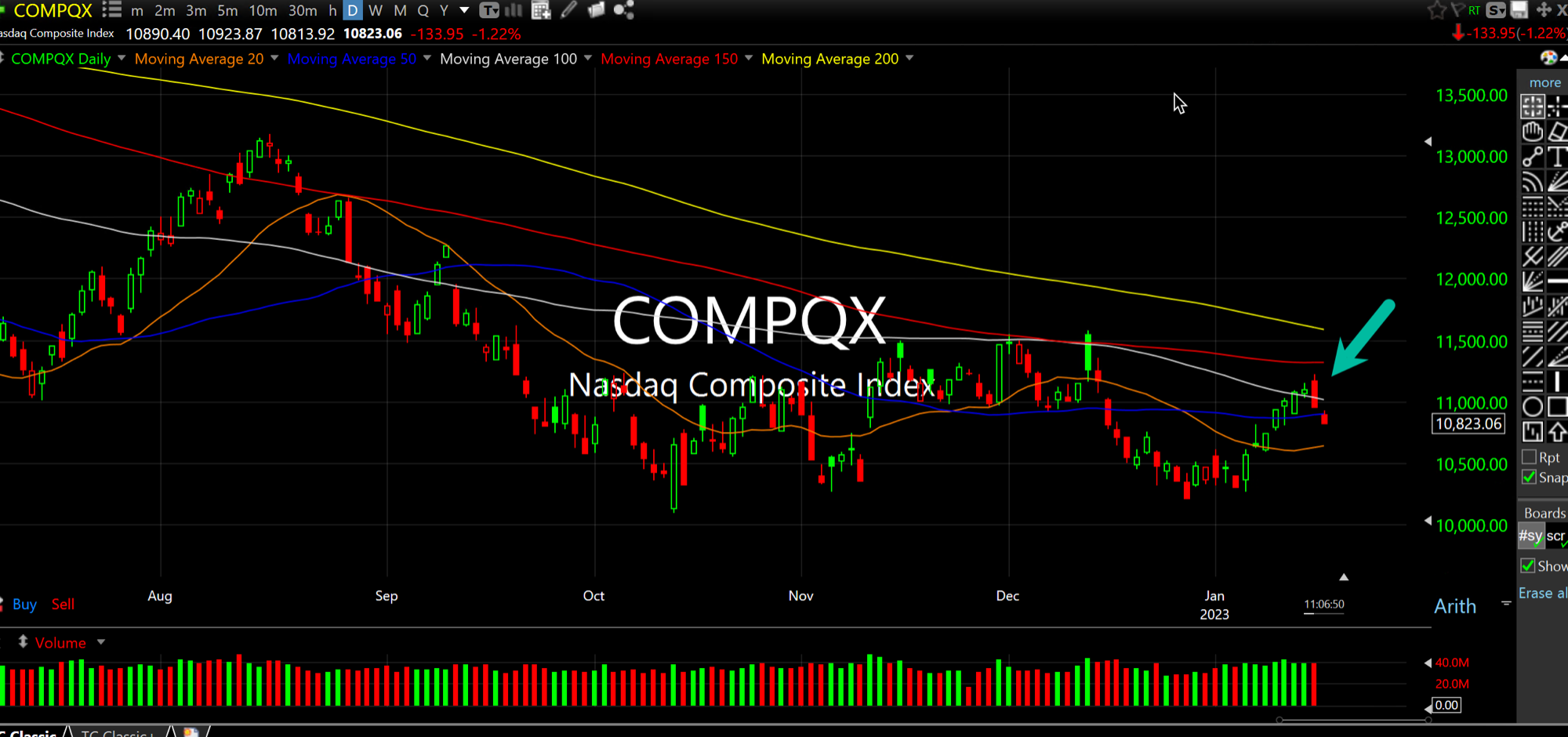

Despite a flurry of calls for a new bull market, you will note that the Nasdaq Composite Index, below on the updated daily chart, remains soundly below a declining 200-day simple moving average (yellow line). From a technical perspective, this is the essence of a bearish trend.

And while I doubt the Nasdaq will lead the next bull market I also do not believe said bull market has begun. It logically follows, gauging history, that we need to see some widespread capitulation in the former leaders in the Nasdaq first--and the Nasdaq itself--before assuming a new bull run underway.

Furthermore, yesterday's textbook bearish engulfing candle (Arrow) is confirming lower so far today. Because the overall trend is firmly down, a bearish reversal of a rally ought to be taken very seriously since the presumption is one of a cascade to fresh bear market lows now.

With the next FOMC just under two weeks away we have a ton of focus on the looming major earnings reports from all the big tech names, among others. Bulls continue to hang their hats on a soft landing scenario for the economy where The Fed can back off and even ease again.

But the Nasdaq Composite itself has given no indications that any of those assumptions are correct. We still have a strong bear market downtrend featuring fast, exuberant, spirited rallies which ultimately run out of steam and, ironically, set up the next leg down.

Stock Market Recap 01/18/23 ... The New Bull Argument: All Y...