31Jan10:28 amEST

Another Wild Ride for Caterpillar Ends

Despite beating on revenue, Caterpillar missed on earnings and reported a struggle with costs in its latest quarterly this morning.

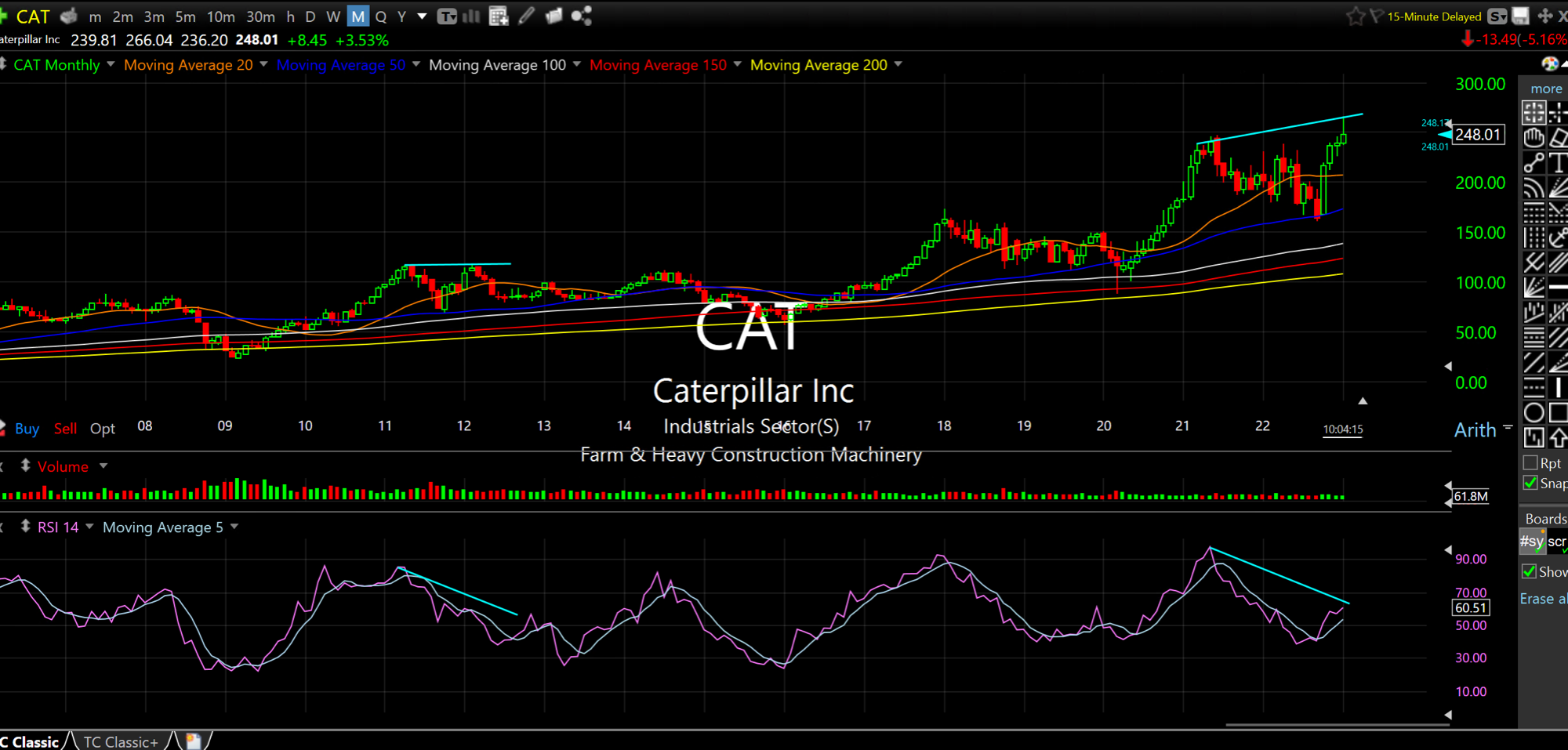

The Big CAT is often a bellwether for industrials. And you can see for yourself the epic overall bull trend the last decade or two on the monthly timeframe, below.

Just as the 2011-2012 multi-year top featured an RSI (simply the Relative Strength Indicator) bearish divergence to price (bottom pane of chart versus the top pane of price), we have a similar setup now, even more magnified on the latest all-time highs printed this month.

Simply put, the risk/reward skews heavily toward CAT having put in a good high for the foreseeable future.

Could we retest or even marginally break those prior $266.04 highs if we get a post-FOMC rally to start February? Sure, but I expect it to be short-lived and, ultimately, a good short opportunity given the overall market structure on top of a long-term bearish RSI divergence.

Easy There, Guy, with Your "... Let's Pretend Jay Powell is ...