30Jan10:04 amEST

Easy There, Guy, with Your "Base Breakouts"

It has been so long since we have seen a protracted bear market (in terms of duration, not the March 2020 percentage drop) that I suspect even many veteran traders have forgotten just how frustrating bears can become just when you think you have correctly declared the bottom.

Specifically, protracted bear markets so often superficially feature many of the characteristics during bull market corrections which often do indeed mark exact bottoms, only to then roll back over and subsequently destroy all of the "base counts" to new lows.

It is not just technical voodoo we are discussing either--The fundamental rationale behind this price action is that bargain hunters initially think they are scooping up value...only to be let down as the economy deteriorates and/or The Fed is more hawkish than initially expected. They then hit the exits en masse.

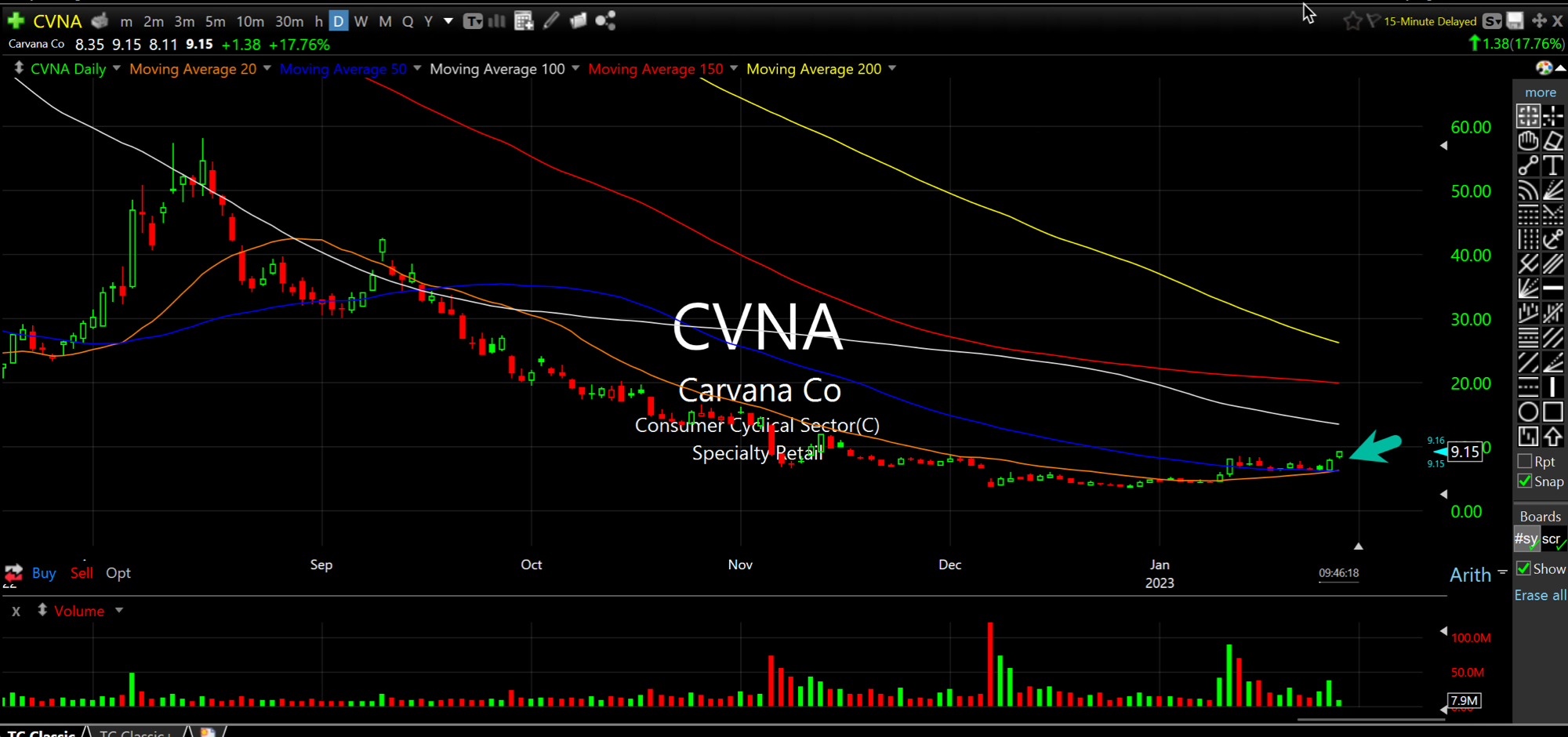

All of this is why with Members we harp on the slope of the 200-day moving average on the major indices and most major stocks and sectors. The 200-day continue to be clearly declining in most of those charts which gives the general presumption of an ongoing bear market, which means all of the base counts and base breakouts are far more vulnerable to rollovers than would seem possible now.

Carvana, below on it daily chart, is one of a bunch of beaten-down trash names squeezing as traders believe they see a base bottom (arrow).

But the monstrous downtrend is still in control, and the 2020 liquidity bonanza is in the rear view mirror and will likely prove to be an outlier for the foreseeable future. I suspect CVNA will be back in trouble later this quarter if not into the summer months,

Weekend Overview and Analysi... Another Wild Ride for Caterp...